Bitcoin’s Ancient Whale Awakens: New Highs, New Fears? Institutional Hands Take Over

#Bitcoin #CryptoMarket

This article only provides an analysis of market trends and does not constitute any investment advice.

On July 14, BTC surged past $123,000, setting a new high. Taking advantage of this price peak, a legendary whale — who began accumulating BTC in 2011 and once held 80,000 coins (with cost basis between $0.78 and $3.37) — started transferring BTC to Galaxy Digital. Galaxy Digital operates across asset management, digital infrastructure solutions, investment banking, and other sectors.

These 80,000 BTC are worth over $9.6 billion. For an early-generation BTC holder like this, the gains have already exceeded tens of millions of times. That’s why moves from “ancient whales” often send a chill through the market: is this a sign of a looming top?

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Is this a sell-off or just a “handover”?

Many immediately linked the news to last year’s BTC downturn caused by the German government selling 50,000 BTC. The mere mention of a whale move stirred panic. Sure enough, on July 15, BTC pulled back over 5% from the previous day’s high.

But looking closely, this whale didn’t dump everything — it chose to offload gradually via institutional channels. Smart institutional buyers were willing to take over these deeply held coins. In essence, this is a case of “high-cost whales” making room for “low-cost institutions.” It resembles a mid-cycle bull market handoff more than a market top warning.

Why does institutional takeover matter so much?

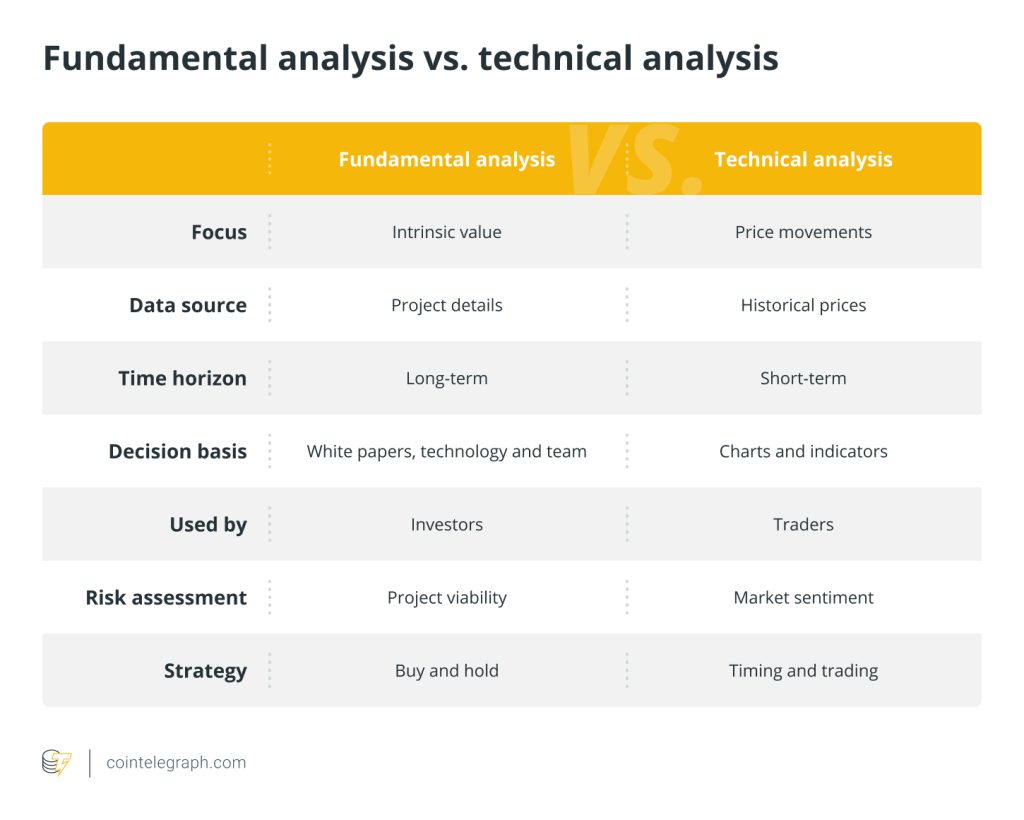

As of mid-July 2025, over 260 institutions and public companies hold BTC, totaling nearly 3.5 million coins. MicroStrategy alone bought 4,225 BTC between July 7–13, bringing its total holdings to 600,000 BTC. Meanwhile, the number of medium-sized addresses (holding 100–1,000 BTC) has significantly increased, rising from 3.9 million to 4.76 million coins. This indicates that institutions are entering aggressively, fueling BTC’s sustained price growth.

