Japan’s Bond Market Liquidity Drops to 2008 Crisis Levels — Crypto Emerges as the Biggest Winner

#Japan #Crypto

Japan’s government bond market is undergoing its worst liquidity crisis since the 2008 global financial meltdown. Once hailed as the most stable long-term bond market in the world, it is now triggering major instability across global finance. Many analysts believe this crisis is merely the prelude to the real storm — just like what happened during the collapse of Lehman Brothers. The risk of a full-blown financial crisis is surging fast.

By the Data — A Snapshot of Japan’s Worsening Bond Crisis Since April 2025:

- 30-year bond yields surged to 3.20%, rising 100 basis points.

- 40-year bonds saw a massive plunge in value, with over $500 billion wiped off the market.

- The Bank of Japan still holds $4.1 trillion in government debt, accounting for 52.5% of all outstanding bonds.

- Total Japanese government debt hit $7.8 trillion, with the debt-to-GDP ratio climbing to a record-breaking 260%.

- Japan’s Q1 2025 real GDP shrank by 0.7%, missing expectations.

- April inflation soared to 3.6%.

- Real wages fell by 2.1% year-on-year.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Breaking Down the Data — What’s Really Going On?

1. Soaring Long-Term Yields, Plunging Bond Prices

- 30-year JGB yields surged to 3.20%, spiking over 100 basis points in a short time, reflecting sharp market turmoil and capital flight.

- 40-year JGBs lost over $500 billion in value — a clear sign that investor fears over long-term inflation and Japan’s solvency are mounting.

2. BOJ Is “Pinning Down” the Market

- With over 52.5% of bonds on its balance sheet, the Bank of Japan has severely distorted market pricing. This yield suppression might help in the short term but has crippled liquidity and price discovery.

3. Debt Spiral Meets Economic Decay

- Debt-to-GDP at 260% puts Japan well above global peers — more than double the U.S. level.

- Negative GDP growth and rising inflation hint at stagflation.

- Falling wages mean eroded consumer purchasing power and weakening domestic demand.

In essence, BOJ’s oversized intervention has led to a dysfunctional bond market. With investor confidence shaken, long-term capital — particularly foreign investment — is fleeing the market, triggering a full-blown liquidity crisis.

It all feels eerily similar to 2008, where asset mispricing, credit freeze, and eroded confidence preceded the financial collapse.

Winners Emerge: Crypto Becomes the New Safe Haven

While Japan’s government bond market is breaking down, crypto has quietly emerged as a safe harbor for capital flight — especially as Bitcoin (BTC) breaks through the $110,000 milestone. The tremors in Japan’s financial system have directly contributed to this risk-hedging momentum.

1. Japan’s Crypto Market: An Unexpected Source of Resilience

Despite macroeconomic woes and a massive debt overhang, Japan’s crypto sector is showing surprising strength. As of April 30, 2025, there were 32 officially registered crypto exchanges operating under full compliance, according to JVCEA.

- In February 2025 alone, Japan’s spot crypto trading volume reached nearly ¥1.9 trillion (~$13.1 billion).

- Leveraged and margin trading volume hit ¥1.5 trillion.

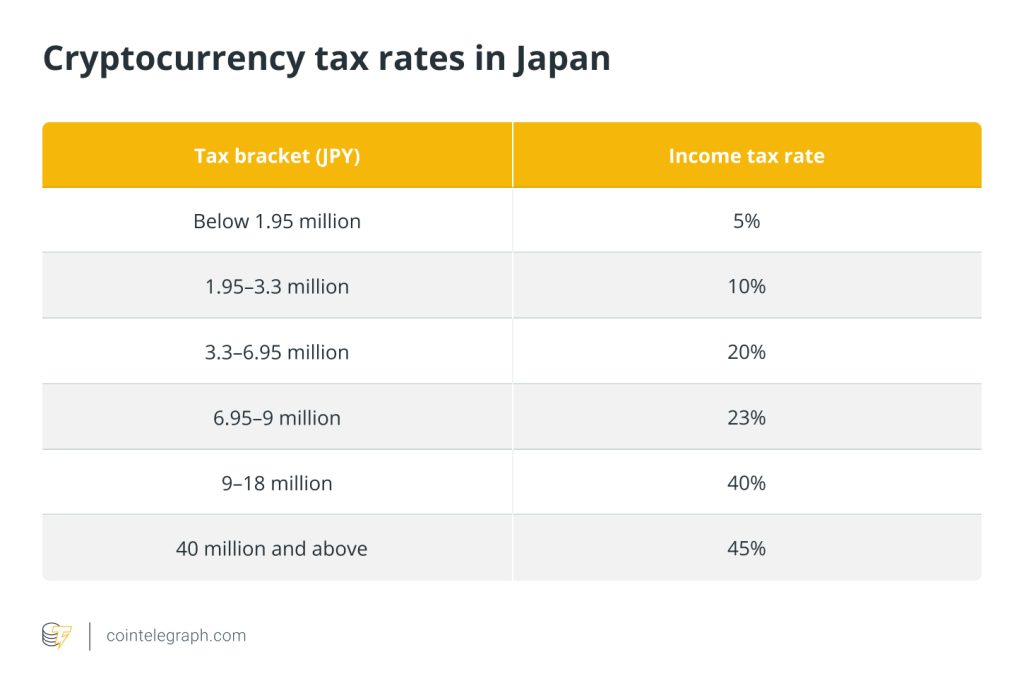

Japan’s regulatory approach has been clear but non-restrictive. The ruling LDP’s Web3 task force is pushing to officially classify crypto assets as a standalone financial product under the Financial Instruments and Exchange Act (FIEA) — a move that would bring legitimacy and pave the way for institutional adoption.

2. Traditional Market Turmoil Triggers a Surge in “Flight-to-Safety” Demand

The current JGB market turmoil isn’t just about collapsing bond prices or surging yields — it signals something more ominous: the yen is losing its safe-haven status.

The famed carry trade (borrowing yen at low rates to invest elsewhere) is breaking down. And as the BOJ struggles to keep suppressing yields, the yen continues to depreciate, further undermining domestic wealth.

This backdrop has prompted a re-evaluation of crypto — especially Bitcoin — as a credible hedge.

On-chain data shows that since mid-April 2025:

- Japanese wallet creation and BTC inflows have spiked.

- Local exchanges reported abnormally high fiat inflows, indicating a surge in yen capital entering crypto.

3. Bitcoin Breaks $110K — Japan’s Crisis Played a Role

During 2025’s Pizza Day, BTC hit $110,000 — a historic all-time high. While macro factors such as global risk appetite and institutional buying played a part, Japan’s sovereign debt meltdown served as a key catalyst.

High-net-worth individuals and asset managers in Japan have started allocating to BTC and stablecoins.BTC, ETH, and yen-linked stablecoin trading pairs (like JPYC) saw significant volume increases, showing that investors are actively fleeing the yen and searching for non-sovereign value anchors.

Conclusion

What seems like a national debt crisis is fast becoming a global asset rebalancing trigger.More and more capital is asking: In a world of fragile sovereign debt, what’s the real safe haven?

Crypto — especially Bitcoin — is offering an answer with its performance.

For Japanese investors and beyond, this might be the starting point of a shift from legacy finance to a decentralized financial future — a pivotal moment where on-chain assets earn their place as trusted stores of value.

Responses