July Market Watch: Trump’s Policy Blitz vs. Crypto’s Eerie Calm — What’s Really Going On?

#Trump #Crypto

Every summer, the crypto market seems to “slow down.” But July 2025 feels… different.

On one hand, Trump launched a triple strike — a massive budget bill, tariff expiration tensions, and looming crypto policy deadlines. On the other hand, the market remained unusually quiet: no sharp volatility, no breakout moves.

It’s the paradox of the month: news keeps coming, but the market stays frozen. Is this the calm before the storm — or just another round of noise with no substance?

Let’s unpack why the market is so calm in the face of major headlines, and what risks and opportunities may lie beneath the surface.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Trump’s Triple Strike: A Financial, Trade, and Crypto Trilogy

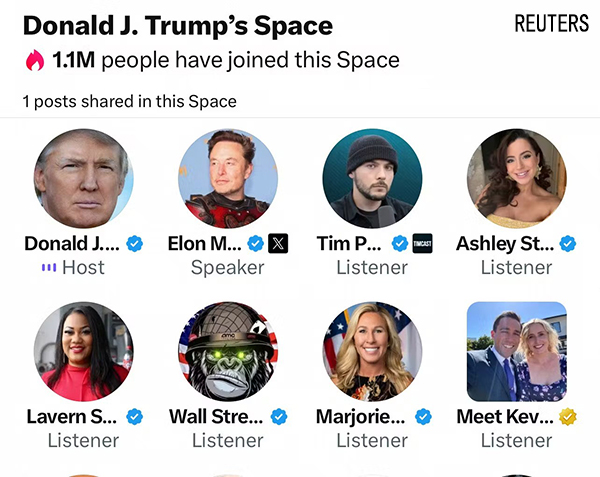

Trump and Musk once again dominated the crypto narrative this month — but especially Trump, whose three-part financial play may be the biggest macro catalyst on the horizon.

Strike One: The “Big & Bold” Budget Bill

In early July, Trump signed a massive federal budget package. It’s large in scale, aggressive in spending, and sparked fierce debate about U.S. deficit risks and dollar devaluation.

Logically, this should be bullish for decentralized, anti-inflationary assets like Bitcoin. But… the market didn’t flinch.

This “no reaction” response reflects a larger theme:Investors are ignoring old narratives and focusing on real uncertainty.

Strike Two: Tariff Expiration Raises Global Tensions

By mid-July, multiple U.S. tariff exemptions are due to expire. While no final policy has been announced, anxiety over a new round of trade wars is rising.

Normally, macro instability like this would hurt risk appetite — especially in crypto, which thrives on confidence and momentum.

But this time, investors are taking a “wait and see” stance:“No policy, no position.” Rather than reacting prematurely, the market is staying sidelined.

Strike Three: Crypto Executive Order Deadline (SBR Watch)

July 22 marks the final deadline for a major U.S. crypto executive order report — likely summarizing federal-level digital asset recommendations, regulatory guidance, and potentially the first glimpse into a Strategic Bitcoin Reserve (SBR).

There’s no leaked content yet, but anticipation is high. And yet… the market is still frozen. Why?Because investors know the importance of this moment — but refuse to front-run it.

This “conscious inaction” is a defining feature of the current climate.

Why So Quiet? Not Boredom — But High-Stakes Caution

The crypto market isn’t asleep. It’s hyper-aware and ultra-cautious.We’re in a collective standoff, where everyone’s waiting for someone else to make the first move.

1. Low Volatility: Natural Cooldown or Storm Brewing?

It’s true: July is often a “slow” season for both crypto and TradFi. But this year is different.Despite the stacked calendar of major events, no one’s making big plays. This low-volatility environment is not calming — it’s anxiety-inducing.

Traders face a dilemma:

- What if I miss the breakout?

- What if I buy too early and get burned?

Result: No one dares to go all-in. Everyone waits for confirmation.

2. Capital Is Moving — Even If Prices Aren’t

Behind the scenes, funds are flowing quietly.

There’s institutional interest building in ETFs, regulated exchanges, and long-term crypto vehicles. Just yesterday, the “Satoshi-Era Bitcoin Transfer” moved 80,000 BTC — highlighting latent capital movement.

But this isn’t retail panic buying or leveraged FOMO.It’s the methodical, cautious buildup of institutional positioning:“We’re not here to moon — we’re here to stay.”

This explains why prices haven’t spiked, but the underlying structure is firming.

3. History Says: Beware the Quiet Julys

A look at recent crypto history shows that July is rarely as calm as it seems:

- 2021: China’s mining ban triggered a market crash — and rebound

- 2022: Three Arrows Capital collapse sent shockwaves

- 2023: BlackRock filed its landmark BTC ETF application

- 2024: German BTC sell-offs + Mt. Gox repayments + Trump assassination attempt

So while history doesn’t repeat, it often rhymes. This month’s silence?It may just be the prelude to a big reveal.

What Should Crypto Traders Watch Next?

If you’re a trader or investor, ignore the price charts for a second. Focus instead on these four signal lights:

- July 22: Will we see concrete SBR (Strategic Bitcoin Reserve) disclosures?

- Tariff policy: Will renewed trade barriers ignite a risk-off cascade?

- Trump’s crypto stance: Will he double down on pro-crypto policies?

- Elon’s “American Party”: Will its pro-crypto platform translate into meaningful adoption?

Once any of these flash green, expect a sudden market snap.

Final Thoughts: Quiet ≠ Safe. Waiting ≠ Weakness.

The crypto market has entered a low-noise, high-sensitivity window.To some, it may feel like there’s “nothing going on.” But make no mistake:This kind of silence is often the setup for massive shifts.

So stay patient. Stay observant. Don’t gamble recklessly — but don’t zone out either.The real signal might already be hiding in a seemingly uneventful moment this July.

Responses