White House Releases Crypto Policy Report: Full Interpretation and In-Depth Market Analysis

#WhiteHouse #Crypto #Web3

Have you ever wondered how the U.S. government really sees “cryptocurrency”? Is it a “regulatory target” or a “strategic asset”? The answer may lie in this newly disclosed report — 166 pages long, mentioning cryptocurrency 391 times, Bitcoin 130 times, and DeFi 32 times.

This report comes from the interagency digital asset working group established by the Trump administration, officially responding to the president’s Executive Order 14178 signed in January. Today, we’ll walk through this “White House internal summary” to understand: U.S. policy direction, market impact, and the major changes that may face the crypto ecosystem in the future.

It mentions, including but not limited to:

- Stablecoin regulations, DeFi legal clarity, tax guidance, digital asset infrastructure support;

- An explicit rejection of issuing a central bank digital currency (CBDC);

- A call to clarify SEC and CFTC responsibilities and to advance the implementation of the Clarity Act and GENIUS Act;

- The report does not provide new implementation details for the “U.S. Bitcoin Strategic Reserve,” only reiterates previous executive order content, stating that more updates may come in the future but no public plan is available yet.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Market Impact: Deep Implications

1. Policy Tone Shift: “Regulatory Certainty + Freedom to Innovate” as Twin Pillars

- Clear regulatory division: The report recommends that SEC regulate security tokens, CFTC oversee commodity-type tokens (such as BTC), and stablecoins and trading platforms adopt separate licensing systems to prevent regulators from “stepping on each other’s toes.”

- Support for innovation mechanisms: It advocates creating regulatory sandboxes and safe harbor mechanisms, allowing DeFi projects to try new products within legal bounds and reduce the risk of unpredictable penalties.

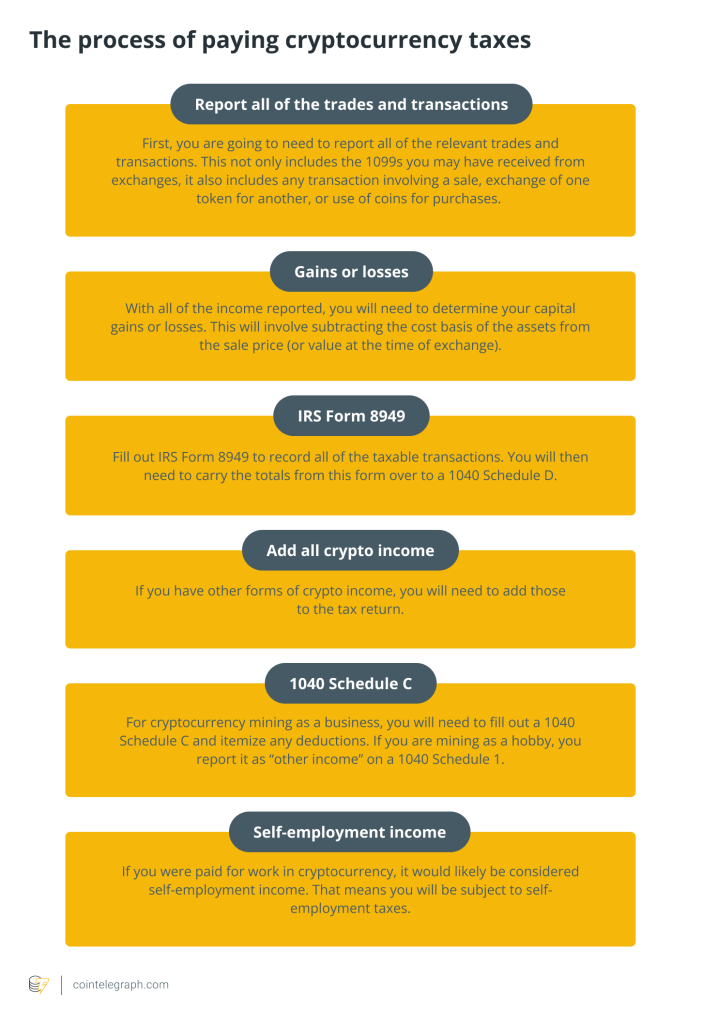

- Encouraging tax compliance and enterprise participation: IRS will release clearer guidelines on mining, staking, and retail digital asset accounting, while supporting crypto assets entering retirement accounts (401k) within a compliant framework.

