Tether shuns blockchain launch, cites market concerns

Tether’s decision to avoid launching its blockchain stems from the crowded market and strategic alignment with existing platforms.

Tether, the issuer of the world’s largest stablecoin, USDT, has calculated to forgo its own blockchain launch, citing market saturation and strategic concerns.

According to an interview with Bloomberg News, the company’s CEO, Paolo Ardoino, explained that the stance comes from analyzing the blockchain space and a crowded market.

Ardoino stated that the firm launching a blockchain might not be the “right move” since “very good blockchains” are already available to the public.

Related: Tether expands USDT to Aptos blockchain for lower fees

Market saturation

In the interview, Ardoino noted that blockchains are becoming increasingly commoditized, with many offering similar functionality to users.

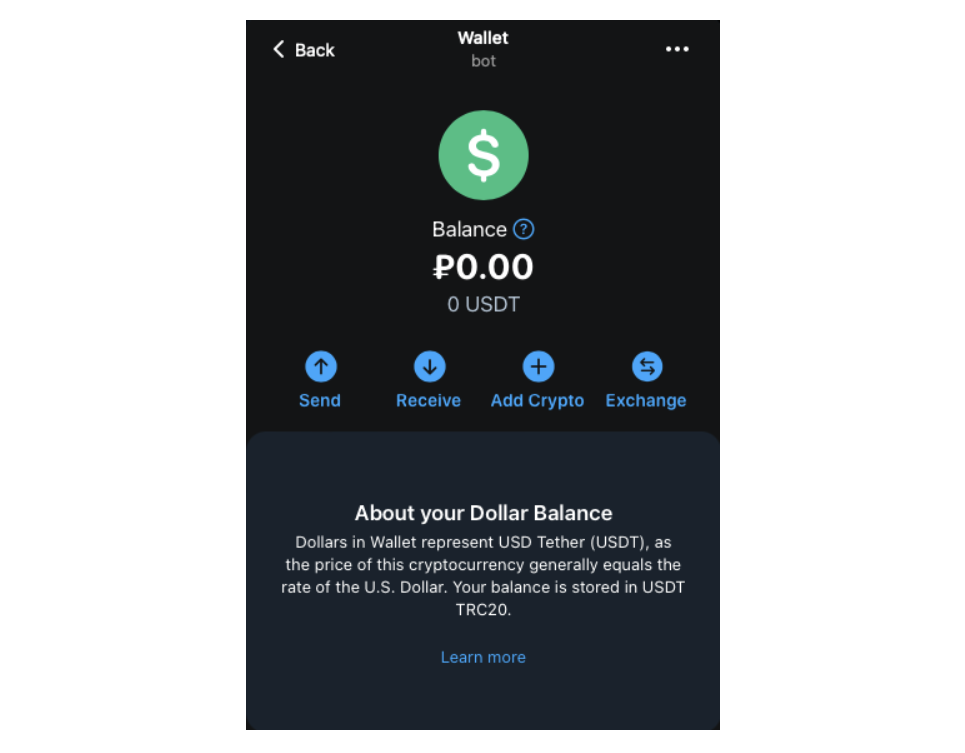

As such, he explained that the firm is satisfied with the remaining blockchain as “agnostic” as long as USDT (USDT) trading retains peak sustainability and security using blockchains as “transport layers.”

In a YouTube interview with Unlock Blockchain, Ardoino explained that Tether is “a product market fit.”

“We created the entire stablecoin market in 2014. There was no stablecoin before us.”

Related: Tether plans to launch dirham stablecoin with UAE partners

Tether Aptos expansion

On Aug. 19, Tether launched USDT on the Aptos blockchain to reduce transaction costs and improve global digital currency accessibility.

With the new integration, the company aims to leverage Aptos’ speed and scalability to provide users with gas fees that cost “only a fraction of a penny.”

The announcement by Tether follows the Aptos blockchain, witnessing significant growth and a “record-breaking” 157 million transactions in a single day in May.

Related: Tether mints another $1B USDT on Tron network

Launch of dirham stablecoin

On Aug. 21, Tether partnered with the United Arab Emirates’ Phoenix Group and Green Acorn Investments to launch a dirham-backed stablecoin.

The new stablecoin aims to digitally represent the dirham currency, “fully backed by liquid UAE-based reserves” while adhering to Tether’s “transparent and robust standards.”

This expansion into the UAE market is expected to offer users a cost-effective method for accessing “the benefits of the AED.”

Magazine: Dorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

Responses