SuperEx丨News: FBI Seizes Polymarket CEO’s Phone and Electronic Devices

#SuperEx #FBI #Polymarket

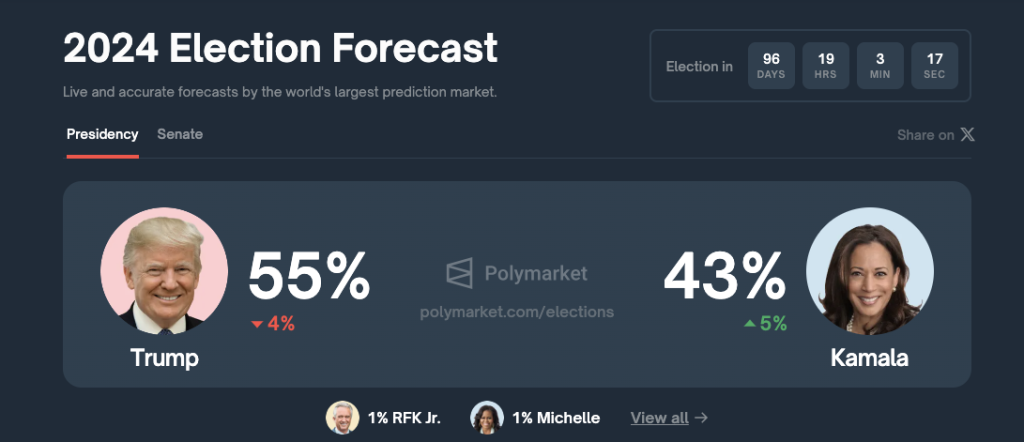

On November 13, the FBI seized the phone and other electronic devices of Polymarket CEO Shayne Coplan. According to the New York Post, the FBI raided Coplan’s residence in New York’s Soho neighborhood, demanding access to his electronic devices. This action came just eight days after Polymarket successfully predicted Donald Trump’s victory in the 2024 presidential election, during which the platform’s trading volume exceeded $3 billion.

Anonymous sources claim that the FBI suspects the platform of manipulating election markets and view this as “political retaliation” from the previous administration against Polymarket.

Currently, the U.S. Department of Justice has stepped in, focusing its investigation on whether Polymarket violated the Commodity Exchange Act (CFTC regulations) or other financial market rules. Notably, in 2021, the CFTC fined Polymarket $1.4 million for “illegally operating an unregistered market.”

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

Analysis: Potential Motives Behind the FBI’s Action

- Market Manipulation and Privacy Concerns

Sources suggest the FBI might suspect Polymarket of market manipulation, such as influencing outcomes through insider trading. Moreover, decentralized platforms like Polymarket typically allow anonymous transactions, raising concerns about money laundering or obscure sources of funds. Amid heightened U.S. cryptocurrency regulations, the FBI’s action may signal stronger enforcement in the digital asset space. - The Conflict Between Innovation and Legal Frameworks

Prediction markets rely on blockchain technology, emphasizing decentralization and transparency. However, their operational model challenges existing legal frameworks. NYU law professor Jane Roberts remarked, “Platforms like Polymarket are at the intersection of technological innovation and legal norms. Regulatory bodies lack the expertise to handle such complex financial instruments.” The FBI’s raid may not only be an enforcement action but also a regulatory assertion over this emerging sector. - Potential Political Influence

Following Trump’s victory, prediction markets quickly became a topic of political discussion. Polymarket’s significant role in election markets may have drawn it into a broader political conflict. Analysts speculate that the FBI’s action against Coplan might reflect concerns within both the Republican and Democratic parties over election interference risks.

Market Impact and Industry Outlook

- Polymarket User Response

While Polymarket’s trading volume temporarily dipped after news of the raid, it quickly rebounded. Users launched the hashtag campaign #SupportPolymarket on social media, criticizing government interference as a barrier to innovation. This indicates that while the FBI’s action created short-term uncertainty, it also garnered attention and support for Polymarket. - Long-term Implications for Prediction Markets

Prediction markets provide unique insights into public expectations for various events. Platforms like Polymarket not only serve as financial tools but also as barometers for public sentiment. However, excessive regulation could stifle their growth. Experts argue that the U.S. needs tailored regulations for prediction markets instead of categorizing them as traditional financial derivatives. - A Cautionary Tale for the Cryptocurrency Industry

The Polymarket case underscores broader regulatory challenges for the cryptocurrency sector. In an era where decentralization and traditional authorities often clash, this event highlights the difficulties of balancing innovation with compliance. Any attempts to disrupt the existing financial order will inevitably face resistance from established institutions.

Conclusion

The FBI’s seizure of Polymarket CEO Shayne Coplan’s electronic devices illustrates the heightened scrutiny prediction markets face as a frontier of financial innovation. Coplan’s case transcends individual circumstances, reflecting broader challenges confronting the cryptocurrency industry. Striking a balance between a free market and regulatory compliance may shape the future trajectory of the digital economy.

Responses