Nasdaq aims to list Bitcoin Index options in US

The announcement follows withdrawals of older applications, signaling progress with regulators.

United States securities exchange Nasdaq aims to list Bitcoin (BTC) options tied to the CME CF Bitcoin Real-Time Index (BRTI), a benchmark for BTC’s spot price, according to an April 27 announcement.

Pending regulatory approval, listing Nasdaq Bitcoin Index Options (XBTX) “would mark a significant milestone for expanding the maturation of the digital assets market,” Greg Ferrari, Nasdaq’s vice president and head of exchange business management, said in a statement.

The news is the latest in a flurry of activity around BTC options in the US. In August, the New York Stock Exchange (NYSE) American and Nasdaq International Securities Exchange (ISE) withdrew four applications with the Securities and Exchange Commission (SEC) related to the potential listing of BTC options.

Related: Expect Bitcoin ETF options to launch before 2025

On Aug. 8, US exchange Cboe filed an amended application for BTC options to the SEC. Nasdaq’s planned XBTX options are different from past proposals because they track a benchmark index rather than an exchange-traded fund (ETF). Bloomberg predicts spot BTC options go live in the fourth quarter.

“There’s definitely some movement on Bitcoin ETF options,” Bloomberg Intelligence analyst James Seyffart said in an Aug. 8 post on X. “The SEC likely gave some sort of feedback.”

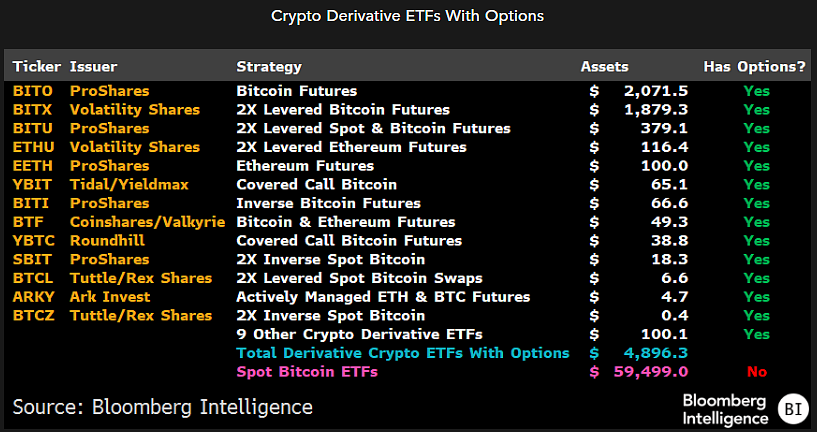

Options on crypto derivatives ETFs are already trading. Source: Bloomberg Intelligence

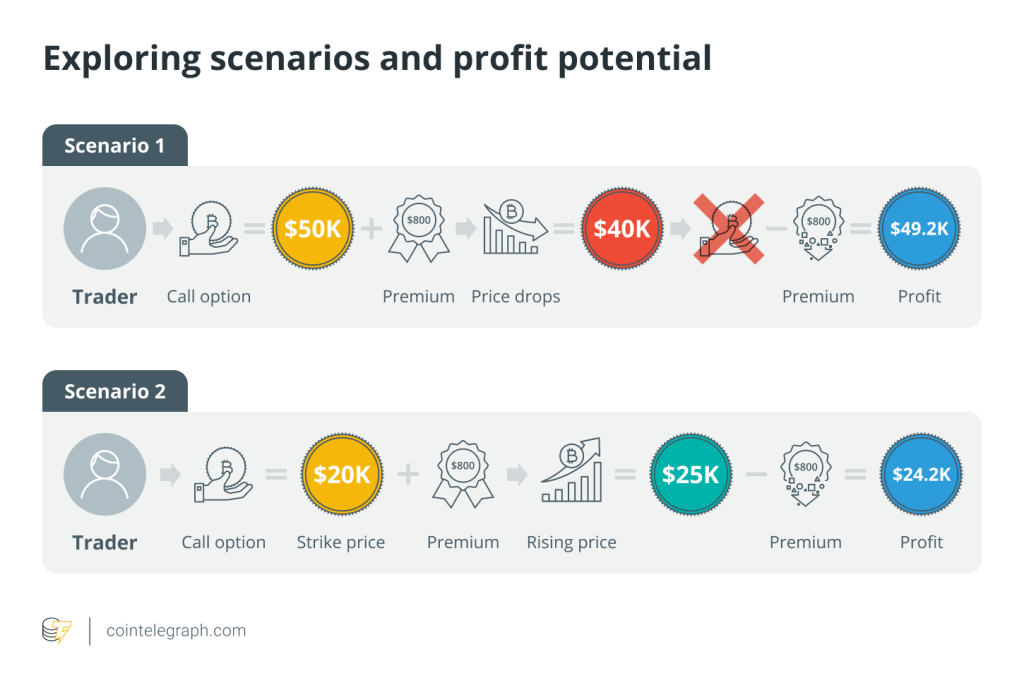

Options are contracts that grant the right to buy or sell — “call” or “put” in trader parlance — an underlying asset at a certain price. They are commonly used as hedging instruments and are popular with speculators, too.

The Chicago Mercantile Exchange (CME) Group announced plans to launch bite-sized Bitcoin futures in September tied to the same benchmark.

Investors in the US are currently permitted to trade options on ETFs that track the performance of BTC using derivatives but not on ETFs that physically hold Bitcoin itself.

Cryptocurrency derivatives on regulated exchanges are soaring in popularity in the US. As of Aug. 20, open interest on CME BTC futures contracts was nearing 30,000, according to data from the Commodity Futures Trading Commission (CFTC). Each CME Bitcoin futures contract is sized at 5 BTC.

Open options interest on BTC futures ETFs — measured by the notional value of all active call and put contracts — exceeds $3.25 billion as of market close on Aug. 9, according to data from The Options Clearing Corporation, an industry self-regulatory organization (SRO).

Magazine: Dorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

Responses