Japan’s Web3 Summit Kicks Off in Tokyo This August: A Global Game of Stablecoins, RWA, DeFi, and AI

#Japan #Stablecoin #RWA

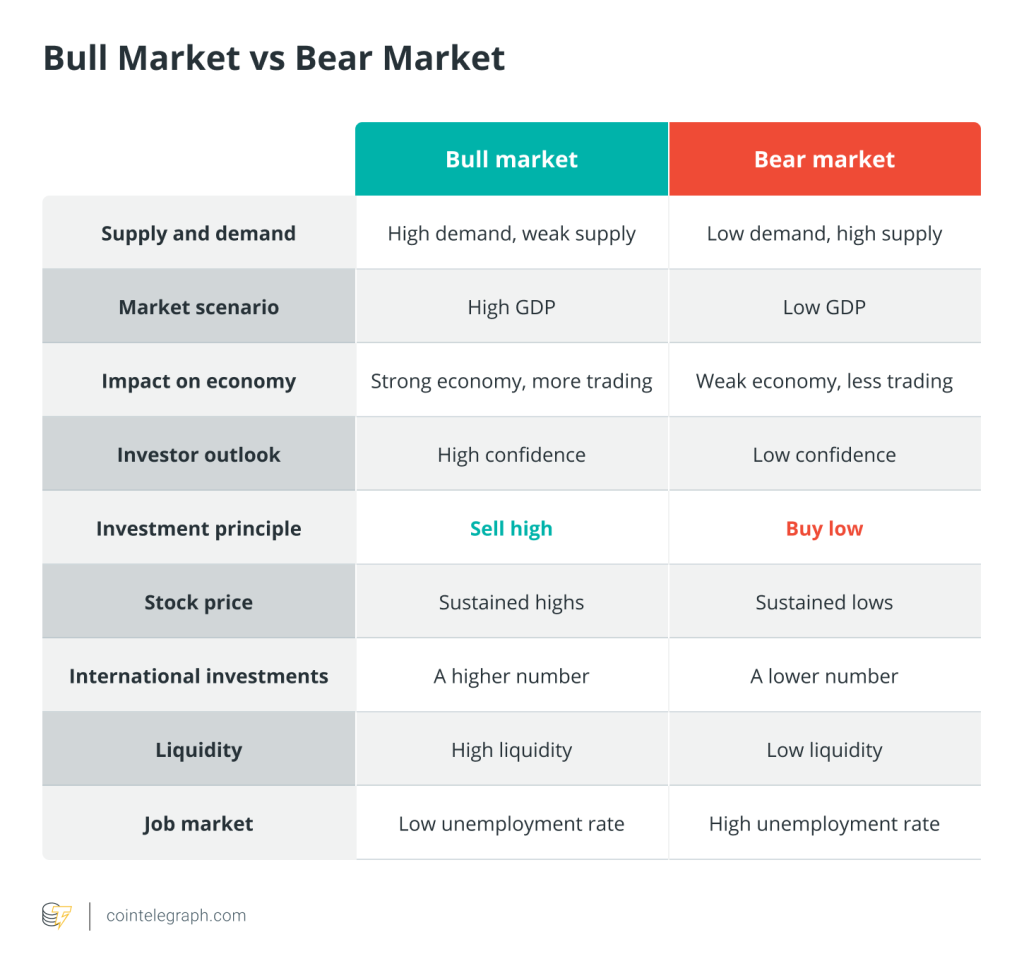

After several bull and bear cycles in the global crypto market, Tokyo in 2025 seems poised for a heavyweight “industry checkup.” From August 25 to 26, WebX 2025 will be held at The Prince Park Tower Tokyo, bringing together blockchain founders, investors, developers, and policymakers from all over the world.

At first glance, it may look like just another crypto industry conference. But if you take a closer look at the guest list and agenda, it’s not hard to see: this is Japan’s moment to present its “strategic calling card” in the Web3 space to the world.

And the topics go far beyond short-term hot spots like coin prices and on-chain data — the focus is on the core tracks for the next 5 to 10 years: stablecoins, RWA tokenization, decentralized finance (DeFi), the convergence of AI and Web3, and the deep evolution of the Bitcoin ecosystem.

As industry observers, we are not just counting how many big names will show up, but also looking to see the trends and signals behind this event.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Japan’s Web3 Strategy: “Acceleration” from Policy to Ecosystem

Japan is not a newcomer to crypto. As early as 2017, the Financial Services Agency of Japan took the lead in recognizing Bitcoin as legal tender and introduced an exchange licensing system. At the time, this was a highly forward-thinking move, laying a solid foundation for Japan’s position in Asia’s crypto landscape.

Since 2023, the Japanese government has continued to send positive signals:

- Tax optimization: Reducing the tax burden on companies holding tokens, encouraging more Web3 companies to register in Japan.

