Nasdaq wants to launch a Bitcoin index options, seeks SEC approval

Options would allow institutional investors to hedge risks and traders to amplify their buying power.

American stock exchange market Nasdaq is reportedly seeking the approval of United States regulators to launch options on a Bitcoin index.

On Aug. 27, the exchange operator announced that it wants to have index options on a Bitcoin index to give institutions and traders a different way to hedge their exposure to Bitcoin (BTC).

Bitwise chief investment officer Matt Hougan said in the report that it’s important to have options for BTC for the asset class to be fully normalized. The executive said there is a missing piece in the “liquidity picture,” which would be provided by exchange-traded fund (ETF) options.

Bitcoin index options to be based on real-time index

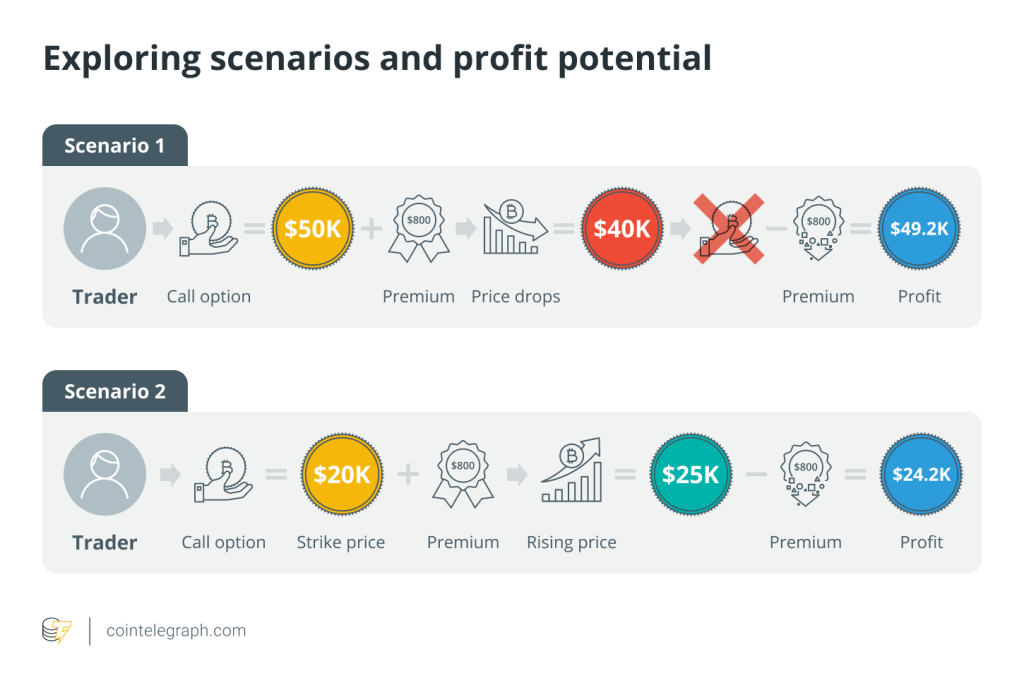

Options are financial instruments that allow traders to buy or sell assets like stocks, indexes and ETFs at a set price on a specified date. This allows institutions to hedge risks and traders to extend their buying power.

The proposed Bitcoin Index Options would be based on the CME CF Bitcoin Real-Time Index developed by CF Benchmarks. The index tracks Bitcoin futures and options contracts on CME Group’s exchange platform.

The United States Securities and Exchange Commission (SEC) has not yet approved any options investment instruments tied to the spot Bitcoin ETFs approved in January. This includes an application by Nasdaq to trade options on the iShares Bitcoin Trust (IBIT) ETF by asset manager BlackRock.

Related: Spot Ethereum ETFs record longest outflow streak amid drying investments

BlackRock ETF sees biggest inflow in 35 days

The announcement comes as BlackRock’s spot Bitcoin ETF saw its largest daily net inflow in 35 days. On Aug. 26, IBIT recorded a $224.1 million net inflow, the largest inflow of the ETF since July 22. The event suggests that investors are likely taking advantage of a small BTC price slide after a rally.

The inflows from BlackRock’s IBIT carried the 11 United States spot Bitcoin ETFs to a $202.6 million daily joint net inflow. Funds from other issuers like Bitwise, Fidelity and VanEck saw a total net outflow of $32.1 million.

Meanwhile, crypto investment products saw their largest inflows in five weeks. From Aug. 18 to Aug. 24, digital asset investment products saw a weekly inflow of $533 million, according to data shared by investment company CoinShares.

Magazine: X Hall of Flame: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer

Responses