LEARN STANDARD ERROR BANDS INDEX IN 3 MINUTES – BLOCKCHAIN 101

In financial market analysis, Standard Error Bands (SEB) is an incredibly useful tool that helps investors understand the range and trends of price fluctuations. By analyzing market data, investors can better grasp trading opportunities and manage risks. This article will delve into the concept of this indicator, its calculation methods, application scenarios, and practical tips.

What are Standard Error Bands?

Standard Error Bands are a technical indicator based on moving averages that create upper and lower limits by calculating the standard error of price data. These limits show the expected range of price volatility over a specific time period, assisting investors in making more informed trading decisions.

Theoretical Foundation

The calculation of Standard Error Bands is grounded in statistical principles, utilizing standard deviation to measure data dispersion. By combining standard deviation with moving averages, Standard Error Bands provide a dynamic risk assessment tool. Understanding price volatility is crucial for decision-making in trading.

Calculating Standard Error Bands

The calculation of Standard Error Bands typically involves the following steps:

Select Time Period: Decide on the time frame for the moving average, such as 20 days, 50 days, or 100 days. Shorter periods may yield more sensitive signals, while longer periods provide smoother trends.

Calculate Moving Average: Compute the Simple Moving Average (SMA) of prices over the selected period. For example, the 20-day SMA is the average of the closing prices over the past 20 trading days.

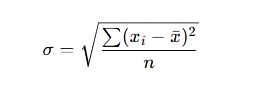

Calculate Standard Error: Use the price data from the moving average period to calculate the standard deviation. The formula for standard deviation is:

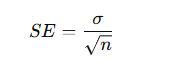

Then, divide the standard deviation by the square root of the number of periods to obtain the standard error:

Determine Upper and Lower Limits:

- Upper Limit = Moving Average + (Standard Error × Multiplier)

- Lower Limit = Moving Average – (Standard Error × Multiplier)

The multiplier is typically set to 2, indicating that approximately 95% of data points will lie within the upper and lower limits.

Applications in Trading

Standard Error Bands have various applications in trading, helping investors formulate strategies and make decisions.

1. Identifying Overbought or Oversold Conditions

The upper and lower limits of Standard Error Bands can serve as signals for overbought or oversold conditions. When prices touch the upper limit, it typically indicates that the market may be overbought, suggesting a potential price correction. Conversely, touching the lower limit may indicate an oversold market, increasing the likelihood of a rebound. Investors can use these signals to seek reversal opportunities.

2. Trend Confirmation

Standard Error Bands can help investors confirm trends. When prices continue to fluctuate between the upper and lower limits, it generally indicates a consolidating market. A breakout above the upper limit may signal the continuation of an upward trend, and vice versa. This confirmation can help traders seize entry opportunities and reduce decision-making risks.

3. Setting Stop Losses and Target Prices

Investors can use the upper and lower limits of Standard Error Bands to set stop losses and target prices. For example, if the price approaches the upper limit, traders may consider setting a stop loss to limit potential losses, and vice versa. Additionally, using Standard Error Bands allows investors to dynamically adjust target prices to capture profits when reaching expected targets.

Practical Case Analysis

To better understand the application of Standard Error Bands, let’s demonstrate its use through a simple case study.

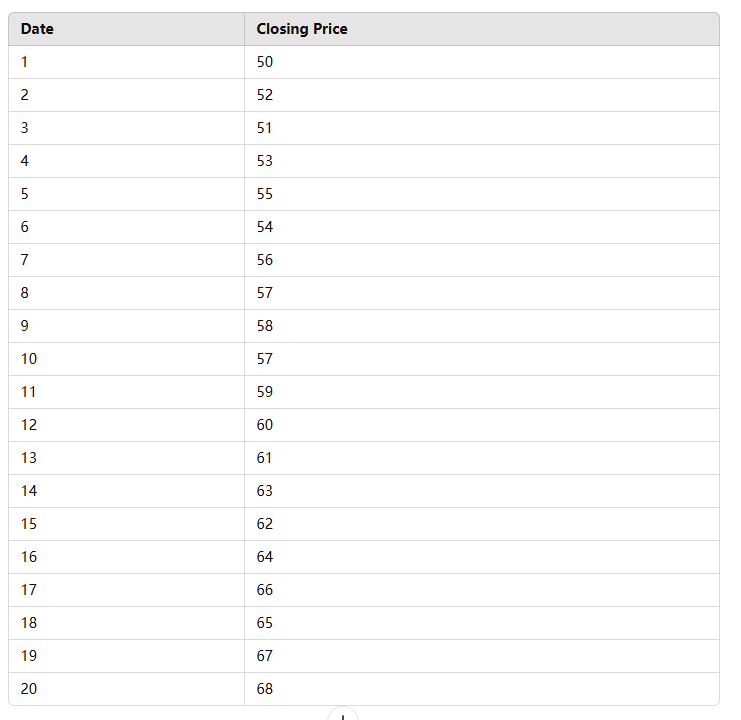

Assume a stock has the following closing prices over the past 20 trading days:

Calculation Steps:

Calculate 20-Day Moving Average: The 20-day SMA of the closing prices is 62.

Calculate Standard Deviation: Assume the calculated standard deviation is 5.

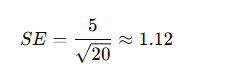

Calculate Standard Error:

Determine Upper and Lower Limits:

Upper Limit = 62 + (1.12 × 2) = 64.24

Lower Limit = 62 – (1.12 × 2) = 59.76

Based on the above data, investors can observe that when the price approaches 64.24, a correction may occur, while a rebound is likely when approaching 59.76.

Future Trends and Challenges

As financial markets continue to evolve, the application of Standard Error Bands is also changing. Investors need to pay attention to shifts in market conditions. For instance, during periods of increased volatility, Standard Error Bands may need adjustments to align with new market dynamics. Furthermore, with the rise of algorithmic trading and artificial intelligence, combining Standard Error Bands with other indicators for more precise trading strategies will be a significant challenge for the future.

Conclusion

Standard Error Bands are a powerful analytical tool that provides investors with a visual reference for price volatility. By mastering its calculation and application methods, investors can participate in the market more effectively and enhance the quality of their trading decisions. However, in the face of market uncertainties, rational investment and in-depth research remain effective strategies for navigating market changes. Standard Error Bands not only assist in identifying trading opportunities but also provide investors with a more comprehensive market perspective.

Responses