After BTC and ETH, Solana Makes a Strong Comeback — Is Altcoin Season Really Here?

# BTC #ETH #Solana

If you’ve been following the crypto market lately, you might be getting a familiar feeling: “the smell of altcoin season is back.”

When Bitcoin broke through its all-time high, of course the applause was for BTC. But seasoned players know that Bitcoin’s rally is often just the opening act. The real frenzy — the one that makes the market boil and gives off that “get rich quick” vibe — usually comes in the next leg, led by Ethereum, Solana, and a wave of high-beta altcoins.

This time, ETH and SOL have once again proven their relevance. ETH has surged over 55%, and SOL has climbed nearly 30% in just a few weeks. On-chain capital flows and institutional buying are fanning the flames of this rally.

So here’s the question: is this altcoin rally the real deal, or just another flash in the pan? This article breaks down the altcoin season storm from multiple dimensions: market signals, capital flow, macro factors, and investor psychology.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

BTC Steps Aside — ETH and SOL Steal the Spotlight

Market logic can be funny — when Bitcoin keeps hitting new highs, investors feel both comforted and… a little bored. They start thinking, “Maybe it’s done rising,” and turn to altcoins with higher volatility and growth potential.

Since early July, ETH has jumped from 2,474 USDT to 3,857 USDT, a surge of over 55%. On-chain data confirms that this is not a “fake pump.” According to market data, in just 20 days, 23 whale and institutional wallets have collectively purchased 681,103 ETH, worth more than $2.6 billion.

Meanwhile, the ETH spot ETF gave the market a massive shot of confidence. On July 21, ETH spot ETF net inflows hit a record $297 million in a single day — equivalent to 80% of BTC ETF volume.

These two stats make it crystal clear: the big money is moving in.

As for Solana, it’s showing that it’s far from a second-string player. SOL has surged from 157.8 USDT to 204.6 USDT — nearly a 30% increase. Even more striking, the entire Solana ecosystem is exploding:

- RAY up 21.01% in 24 hours

- PENGU up 20.5%

- JUP up 17.14%

- AI16Z up 14.73%

This isn’t just a solo breakout — it looks more like a “sector rotation” where capital is flowing collectively into higher-risk, higher-reward altcoins.

The Market’s “Main Theme” Is Shifting — Is Altcoin Season Returning?

1. Signal of Alt Season: BTC Dominance Slipping

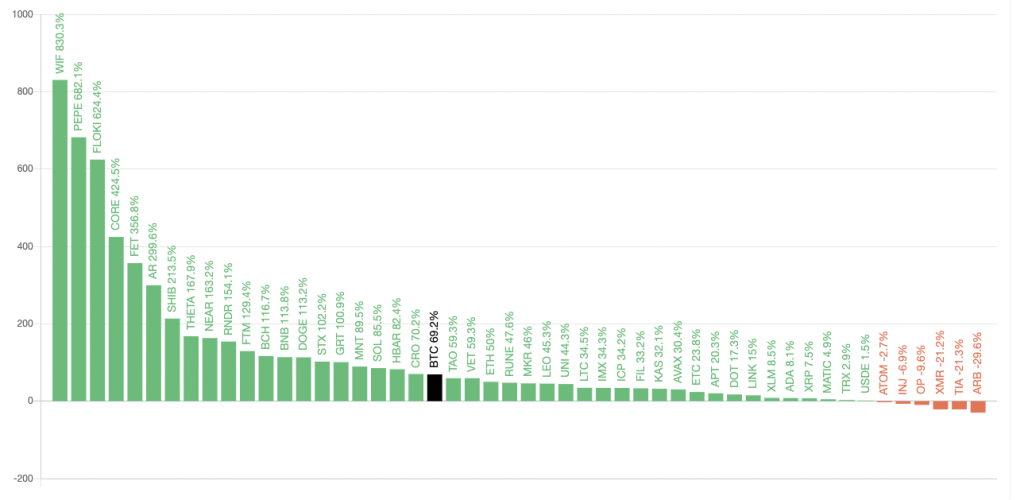

One clear sign: Bitcoin’s dominance is quietly slipping. According to CoinMarketCap, BTC’s market dominance has fallen to 60.1% — the lowest level since March.

