LEARN VOLATILITY CLOSE-TO-CLOSE INDEX IN 3 MINUTES – BLOCKCHAIN 101

In financial markets, volatility is a crucial concept. It reflects the degree of price fluctuations and helps investors assess risk and formulate trading strategies. Today, we will delve into a commonly used volatility measure—the Close-to-Close volatility indicator.

What is the Close-to-Close Volatility Indicator?

The Close-to-Close volatility indicator is a measure of volatility based on closing prices. Its primary purpose is to quantify the degree of price changes between two trading days. This indicator is usually derived by calculating the standard deviation of consecutive closing prices, effectively reflecting market volatility.

Calculation method

Collect Data: Obtain closing price data for a certain period.

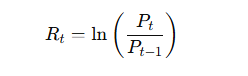

Calculate Returns: Use the following formula to calculate the logarithmic return for each trading day:

Where Rt is the return on day t, Pt is the closing price on day t, andPt−1 is the closing price on the previous day.

Calculate Standard Deviation: Compute the standard deviation of all returns to obtain the Close-to-Close volatility indicator.

Interpret Results: A larger standard deviation indicates higher market volatility, while a smaller value suggests lower volatility.

Example

Suppose we have five days of closing price data:

| Dates | Closing Price |

| 2024-10-1 | 100 |

| 2024-10-2 | 102 |

| 2024-10-3 | 101 |

| 2024-10-4 | 103 |

| 2024-10-5 | 104 |

First, we calculate the logarithmic rate of return:

Next, calculate the standard deviation of these returns to obtain the Close-to-Close volatility indicator.

Application of Close-to-Close Volatility Indicator

Risk assessment

By using the Close-to-Close volatility indicator, investors can better assess investment risks. Higher volatility may prompt investors to adopt more cautious strategies to mitigate potential losses.

Trading strategy development

When formulating trading strategies, investors can adjust their portfolios based on changes in the volatility indicator. During periods of increased volatility, they may consider reducing their risk exposure; conversely, during lower volatility, they might increase their positions.

Analysis of market sentiment

The Close-to-Close volatility indicator can also serve as a reflection of market sentiment. When market volatility rises, it often indicates increased uncertainty, leading to more cautious investor sentiment.

Caveat

While the Close-to-Close volatility indicator is valuable for risk assessment and trading strategy formulation, investors should keep in mind the following points:

Limitations of historical data: The volatility indicator is based on historical data, and past performance may not accurately predict future trends.

Changing market conditions: Different market conditions can affect volatility, so investors need to consider multiple factors.

Combine with other indicators: Using the Close-to-Close volatility indicator in conjunction with other technical indicators can enhance the accuracy of analyses.

The Close-to-Close volatility indicator is a powerful tool that can help investors better understand market risks and dynamics. By applying this indicator wisely, investors can make more informed decisions and improve their chances of success in the market.

I hope today’s discussion helps you gain a deeper understanding of the Close-to-Close volatility indicator and enables you to apply it flexibly in your trading practices. Thank you for your attention!

Responses