LEARN CHAIKIN OSCILLATOR INDEX IN 3 MINUTES ——BLOCKCHAIN 101

SuperEx Academy is the world’s first online academy to offer comprehensive education on crypto-native indicators. It features the most extensive technical indicator tutorials and is the most detailed online learning platform for market technical analysis. Here, you’ll find hundreds of courses on commonly used indicators, along with nearly every known crypto-native indicator tutorial.

Some indicators may sound “academic,” but are surprisingly practicalAmong all technical indicators, some may sound highly “academic,” but are actually very down-to-earth when used in trading. The Chaikin Oscillator is one of them.

It’s not as “straightforward and blunt” as RSI, nor as widely recognized as MACD. Its uniqueness lies in the fact that it combines volume and money flow, using a single “oscillating curve” to reveal the hidden forces behind the market.

In the crypto market, price is often just a “surface phenomenon.” What really drives the trend is the flow of funds. The Chaikin Oscillator works like an ECG monitor, displaying the “heartbeat of capital” in real time.

From theory → calculation → practical cases → crypto application → trading tips,We’ll break it down step by step.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Core Idea of the Chaikin Oscillator: Price + Volume Integration

Traditional price indicators usually just focus on candlesticks. But think about this:

-

If price goes up but volume is low, can this rally really be trusted?

-

Or if price barely drops but volume spikes sharply, isn’t that a signal of hidden turbulence?

The logic of the Chaikin Oscillator is simple:

-

Don’t just look at price.

-

Don’t just look at volume.

-

Instead, combine both to construct a signal of capital flow strength.

In one sentence: It’s closer to the “truth” than pure price indicators.

Formula & Calculation Logic

The Chaikin Oscillator is based on the Accumulation/Distribution Line (ADL).

Formula:

-

Money Flow Multiplier (MF)

MF={(Close−Low)−(High−Close)}/High−Low

This measures the close price relative to the range.If close is near the high → MF approaches +1.If close is near the low → MF approaches -1.

-

Money Flow Volume = MF × Volume

-

ADL = Previous ADL + Current Money Flow Volume

-

Chaikin Oscillator = Short-term EMA of ADL − Long-term EMA of ADL

(Common parameters: Short = 3, Long = 10)

Sounds complicated? Actually, just remember two points:

-

Above zero line → net capital inflow.

-

Below zero line → capital outflow.