- NFT and metaverse policies: Encouraging gaming companies to explore blockchain games and digital assets.

- RWA and stablecoin regulatory framework: Striving to balance innovation and risk, and attract compliant capital inflows.

This time, WebX 2025 will feature not only industry leaders, but also heavyweight figures from Japan’s political sphere — such as the Minister of Digital Affairs and Tokyo Governor Yuriko Koike — directly engaging in policy discussions. This means Japan is sending a clear message to the world:We not only welcome crypto projects to land here — we want to be the central hub for Web3 in Asia.

From the Agenda: The Key Crypto Tracks of 2025

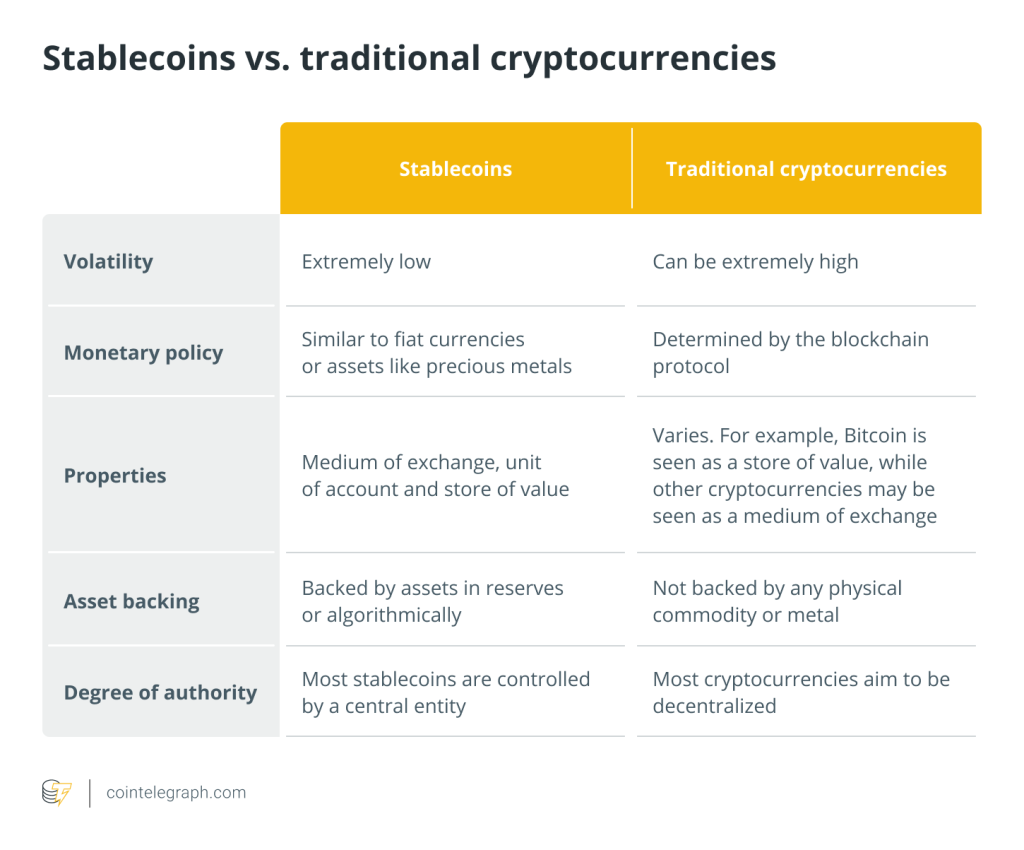

1. Stablecoins: The Next Battle in the Global Payments Landscape

Stablecoins are the most practical and widely deployed crypto application in 2025. On WebX’s agenda, representatives from VISA, Circle, Coincheck, and others will discuss global stablecoin regulation and interoperability. This is not just a technical topic, but a competition for dominance over global payment networks.

Why It Matters:

- The digitalization of the U.S. dollar: Stablecoins like USDC have already become the “base currency” of cross-border payments and DeFi.

- Opportunities in Asian markets: Southeast Asia, Japan, and South Korea have strong demand for cross-border settlements, and stablecoins can significantly reduce costs.

- Regulatory trends: The U.S., EU, and Japan are all drafting stablecoin legal frameworks — whoever lands theirs first will have the advantage.

- Observation tip: If you’re an investor, watch how stablecoins integrate with traditional finance, such as VISA using them for real-time settlement. If you’re a developer, think about how to achieve stablecoin interoperability in a multi-chain environment.

2. RWA Tokenization: Unlocking Trillions in Liquidity

The tokenization of real-world assets (RWA) is increasingly seen as the core driving force of the next crypto bull cycle. In WebX’s RWA sessions, participants include Toyota Blockchain Lab, the Tokyo FinTech Association, and major crypto investment figures like Galaxy Digital CEO Mike Novogratz.

