Hong Kong’s Bitcoin ETFs reach HK$2B milestone, led by OSL

For Hong Kong to truly compete on the global stage, it will need to attract more significant inflows and broader participation from both retail and institutional investors.

Hong Kong’s burgeoning cryptocurrency investment landscape has reached a significant milestone with the total asset management scale of the city’s Bitcoin exchange-traded funds (ETFs) has surpassed HK$2 billion ($256 million).

This achievement underscores the growing interest and confidence in digital assets within the region despite a relatively slow start compared to their US counterparts.

According to data from SoSo Value, the three spot Bitcoin ETFs in Hong Kong experienced a net inflow of approximately 247 BTC this week, bringing their total holdings to around 4,450 BTC, marking a weekly increase of 5.9%. The total asset management scale for these ETFs now stands at approximately HK$2.113 billion.

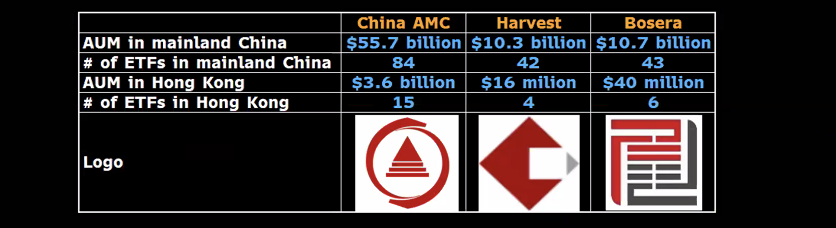

However, a closer look at the distribution of these assets reveals that two of the Bitcoin ETFs, managed by China Asset Management and Harvest Asset Management, have emerged as the dominant players in the market.

These ETFs, operated in partnership with the digital asset trading platform OSL, command an impressive HK$1.337 billion in assets, accounting for over 63% of the total Bitcoin ETF market in Hong Kong. The third spot Bitcoin ETF, unaffiliated with OSL, holds HK$776 million in assets, representing about 42% of the market.

Related: ‘China is about to start bidding’ — Will Hong Kong Bitcoin ETFs spark the halving rally?

While OSL’s strong position reflects investor confidence in its management and operational capabilities, it also underscores the relatively narrow range of options available to investors in Hong Kong’s Bitcoin ETF market.

A slow start compared to the US

Despite the recent gains, Hong Kong’s Bitcoin ETFs have underperformed relative to their US counterparts. When the ETFs launched on April 30, they attracted a total of $262 million in assets under management (AUM) within the first week, with the vast majority of this figure subscribed before the listing.

However, the actual asset inflows during the first week were a modest $14 million, a stark contrast to the billions that flowed into US spot Bitcoin ETFs earlier in January.

This disparity highlights the challenges Hong Kong faces in positioning itself as a global hub for cryptocurrency investments.

As noted by Bloomberg ETF analyst Rebecca Sin, the city’s in-kind ETF creation model offers a unique opportunity to increase AUM and trading volume. However, Hong Kong has yet to catch up with the US market in terms of investor interest and capital inflow.

Magazine: Mt. Gox not dumping Bitcoin just yet, Hong Kong boots out crypto exchanges: Asia Express

Responses