What are the highlights of the White House Cryptocurrency Summit?And who will attend it?

#WhiteHouse #Cryptocurrency #Trump

On March 7, 2025, the White House will host the first government-led cryptocurrency summit in U.S. history. Chaired by President Donald Trump and organized by the Digital Asset Task Force, this summit marks a pivotal shift in U.S. crypto policy from “regulatory confrontation” to “strategic support.” It could also serve as the starting point for a global reevaluation of digital asset valuations.

From the weight of industry participants to the deeper intentions behind the agenda, every detail of this summit has the potential to impact the multi-trillion-dollar cryptocurrency market. This article, based on multiple sources and market data, analyzes the event’s potential impact and investment implications.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

I. Background: From Policy Battles to National Strategy

The shift in Trump’s cryptocurrency policy began during the 2024 presidential election. The Biden administration had intensified enforcement actions following the FTX collapse, causing the U.S. share of the global crypto market to decline from 42% in 2021 to 29% in 2023. To reverse this trend, Trump introduced a “Crypto New Deal” in his campaign, promising to establish a Presidential Digital Asset Task Force, streamline regulatory approval processes, and support a stablecoin framework. These commitments helped him secure over $80 million in political donations from the crypto industry.

Upon taking office, Trump swiftly signed Executive Order 14178, repealing Biden-era crypto regulations (EO 14067) and launching the “Cryptocurrency Strategic Reserve” initiative. This initiative aims to include Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA) in the U.S. national reserve asset pool. The announcement triggered a significant market reaction: on March 2, the total cryptocurrency market cap surged by $300 billion in a single day, with XRP rising 14%, SOL up 11%, and ADA skyrocketing 44%. However, the policy’s uncertainty remains a key concern. On March 4, after Trump announced new tariffs on Canadian and Mexican lumber, Bitcoin’s price dropped 9%, wiping out $180 billion in market value, highlighting the market’s sensitivity to political risks.

This summit arrives at a critical moment for the crypto market. As of March 5, Bitcoin was down 22% from its January all-time high, and the Crypto Fear & Greed Index hit its lowest level since 2022. The industry urgently needs a policy-driven confidence boost, and the White House is keen to use this event to reaffirm U.S. leadership in the Web3.0 era. As David Sacks, the White House’s Head of AI & Crypto Policy, stated:

“The summit aims to keep innovation in the U.S. while establishing regulatory safeguards against systemic risks.”

II. Key Topics: A Dual Approach to Regulation & Strategic Reserves

According to multiple agenda leaks, the summit will focus on four core issues, with the first two accounting for over 70% of the discussions:

1. Clarifying the Regulatory Framework: From Grey Areas to Compliance Pathways

U.S. crypto regulation has long been hindered by jurisdictional conflicts between the SEC and CFTC. In 2024, the SEC increased crypto lawsuits by 37%, but its win rate fell from 63% to 41%, exposing legal ambiguities. The summit is expected to introduce a new classification system:

- Decentralized assets (e.g., Bitcoin, Ethereum) will be labeled as “digital commodities”, regulated by the CFTC.

- Securities tokens & stablecoins will remain under SEC oversight.

If implemented, this framework will benefit exchanges and compliance-focused projects. For example, Coinbase’s stock surged 6.2% after the summit announcement on February 28, as the company’s business boundaries would become clearer. Additionally, Ripple’s (XRP) four-year-long lawsuit with the SEC could see a breakthrough — Ripple CEO Brad Garlinghouse has confirmed his attendance and aims to push for exemptions on cross-border payment tokens. Regulatory experts predict the framework may be modeled after Japan’s Revised Payment Services Act, allowing licensed exchanges to list tokens that pass a “liquidity test,” potentially increasing the number of compliant assets from 38 to over 120.

2. Cryptocurrency Strategic Reserve: Government-Backed Digital Assets

Trump’s “Crypto Strategic Reserve” plan is the summit’s most controversial topic. According to leaked drafts, the U.S. Treasury will allocate $50 billion from the Exchange Stabilization Fund (ESF) to purchase cryptocurrencies:

- 50% Bitcoin

- 30% Ethereum

- 20% XRP, SOL, ADA combined

This allocation has sparked industry debate:

- MicroStrategy CEO Michael Saylor argues Bitcoin should make up 80% of the reserve due to its censorship resistance and deflationary model.

- Paradigm’s Matt Huang supports including smart contract platform tokens, believing Ethereum’s ecosystem value is significantly undervalued.

Despite potential obstacles in Congress, the symbolic impact is undeniable. Historical data suggests that sovereign fund investments can reduce crypto volatility by over 40%. For instance, after Singapore’s GIC invested $230 million in Bitcoin via Odin in 2024, BTC’s monthly volatility dropped from 18.7% to 11.2%. If the U.S. executes this plan, institutional inflows of at least $20 billion are expected.

3. Stablecoin Regulation: The Digital Extension of Dollar Hegemony

Stablecoins, as fiat-pegged digital assets, are another focus. David Sacks has publicly stated:

“USDT and USDC are natural carriers of the digital dollar and should replace SWIFT for cross-border transactions.”