Why RWA Is Hot:

- The asset digitization wave: From government bonds and real estate to artwork, blockchain enables fractional ownership.

- Liquidity boost: Assets that are illiquid in traditional markets can trade 24/7 on-chain.

- Institutional adoption: RWA projects are more likely to get licenses and institutional investment because they are tied to the real economy.

- Industry trends: In the short term, tokenized government bonds and real estate will lead the way; in the mid-term, private equity and commodity futures may follow; in the long term, the line between on-chain and off-chain assets will blur.

3. The Evolution of DeFi: From Speculation to Infrastructure

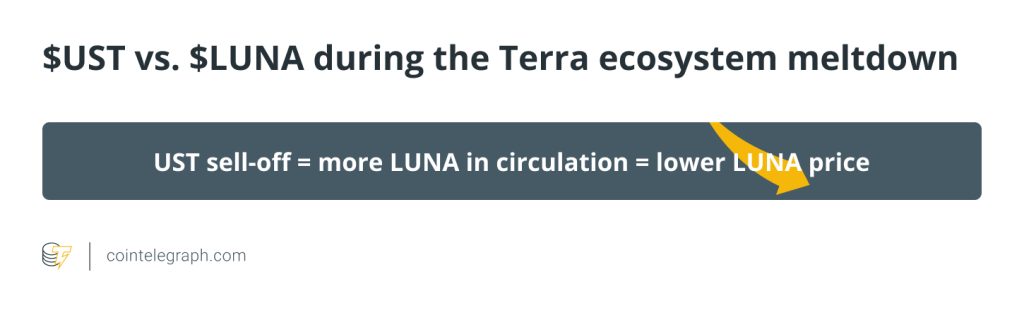

DeFi sparked a “liquidity mining frenzy” in 2020–2021, but cooled down after hacks and high volatility. At this WebX, Uniswap founder Hayden Adams will present the latest developments in DeFi, and the Solana Foundation will discuss scalability and privacy issues.

Key Shifts:

- Compliance trend: Future DeFi may integrate KYC (Know Your Customer) to meet institutional participation needs.

- Multi-chain ecosystems: Expanding from single-chain Ethereum to collaborative models like Ethereum + Layer 2 + Solana.

- Privacy protection: Zero-knowledge proofs (ZKPs) enabling compliant transactions while preserving user privacy.

4. AI + Web3: An Intelligent, Decentralized Future

AI is the global tech buzzword this year, and its combination with Web3 could reshape decentralized application models. In WebX’s AI + Crypto sessions, Arm AI’s Director and several entrepreneurs will explore using blockchain to train, manage, and distribute AI models.

Where the Potential Lies:

- Data ownership: Blockchain can provide provenance and ownership protection for AI training data.

- Decentralized AI marketplaces: Models and computing power can be freely traded on-chain.

- Autonomous economies: AI agents can use cryptocurrencies to autonomously trade and execute tasks.

5. Bitcoin Ecosystem: From “Digital Gold” to a Multifaceted Platform

In recent years, the Bitcoin ecosystem has seen breakthroughs in the Lightning Network, Ordinals NFTs, and Layer 2s. In WebX’s Bitcoin-focused sessions, investors and enterprises will discuss its dual role as a store of value and a financial tool.

Trend Insights:

- Store-of-value role solidifying: Growing macroeconomic uncertainty has strengthened Bitcoin’s safe-haven value.

- Function diversification: Beyond “HODLing,” Bitcoin can now support decentralized applications (dApps) and NFTs.

- Asian opportunities: Japan and South Korea have natural advantages in Bitcoin payments and trading infrastructure.

Opportunities and Challenges for Web3 in Asia

Asia’s markets are characterized by dense populations, widespread mobile internet adoption, and frequent cross-border trade — all favorable conditions for Web3 adoption.

However, challenges are equally significant:

- Regulatory fragmentation: Different laws across countries raise compliance costs for cross-border projects.

- Education and awareness gaps: Public understanding of crypto still often stays at the speculative level.

- Talent competition: AI, blockchain, and cybersecurity experts are in fierce demand.

- Japan’s edge lies in clear policies, ample funding, and strong tech foundations; its limitation is market size, so it must radiate influence across Asia.

Conclusion

WebX 2025 is more than just an industry gathering — it’s more like the “Asia station” declaration in the global crypto landscape. Stablecoins will reshape payment systems, RWA tokenization will open trillion-dollar markets, DeFi will evolve into infrastructure, AI + Web3 will give birth to new species, and the Bitcoin ecosystem will become more diversified.

Standing in the summer of 2025, we can feel Japan’s attempt to claim a long-term strategic high ground in the global Web3 competition.

Responses