$24M CryptoPunk sale shows either ‘NFTs are over’ or ‘this is the bottom’

SideShift.ai CEO Andreas Brekken believes CryptoPunk ##5822 was “most definitely” sold at a loss and that NFTs are “going to zero.”

Non-fungible tokens (NFTs) that used to be worth millions of dollars have faced significant declines as the market moves on to different investments. Some believe this could be the start of the end for digital collectibles.

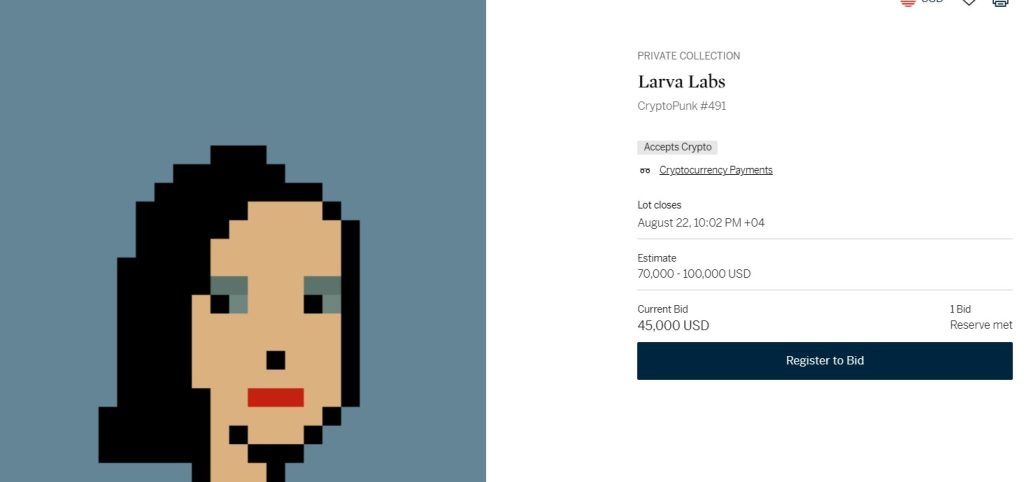

CryptoPunk #5822 was sold for 8,000 Ether (ETH), valued at $23.7 million, in 2022. The NFT holds the record for the most expensive CryptoPunk sale and is the fourth most expensive NFT of all time. On Aug. 19, the NFT was transferred to an unlabelled wallet for an undisclosed amount.

Cointelegraph approached Web3 professionals to get their thoughts on the latest NFT sale.

Most expensive CryptoPunk sold at a loss

When asked if they thought the NFT piece was sold at a loss, Web3 professionals unanimously agreed that the digital asset that used to be worth over $23 million was sold at a loss.

Gabriele Giancola, the co-founder and CEO of Web3 loyalty platform Qiibee, believes that the lack of a public announcement shows that it was sold at a loss. Giancola said:

“Yes, I believe that if the recent sale of the most expensive CryptoPunk had resulted in a profit, the seller would have likely and proudly communicated this achievement publicly.”

The executive believes this reflects the current market dynamics and will likely impact other blue-chip NFT collections. Coupled with the underperformance of another CryptoPunk auction by fine arts broker Sotheby’s, Giancola said that the initial hype surrounding certain collections continues to dip.

“This trend is likely to impact other blue-chip NFT collections that have primarily relied on speculative interest rather than substantive value,” he added.

Tyler Adams, co-founder and CEO of Web3 company COZ, also believes that the NFT was sold at a loss. The executive pointed toward the data showing how NFTs face declining sales volume. Adams believes that the days of “sky-high prices” for NFTs are becoming a thing of the past.

“The prices we saw were unrealistic, based on the novelty of the technology and the hype created by the communities, but there wasn’t any intrinsic value in the assets. The market is starting to adjust prices according to new, more realistic levels of demand,” Adams added.

Andreas Brekken, the CEO and founder of trading platform SideShift.ai, criticized the value of NFTs and said that they will “go to zero.” Brekken also believes the NFT was “most definitely” sold at a loss. The executive said that the seller is cutting their losses. Brekken added:

“At this point, there are two possible views: either NFTs are over, or this is the bottom.”

Related: Some NFTs sold for millions — What are they worth today?

Speculative capital moved from NFTs to memecoins

Meanwhile, Solo Ceesay, co-founder and CEO of social wallet Calaxy, said that one of the most probable reasons for selling the NFT is that the seller wants to rotate the capital into memecoins. According to Ceesay, memecoins’ retail adoption looks similar to the historic run of NFTs in the last cycle. Ceesay explained:

“Speculative capital in the space has disproportionately flowed into memecoins versus NFTs so far this cycle. Additionally, institutional capital preceded retail, which could influence those future inflows to flow into safer investments to avoid being overexposed too late in the cycle.”

Ceesay added that to survive, NFT projects must evolve from digital art collections into legitimate businesses with unique value propositions. While provenance is a strong tailwind for NFT utility, novel business and utility will increase consumers’ interest in the space.

Magazine: ‘Treat your first NFT purchase like a first date’ — NFT Collector Suzanne

Responses