The task force proposes a “two-tier regulatory model”:

- Stablecoin issuers exceeding $5 billion in circulation must obtain a federal charter and undergo Federal Reserve audits.

- Smaller issuers will be regulated at the state level.

This could accelerate market consolidation, with USDT and USDC’s combined dominance potentially rising from 89% to over 95%.

4. Market Structure & Investor Protection: Balancing Innovation & Risk

The Digital Asset Task Force will release a “Crypto Market Health Report”, assessing leverage ratios and derivatives transparency. Notably, in 2024, crypto derivatives accounted for 78% of total trading volume, yet only 23% of platforms provided proof of reserves. The summit may introduce:

- Circuit breakers for extreme volatility events.

- Broker-dealer separation (ensuring customer assets are ring-fenced from exchange operations).

III. Power & Capital: The Summit’s Key Attendees

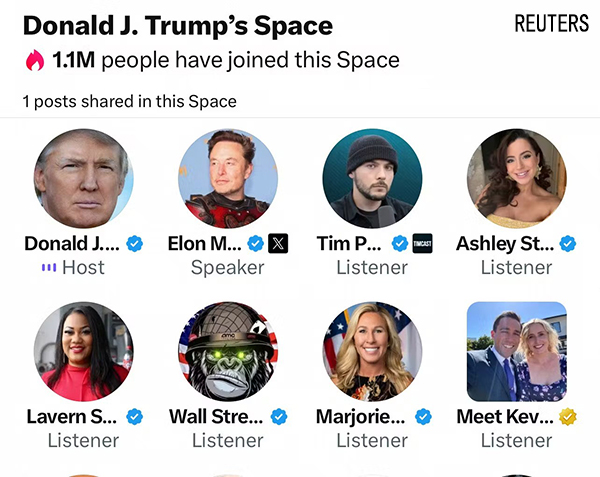

The 120 invitees reflect the crypto industry’s shifting power structure:

Government Representatives:

- Presidential Digital Asset Task Force (Treasury, SEC, CFTC officials).

- White House AI & Crypto Policy Director David Sacks.

- Executive Director Bo Hines.

Industry Leaders:

- Michael Saylor (MicroStrategy, 200K+ BTC holdings).

- Brad Garlinghouse (Ripple CEO).

- Matt Huang (Paradigm Founder).

- Martin Ward (BlackRock Digital Assets Chief).

Tech Pioneers:

- Anatoly Yakovenko (Solana Co-Founder).

- Charles Hoskinson (Cardano Founder).

- Sergey Nazarov (Chainlink Founder, unconfirmed).

It is worth noting that the proportion of representatives from traditional financial institutions has increased significantly. BlackRock has included its Bitcoin ETF (IBIT) in its model investment portfolio, with an allocation ratio of 1%-2%, corresponding to approximately $960 million in funds. Meanwhile, the Chicago Mercantile Exchange (CME) has announced the launch of SOL futures on March 17, further opening the gateway for traditional capital to enter the crypto market. The formation of this “political-business-technology” iron triangle marks the official integration of the crypto industry into the mainstream economic system.

IV. Potential Market Impact: Structural Opportunities Amid Volatility

Historically, policy-intensive events have often led to significant divergence in crypto assets. Based on current information, three major trends can be anticipated:

- Acceleration of Bitcoin’s “Goldification” Process

If the strategic reserve plan is approved, Bitcoin will become the first decentralized asset to be held on a large scale by sovereign nations. Looking at gold’s performance after the abandonment of the gold standard in 1971, Bitcoin may enter a “de-speculation” phase. By Q4 2024, the concentration of hedge funds’ Bitcoin holdings has already declined from 62% to 48%, while the proportion held by sovereign and pension funds has risen to 17%. Technically, BTC has formed strong support around $86,000. If it breaks the $95,000 resistance level, it could challenge its previous high of $105,000. - Valuation Reassessment of Compliant Tokens

Tokens included in regulatory white lists will benefit from a liquidity premium. Taking XRP as an example, if its compliance status for cross-border payments is recognized by the SEC, its market cap could recover from the current $54 billion to its 2021 peak of $88 billion. Meanwhile, SOL, with its futures being listed on the CME, may replicate ETH’s performance in 2023 — when ETH futures were approved, its price surged by 65% within three months. - Intensification of the “Matthew Effect” in Stablecoins

Under a dual-layer regulatory framework, Tether (USDT) and Circle (USDC) may further expand their market shares. USDC, in particular, could become the “officially endorsed” stablecoin due to its parent company Coinbase’s close ties with the U.S. government. By Q4 2024, USDC’s circulation has rebounded to $38 billion, marking a 120% increase from its low during the FTX crisis.

V. Risk Warnings: Uncertainty in Policy Implementation

Despite the positive signals from the summit, the crypto market still faces three major risks:

- First, the strategic reserve plan requires congressional approval, and Democratic lawmakers have issued a joint statement opposing the use of taxpayer funds to speculate on high-risk assets.

- Second, the Federal Reserve’s expected interest rate cut has been postponed to June, with the high-rate environment suppressing risk appetite.

- Third, the European Central Bank has warned that U.S. deregulation could pose a systemic financial risk globally, raising the possibility of G20 coordination to tighten policies.

Responses