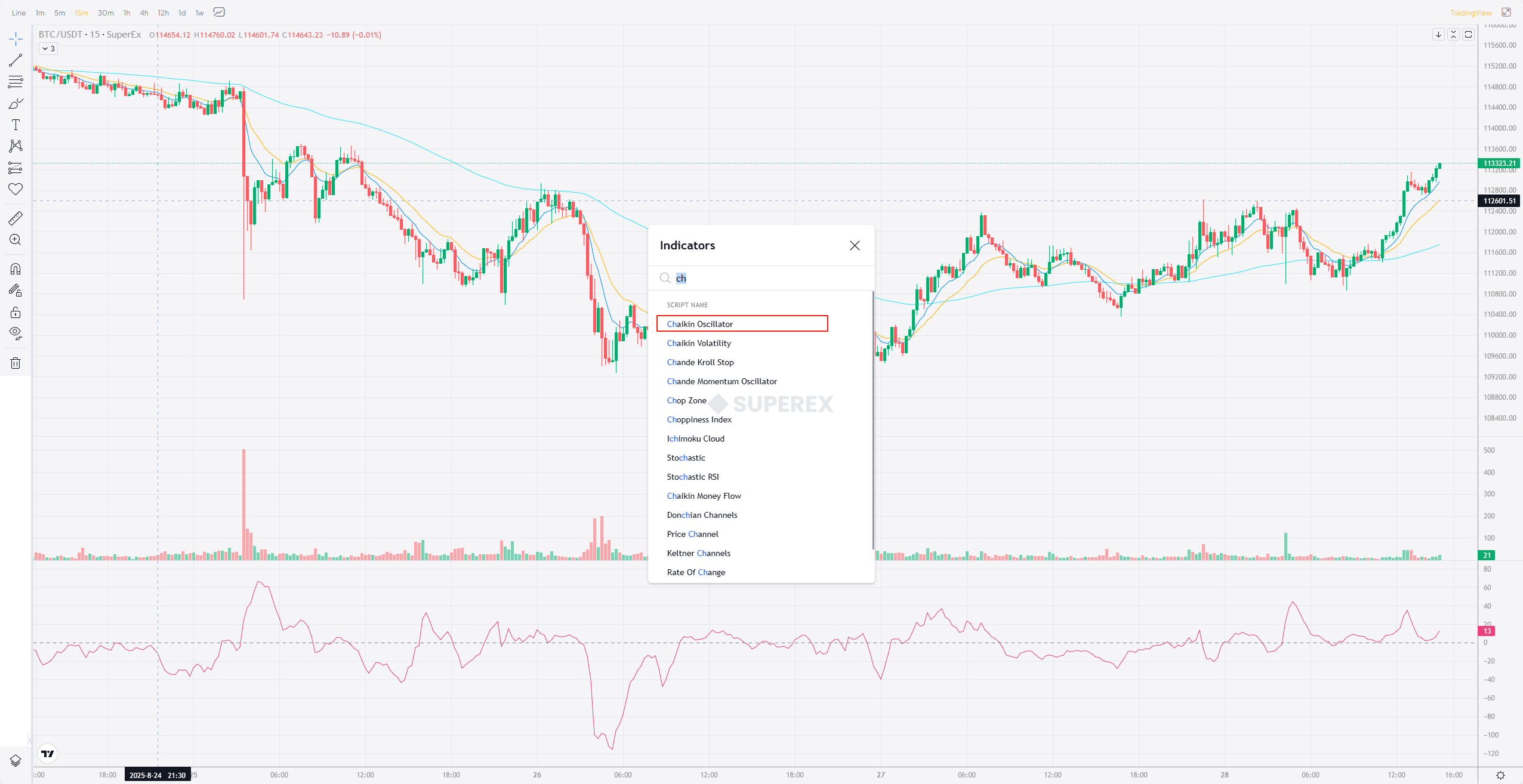

Think of it as a “capital ECG line,” oscillating up and down, showing the tug-of-war between buyers and sellers.And yes, you can directly call out the Chaikin Oscillator chart in the SuperEx indicator library—all parameters are pre-set for convenience.

Why is the Chaikin Oscillator more important in the crypto market?

In traditional markets, volume is relatively stable. But in crypto, volume is extremely volatile, sometimes even manipulated by “fake pumps.” The Chaikin Oscillator helps cut through that noise:

-

Identify false rallies quickly

Price rises but the oscillator doesn’t → be wary of market makers dumping. -

Spot early signs of a breakout

Price is flat, but oscillator strengthens → funds may already be flowing in quietly. -

Works for both short- and mid-term

Usable on 1h, 4h, daily charts—versatile across cycles.

In short: the Chaikin Oscillator is a “capital detector” for crypto.

How to Apply in Practice (Trading Guide)

-

Zero-line observation method

-

Cross above zero → bullish signal.

-

Cross below zero → bearish signal.

-

Divergence signals

-

Price makes new high but indicator does not → possible reversal downward.

-

Price makes new low but indicator does not → possible rebound.

-

Combine with other indicators

-

With MACD: confirm trend direction.

-

With RSI: avoid chasing tops/bottoms.

-

With Volume MA: confirm authenticity of volume.

Unique Use Cases in the Crypto Market

-

Exchange fund movements

Large BTC transfers between exchanges can cause sudden anomalies. Best used with on-chain alerts (e.g., Whale Alert). -

New token listings

Often, the oscillator reacts earlier than price—helpful for catching “early bird rallies.” -

DeFi & Altcoins

Even when volumes are inflated, the indicator can still reveal “fake pumps.”

One-Sentence Summary

The Chaikin Oscillator is not a “crystal ball” that predicts the future. It’s more like a market ECG. In the fast-paced world of crypto, seeing capital flows ahead of others gives you an edge.

Imagine this: while others are still glued to candlesticks, you’re already spotting quiet inflows through the Chaikin Oscillator—that’s your advantage.

✦ SuperEx Academy will continue to launch more 3-minute quick-learn indicator lessons, helping you not just “read charts,” but truly understand the logic behind the market.

Responses