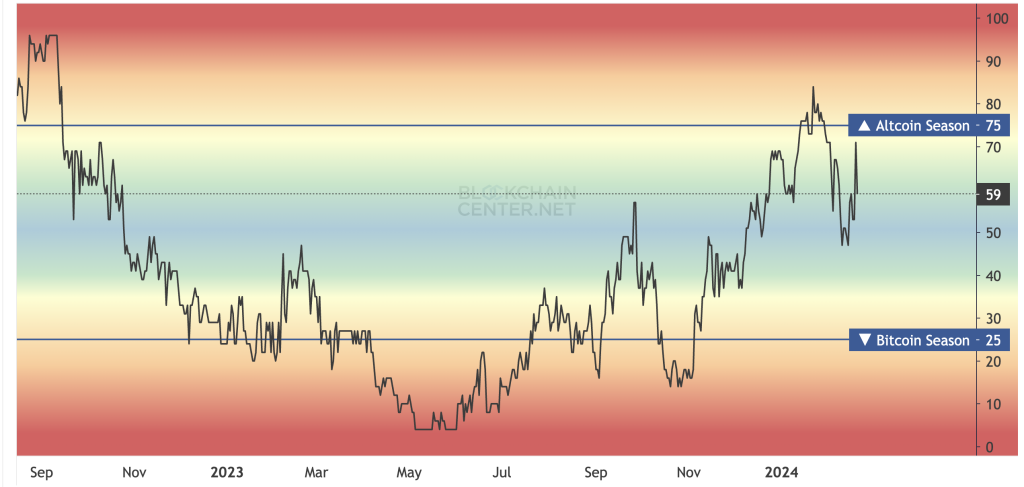

Meanwhile, the Altcoin Season Index has risen above 50. This means that, over the past 90 days, more than half of the top 100 cryptocurrencies have outperformed BTC.

What does this mean? Simply put, it’s the prelude to “altcoins are about to fly.”

2. The Signal of “Capital Shifting” Is Obvious

Researcher Chloe nailed it: Bitcoin’s breakout to all-time highs is just the “intro music” for the broader crypto market. Once the risk-averse capital feels safe, the capital chasing higher risk and higher returns quickly rotates into altcoins — especially core assets like ETH and SOL.

Look at the options market: ETH call option premiums are rising steadily, showing that institutional capital is positioning for a bigger ETH breakout.

3. A Few Key Drivers of This Rally

- ETH Spot ETF net inflows have surpassed BTC for several days, signaling growing institutional confidence in ETH.

- The GENIUS Act passed, providing a clear regulatory framework for stablecoin issuance — paving the way for more institutional participation in altcoins.

- Macro tailwinds: Global interest rates may have peaked. If the Fed signals rate cuts, a flood of capital will rush into risk assets.

Even whale investor James Wynn predicts: Bitcoin may reach $145,000 by the end of July, but will likely correct to around $110,000 after. During BTC’s cooldown phase, altcoins could have their “party moment.”

4. The Core of This Alt Season: The ETH + SOL Dual Track

Unlike previous alt seasons, this one might not be a chaotic pump of random microcaps. Instead, it could be a structured rally led by ETH and SOL.

- ETH represents institutional consensus. Continuous ETF inflows give it a solid foundation.

- SOL is the DeFi and NFT ecosystem dark horse — its high performance and rapid scalability are drawing liquidity and on-chain activity.

So, if this alt season really is underway, ETH and SOL will likely be the brightest stars in the sky.

The charm of altcoin season lies in its high returns — but the risks are just as real.

For regular investors, here are three key tips:

- Don’t blindly chase microcaps: Blue-chip altcoins like ETH and SOL offer more certainty.

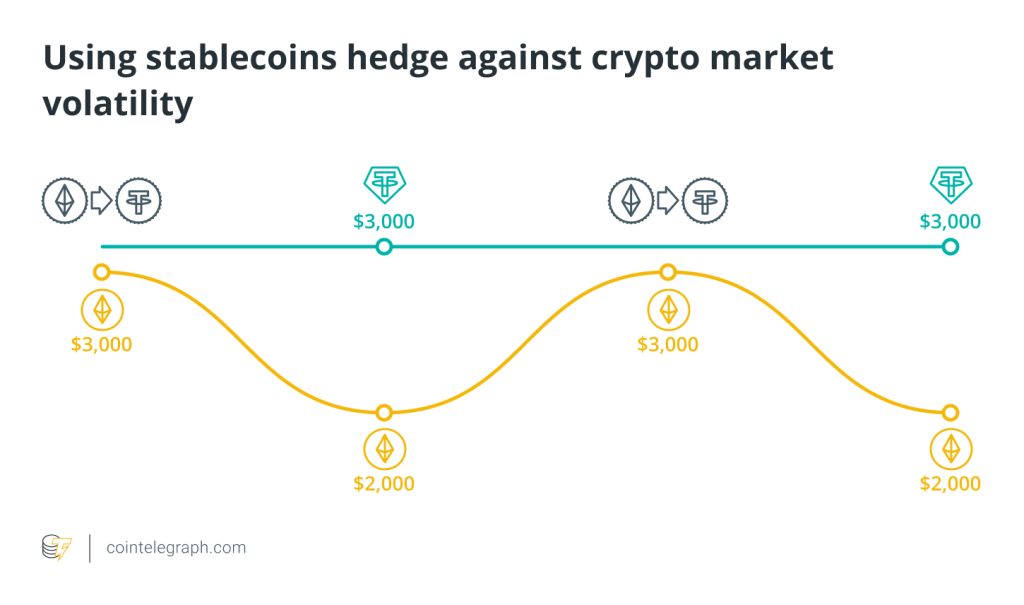

- Set clear take-profit and stop-loss levels: The volatility is real — without a plan, you could get burned.

- Follow capital flows: ETF data, options premiums, whale on-chain behavior — these are more reliable than emotion.

Conclusion: Has the Drumbeat of Alt Season Started?

From ETH’s surge to SOL’s follow-up rally… from BTC dominance decline to the strengthening Altcoin Season Index — we can feel the “music” of the market changing. Bitcoin has laid the foundation with its breakout, and now altcoins are ready to take the baton.

The real alt season might quietly begin… this summer.

Responses