Institutions don’t just bring deep pockets — they typically take strategic positions with holding periods far longer than retail investors. Their steady inflow and handoff behavior are transforming them into the new market-driving force. OTC buyers, for instance, are leveraging deep liquidity to absorb whale-scale dumps.

Interestingly, even as BTC hits new highs, retail chatter on social media remains subdued. The number of small BTC-holding wallets is growing slowly, indicating that “retail FOMO” hasn’t kicked in yet. In past bull markets, the biggest rallies often came when retail was most active. The current “quiet entry” may actually be the perfect window for quality retail onboarding. Still, the market is not without risk — retail investors are advised to manage position sizes prudently, enter in tranches, and closely monitor macro and on-chain indicators.

Let’s talk long-term trends: Eight words — Ancient Whale Awakens, Institutions Strategize.

“Ancient whale awakenings” typically occur in the middle of bull cycles — when prices rise steadily and institutions begin profit-taking. Every bull market has seen these narratives. In the 2021 golden bull run, similar whale transfers triggered short-term volatility but didn’t create sustained sell pressure. The market soon broke through and entered a new cycle.

This time, the whale is using Galaxy’s OTC desk, signaling a “main channel adjustment.” Institutions are ready, with capital on hand — indicating the upward trend remains intact. After all, one OTC desk absorbing tens of millions in BTC doesn’t spell doom — it reflects institutional-level handover.

- From a technical standpoint, BTC’s short-term pullback remains within a medium- to long-term uptrend. MACD/RSI indicators haven’t shown extreme overbought/oversold signals and remain biased toward bullishness.

- On-chain, long-term holders have high cost bases. Current price fluctuations mostly reflect internal rotations among holders, not a bursting bubble. In the medium term, institutional allocations are likely to remain locked for the long haul or used as backing for financial products (staking, ETF reserves, etc.). Market structure is stabilizing.

So, is this a turning point or a crossroads?

Although the whale transfer triggered short-term tension, it didn’t cause panic or systemic breakdowns. In other words, this looks more like a “healthy mid-cycle adjustment and structural handoff.”

With long-term holders (institutions, corporations) taking control, BTC price gains become more resilient. From a certain perspective, this adjustment signals a shift in market leadership. Retail used to drive bull markets with emotion, but now institutions and high-net-worth players clearly occupy center stage.

It’s like a baton pass in the battle between bulls and bears — ancient whales and retail may quietly be handing the torch to Wall Street.

That doesn’t mean retail is out of the game. On the contrary, under this wave of structural capital inflow and increasing regulatory clarity, retail’s role is evolving — from “wave maker” to “trend follower.” But with the right timing, they can still profit handsomely from the cycle.

For example, institutions like Galaxy Digital, Fidelity, MicroStrategy, and BlackRock are now classifying BTC as core holdings in their portfolios — not speculative “satellite assets.” This means they are unlikely to sell anytime soon and more likely to lock their BTC long-term, providing price support in secondary markets.

At the same time, on-chain data shows a sharp rise in addresses holding 100–1,000 BTC — often associated with small funds, family offices, and high-net-worth individuals. These players are more flexible than institutions, more aggressive than retail, and are key to driving price upward. In other words, the middle class is institutionalizing.

For ordinary investors, two key directions now deserve attention:

First, the trend of on-chain capital inflows and outflows.

The ancient whale’s BTC will most likely be “fed” to institutions via OTC transactions. This doesn’t cause direct market dumping but may create local liquidity slack — opening entry windows for “smart money.” We’ve already seen this: following the mid-July correction, a large amount of sideline capital has started flowing into BTC via CEXs and ETH-based channels — meaning “buy-the-dip” behavior is already underway.

Second, the alignment of policy and macro cycles.

The Trump administration recently announced multiple crypto-friendly policies (including JPMorgan accepting BTC as collateral, BTC added to national reserves, etc.). If this trend continues, the convergence of traditional finance and crypto markets will accelerate. In an election year, with crypto “legalization dividends” in play, this could become a key catalyst in Q3–Q4 2025.

Conclusion

Put simply, if you’re someone thinking of entering the market but worried it’s already “too high,” now is actually the best time to sharpen your fundamentals:

- Learn to read on-chain data;

- Don’t all-in — scale in gradually;

- Avoid chasing tops or panic selling — use narrative timing, not candlestick emotions.

Remember: OTC transfers are not the same as CEX dumping — don’t be scared by large transfers on the surface.

One last point that matters: This bull run isn’t like 2021’s meme-fueled speculative loop. It’s built on ETFs, spot trading, institutional allocations, and on-chain regulatory alignment. That makes it more durable — but also more logical. Prices won’t rise because of who shouts the loudest, but because capital, policy, and narratives align long-term.

So, the awakening of the ancient whale isn’t the end — it’s the beginning of the next structural adjustment in the 2025 crypto market.

Responses