LEARN DONCHIAN CHANNELS IN 3 MINUTES – BLOCKCHAIN 101

What Are Donchian Channels?

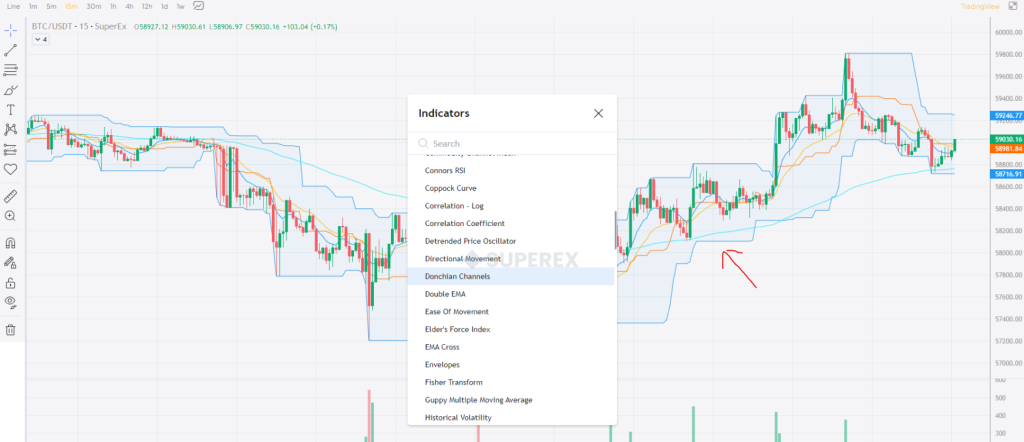

Donchian Channels is a trend-following indicator developed by Richard Donchian. It consists of three bands calculated based on the highest high and lowest low over a specified period, typically 20 periods. The upper band represents the highest price, the lower band the lowest price, and the middle band is the average of these two.

Donchian Channels help traders identify potential breakouts, trends, and price volatility. It’s particularly useful in trending markets, where price movements are more predictable.

Key Components of Donchian Channels

- Upper Band: The highest price over the selected period.

- Lower Band:The lowest price over the selected period.

- Middle Band: The average of the upper and lower bands, serving as a potential support or resistance level.

How to Use Donchian Channels in Trading

- Breakout Strategy:

- Buy Signal:When the price breaks above the upper band, it indicates a potential bullish breakout. Traders may enter a long position, expecting the uptrend to continue.

- Sell Signal: When the price drops below the lower band, it suggests a bearish breakout. Traders may enter a short position, anticipating a further decline.

- Trend Following:

The middle band often acts as a dynamic support or resistance level. In an uptrend, if the price retraces to the middle band and bounces off, it may confirm the continuation of the uptrend. Conversely, in a downtrend, a bounce off the middle band may signal the continuation of the downtrend.

3. Reversal Strategy:

If the price approaches the upper or lower band without breaking through and then reverses, it could indicate a potential trend reversal. Traders might use this as an opportunity to exit existing positions or enter counter-trend trades.

Advanced Tips for Using Donchian Channels

- Combining with Other Indicators:Donchian Channels are more effective when combined with other indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). For instance, an RSI reading above 70 during a breakout above the upper band can confirm a strong bullish trend.

- Adjusting the Period: While the default period is 20, traders can adjust this based on their trading style. A shorter period (e.g., 10) makes the channel more sensitive to price movements, suitable for short-term traders. A longer period (e.g., 50) smooths out the price action, better for long-term traders.

- Risk Management:Donchian Channels can help in setting stop-loss orders. For example, in a long position, a stop-loss can be placed just below the lower band to protect against potential losses.

Advantages of Donchian Channels

- Simplicity:Easy to understand and apply, making it accessible for traders of all experience levels.

- Versatility: Applicable across various markets, including stocks, forex, commodities, and

- Visual Clarity: Provides clear visual signals for potential breakouts, trend continuations, and reversals.

Limitations and Considerations

- False Signals:In choppy or ranging markets, Donchian Channels might produce false signals. It’s crucial to use additional indicators or confirmation strategies to mitigate this risk.

- Lagging Indicator: Since Donchian Channels are based on past price data, they may lag in fast-moving markets, potentially causing delayed entry or exit points.

Conclusion

Donchian Channels are a valuable tool for traders looking to capitalize on market trends and potential breakout opportunities. By understanding how to interpret the signals provided by Donchian Channels and combining them with other technical analysis tools, traders can enhance their decision-making process and improve their trading performance.

-INDEX-IN-3-MINUTES@2x-1024x576-4.png)

Responses