This will greatly reduce compliance costs for businesses. Over the past few years, crypto companies have struggled under dual SEC and CFTC scrutiny, with many founders even forced to give up the U.S. market. Now, once regulatory boundaries are clear, crypto companies will “know exactly who to apply to and which rules to follow,” which is a significant positive for fundraising, business planning, and company valuation.

In addition, this kind of division-of-labor system may become a template for other countries, driving global regulation toward more rational and professional frameworks.

2. Stablecoin Market Reshuffle: Licensing + Reserves + Audits as Three Hard Barriers

The report makes it clear: if you want to issue a USD-pegged stablecoin, you must:

- Obtain a license;

- Maintain fully-backed reserves and ensure immediate redemption;

- Undergo regular audits and prohibit false promotion.

These three barriers essentially build a compliance moat, dividing the stablecoin market into “state-trusted issuers” and “high-risk anonymous issuers.”Projects like Circle (USDC) and Paxos (USDP) will gain stronger credibility, not only entering traditional finance and payments, but also more easily gaining banking and government procurement support.In contrast, projects that relied on “offshore structures” to blur management boundaries, such as TUSD, USDD, with poor transparency and no robust audit, are likely to be delisted by major platforms or even face legal action.

Stablecoins are truly entering the “licensed era.”

3. DeFi and On-Chain Infrastructure Face a Window of Opportunity

The report supports:

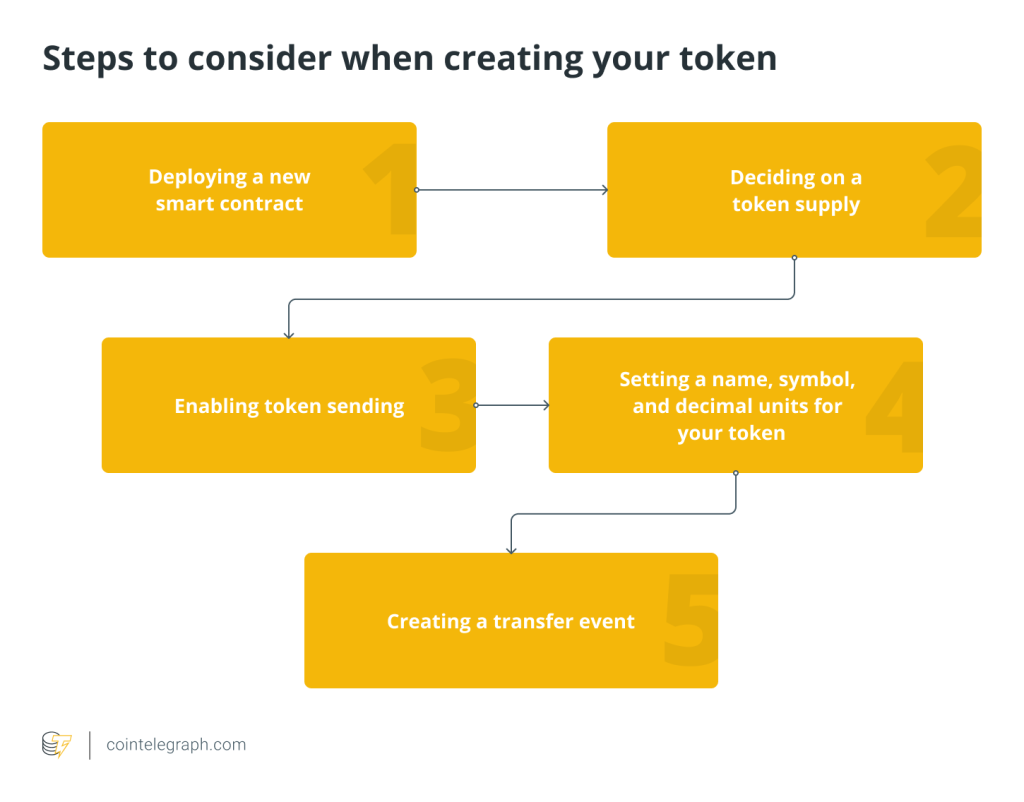

- DeFi technology integrating with mainstream finance;

- Banks legally providing custody, tokenization, stablecoin issuance, and blockchain settlement;

- Streamlining the process for banks to obtain federal licenses and reserve accounts.

This opens an entirely new compliant infrastructure channel for DeFi projects. Previously, many DeFi protocols were limited by no custody licenses and no access to banking payment systems, resulting in restricted liquidity and cautious banking partnerships.

In the future, with a license regime, institutions like Coinbase or Anchorage Digital that already have banking capabilities can legally handle DeFi custody and stablecoin clearing, building new financial products that combine compliance + decentralization.

This also means:

- Compliant infrastructure will enter DeFi;

- Exchanges, wallets, and bank custody platforms will be brought under regulatory frameworks;

- Bridges between decentralized finance and traditional finance will accelerate.

Institutions like Chainlink, Coinbase, Kraken, MicroStrategy, and a16z are closely tracking the report and subsequent regulations to assess how to keep innovating and scaling under compliance.

4. Bitcoin Reserve Still Pending, But Could Progress with Infrastructure Build-Out

Although the president signed an executive order in March to establish a “Strategic Bitcoin Reserve” and digital asset stockpile, the report offers no new details, only noting that infrastructure construction is underway and that further updates may follow.

If, in the future, the Federal Reserve or Treasury indirectly participates in BTC reserve-building (e.g., through ETFs or diversified reserve pilots), that would become the next true bull-market trigger for crypto.

Market sentiment:

- Some investors see this as a long-term bullish factor;

- Others believe it remains in a cautious phase, with limited short-term impact.

5. Market Reaction: Price Fluctuations, ETF Flows Steady, Confidence Improving

Under the combined influence of this report and the Fed’s interest rate meeting:

- BTC briefly dropped from $118k to $117k;

- ETH, XRP, and SOL corrected ~1%–3%.

But in the medium-to-long term:

- ETF inflows remain robust, especially for ETH;

- Legally clear assets (like USDC and compliant DeFi platforms) continue to attract allocation;

- Institutional confidence is gradually recovering as the policy framework clarifies.

Overall: Prices waver, but the confidence structure is being rebuilt.

Concise Summary and Future Outlook

Quick takeaways:

- The report covers DeFi, stablecoins, taxation, and infrastructure;

- Urges Congress to pass the Clarity Act to finalize SEC/CFTC boundaries;

- Opposes issuing a U.S. CBDC;

- Encourages private-sector innovation without mandating an official digital currency.

Three things to watch next:

- Will Congress pass the Clarity Act to clearly define SEC/CFTC authority?

- How fast will GENIUS Act-based stablecoin issuance move forward?

- When will strategic Bitcoin reserve plans become concrete?

Conclusion: U.S. Crypto Institutionalization Officially Begins

This White House report may not reveal explosive new policies, but it confirms the direction:

- Clear regulatory frameworks

- Compliance first

- Controlled innovation

For the industry, this is likely one of the most important U.S. crypto policy signals of 2025. From institutional investors and stablecoin issuers to DeFi protocols and cross-border payment platforms, studying and aligning with this “policy blueprint” is essential to capture opportunities in the next market cycle.

Responses