SuperEx Exchange | What Does the Federal Reserve’s Potential Rate Cuts in 2024 Mean for the Crypto Market?

OnSeptember 23, Federal Reserve official Neel Kashkari indicated that the Fed is expected to cut rates by another 50 basis points in 2024, with two cuts of 25 basis points each. This signals that the Fed’s easing policy will likely remain unchanged for the rest of 2024.

Rate cuts are a key tool used by the Federal Reserve during periods of economic slowdown or recession to stimulate growth. A reduction in the benchmark interest rate typically has a series of important effects on the economy. Lower borrowing costs encourage businesses and consumers to take on more loans, which in turn boosts investment and consumption. Additionally, rate cuts can help promote economic growth as easier access to credit enhances market demand. However, rate cuts may also lead to inflationary pressures, as increased demand can drive prices higher. Furthermore, lower interest rates often lead to rising prices for assets such as stocks and real estate, as investors seek higher returns. A decrease in rates may also cause the national currency to depreciate, as investors shift their focus to higher-yielding assets in other currencies. Overall, the Fed’s ongoing rate cuts reflect concerns about the U.S. economy, signaling possible signs of a recession.

For the cryptocurrency market, rate cuts are one of the most anticipated bullish events, second only to Bitcoin halving. With interest rates falling, investors may be more inclined to explore alternative assets like cryptocurrencies.

- Click to register SuperEx

- Click to download the SuperEx APP

- Click to enter SuperEx CMC

- Click to enter SuperEx DAO Academy — Space

The impact of the Fed’s rate cuts on the crypto market can be analyzed through several key points:

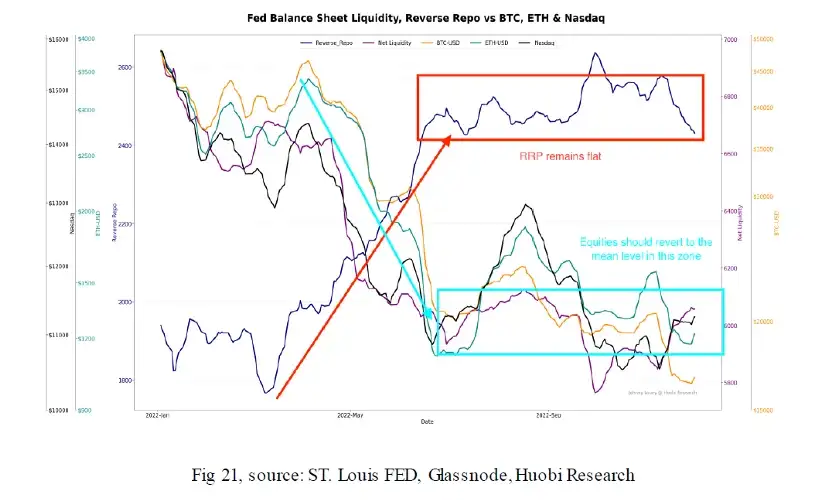

1. Increased Liquidity, Favoring Risk Assets

In a rate-cutting environment, the cost of capital decreases, leading more investors to seek high-risk, high-reward asset classes to improve their returns. Cryptocurrencies, known for their volatility and potential for high gains, are likely to attract more capital inflows. As traditional investment avenues yield lower returns in a low-interest-rate setting, some investors may allocate a portion of their portfolio to crypto assets, seeking diversification and additional yield. Over the coming months, with further rate cuts expected, the liquidity and trading volume of the crypto market could see a significant increase.

2. US Dollar Depreciation Boosts Demand for Crypto

Rate cuts often lead to a depreciation of the U.S. dollar, as lower interest rates reduce demand for dollar-denominated assets from foreign investors. In such scenarios, many investors turn to store-of-value assets, including cryptocurrencies like Bitcoin, which is often seen as “digital gold” due to its inflation-resistant and anti-devaluation characteristics. When the dollar weakens, there is typically a higher demand for Bitcoin and other crypto assets as investors seek to hedge against fiat currency depreciation. As the Fed continues to ease its policy, the pressure on the dollar is likely to drive more funds into the crypto market, potentially pushing prices higher.

3. Increased Risk Appetite Fuels Innovative Investments

The Fed’s rate-cutting policy also boosts the overall risk appetite in the market, which could lead to increased capital flows into innovative crypto projects. As the cryptocurrency space evolves, areas such as decentralized finance (DeFi), NFTs, and Web 3.0 initiatives have gained significant traction. With prolonged rate cuts, more capital may flow into these innovative sectors, driving further development and growth. This not only enhances the overall market cap of cryptocurrencies but also creates new opportunities for investors and ways to hedge risks.

4. Regulatory Environment and Rate Cuts: A Balancing Act

While rate cuts may spur growth in the crypto market, we cannot ignore the potential for increased regulatory scrutiny. As more funds move into crypto assets, regulators may step up their oversight to mitigate speculative behavior and systemic risks. Therefore, while rate cuts present an opportunity for market expansion, investors need to stay informed about regulatory developments that could impact the market.

5. Long-term Outlook: The Synergy of Rate Cuts and Bitcoin Halving

The combination of the Fed’s continued rate cuts and Bitcoin’s halving cycle creates a unique synergy in the market. Bitcoin’s halving event, which reduces its supply every four years, typically drives its price higher due to decreased issuance. When coupled with the trend of capital flowing into risk assets during periods of low interest rates, this could lead to a strong upward trajectory for Bitcoin and other cryptocurrencies in 2024. For long-term investors, the current environment could provide a favorable entry point into the crypto market.

Conclusion

The Federal Reserve’s potential rate cuts in 2024 will have profound effects on the crypto market. From increased liquidity to higher demand for cryptocurrencies, as well as a shift towards innovative investments, rate cuts offer unique opportunities for the crypto sector. However, investors should remain cautious of potential regulatory risks and ensure they are diversifying their portfolios appropriately. SuperEx will continue to monitor global macroeconomic policies closely, helping users seize market opportunities as they arise.

Responses