Will the September Rate Cut Really Trigger a Bull Market? — Lessons from 30 Years of Fed Cycles for the Crypto Market

#FED #CryptoMarket

The Fed is very likely to cut rates in September. Does this mean the bull market is coming? I think this must be the most frequently asked and heard question in recent weeks.

Just yesterday, CME’s “FedWatch” tool showed that the probability of the Fed keeping rates unchanged in September was only 13.9%, while the probability of cutting 25 bps was as high as 86.1%. Looking ahead to October, the chance of further cuts is also significant: the probability of a cumulative 25 bps cut is 47.5%, while a cumulative 50 bps cut is 46%.

In other words, the market has almost fully priced in a September rate cut. But the real question is: will the market rally immediately after the cut?

Many people treat “rate cuts” as if pressing the bull market button, even imagining stocks, Bitcoin, and altcoins soaring together. But history tells us it’s not that simple. Sometimes rate cuts are preventive “lubricants,” sometimes they’re emergency “firefighting” after a crisis has erupted. And the reaction of stocks and crypto has never been identical.

So today, let’s take a look — reviewing the Fed’s rate cut cycles of the past 30 years — can it help us see what September’s cut really means for the market?

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Rate Cut ≠ Bull Market Button: What History Really Shows

From 1990 to today, the Fed has gone through five major easing cycles, each with different backgrounds and outcomes:

- 1990–1992: Savings & Loan crisis + Gulf War. The Fed cut from 8% all the way to 3%. Result: Dow up 17.5%, S&P up 21%, Nasdaq up 47%. This was a “soft landing,” with prosperity after the crisis.

- 1995–1998: U.S. slowdown + Asian financial crisis. The Fed cautiously cut three times. Result? Stocks exploded, Nasdaq surged 134%, setting the stage for the dot-com bubble.

- 2001–2003: Dot-com bust + 9/11. The Fed slashed 500 bps. But stocks still fell — Nasdaq and S&P both tanked. Cuts turned out to be an “ineffective firefighter.”

- 2007–2009: Subprime crisis. Fed took rates down to 0–0.25%. Result? Markets crashed, Dow lost over 50%. Only after fiscal stimulus and QE did recovery come.

- 2019–2021: Preventive cuts + Covid-19. In March 2020, the Fed emergency cut to zero and launched QE, alongside fiscal stimulus. Result? V-shaped rebound: Nasdaq rose 1.6x in two and a half years, Bitcoin hit $60k in the liquidity flood.

Looking at history, one clear lesson emerges: whether rate cuts spark a bull market depends on the context.

- If it’s preventive easing, with no recession yet, markets often ignite (1995, 2019).

- If it’s crisis-driven easing, the fire is already burning, and stocks/crypto usually keep falling (2001, 2008).

So the September question becomes: is this cut preventive, or crisis-driven?

Today’s Environment: Closer to 1995 & 2019, Not 2008

The U.S. economy today isn’t great, but it’s not collapsing either.

- Inflation: CPI has clearly come down from 2022 highs, widely seen as manageable.

- Labor market: Showing fatigue, job growth slowing, but not collapsing.

- Policy risks: Geopolitical tensions and tariffs are risks, but not a systemic 2008-style crisis.

That’s why many investment banks and institutions view this as a preventive cut. The Fed is worried about over-tightening causing a hard landing, so it’s preemptively easing. If that’s true, the market’s reaction could look more like 1995 or 2019:

- Stocks: Potential for another rally, with tech outperforming.

- Crypto: Bitcoin and altcoins may benefit from the liquidity boost, something we also discussed in the past two days’ articles.

But unlike the past, the role of crypto in the “risk asset pool” has fundamentally changed.

Crypto’s Mirror: 2017 vs 2021 vs 2025

Let’s compare crypto’s past two bull runs:

- 2017: Low rates + easy liquidity, with the ICO craze. Bitcoin went from $1,000 to $20,000, ETH from a few dollars to $1,400, altcoins everywhere. But the bubble burst fast, and 2018 saw a wipeout.

- 2021: Liquidity flood post-pandemic + DeFi and NFT boom. Bitcoin hit $60k, ETH nearly $5,000, Solana, Avalanche, and meme coins all took off. Then? In 2022, Fed hikes drained liquidity, and the market crashed.

- 2025 (right now): The difference vs 2021 is huge — compliance and institutional participation are on a different level.

-ETFs brought in long-term capital.

-Stablecoins are entering regulatory frameworks.

-RWA (real-world assets) opened new narratives.

-Corporate treasuries (MicroStrategy, Dat, etc.) turned Bitcoin into part of enterprise balance sheets.

So if 2017 was a “retail ICO bull”, and 2021 was a “liquidity bull”, then 2025 looks more like a “structural bull.”

Meaning? Not all coins will pump. Money will be more selective: Bitcoin, ETH, RWA tokens, top layer-1s may keep rising, but long-tail altcoins could be permanently sidelined.

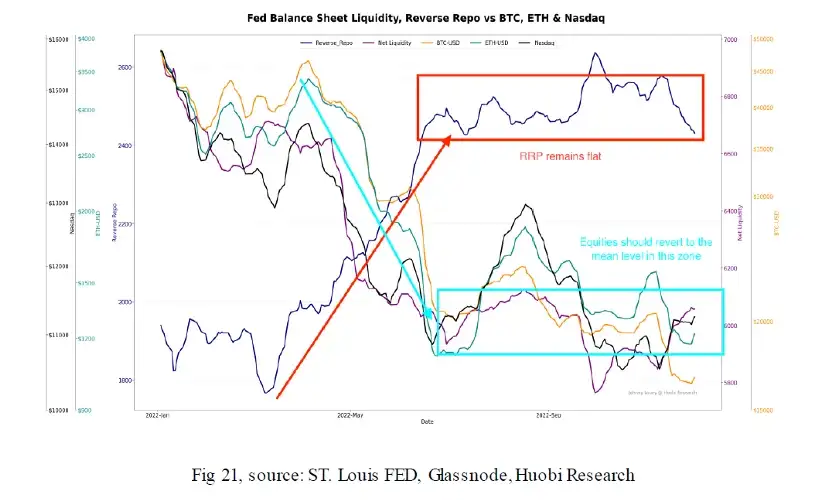

The Key Firepower: $7.2 Trillion Powder Keg

Don’t forget — there’s a hidden bomb: U.S. money market funds, now holding a record $7.2 trillion. History shows:

- When money starts flowing out of MMFs, risk assets usually rally.

- Because once rates drop, MMF yields aren’t attractive, so capital chases higher returns.

Translation: after September’s cut, this giant pool could become the biggest fuel source for crypto and equities.

Altseason Still the Hot Topic

Looking inside crypto:

- BTC dominance: Fell from 65% in May to ~59% now.

- Altcoin market cap: Surged 50% since early July, now $1.4T.

- ETH’s appeal: ETF inflows above $22B; still the backbone of stablecoins and RWA.

Interestingly, CoinMarketCap’s “Altseason Index” is still around 40, far below the 75 threshold.

This means the altcoin rally is underway, but not yet at full mania. The real explosion may still be ahead.

Don’t Forget Risks: Structural Bull ≠ Blind YOLO

We can’t just stare at the bull thesis and ignore risks:

- Valuations: Overall already high.

- Institutional selling pressure: Treasuries over-financialized could trigger liquidations.

- Global risks: Trade wars, geopolitical shocks could pour cold water anytime.

So forget the 2017 fantasy of “everything mooning.” This is the era of smart money picking winners.

Conclusion: Rate Cuts Are Opportunities, Not Magic Wands

If we sum this up in one line: September’s cut looks more like 1995 and 2019’s preventive easing, not 2008’s crisis firefighting. That means the market tone is still tilted bullish.

For crypto:

- Bitcoin remains the safe haven, but dominance may slowly erode.

- ETH, RWA tokens, and top chains are the strongest narratives.

- Long-tail altcoins may get wiped out in this cycle.

So yes, the rate cut could ignite the market — but whether you actually profit depends entirely on which track you’re standing on. Simply put: the bull market may really be here, but it won’t belong to everyone.

Responses