Bitcoin price hits $61K, but investors still prefer stocks and bonds right now

Investors balance risk as Bitcoin futures dip, reflecting uncertainty before the Federal Reserve’s September meeting.

Although Bitcoin (BTC) has gained 21% since it retested the sub-$50,000 level on Aug. 5, its price has struggled to maintain above $62,000. Meanwhile, the S&P 500 index has fully recovered and is now trading just 1% below its all-time high set on July 16.

Bitcoin faces several conflicting trends which include derivatives metrics reflecting low buyer interest and macroeconomic indicators suggesting that traders are increasingly shifting away from cash positions. Interestingly, these stock market gains have coincided with a notable decline in US Treasury yields, which signals robust demand for these traditionally safe instruments.

In essence, traders are now willing to accept lower returns on fixed-income assets, likely reflecting a growing confidence in the Federal Reserve’s (Fed) strategy to curb inflation without sparking a recession. The Fed is widely expected to cut interest rates on Sept. 18, after maintaining rates above 4% since December 2022.

Investors are focusing on stocks and bonds ahead of economic uncertainty

The strong demand for government bonds, typically considered the safest asset class, doesn’t necessarily imply confidence in the US dollar’s purchasing power. If investors begin to perceive the US government’s fiscal position as unsustainable due to its ever-growing debt, their initial reaction would likely be to seek protection in safer assets. If this scenario unfolds, Bitcoin investors might have reason to be moderately concerned in the short term, despite a generally bullish long-term outlook.

The US dollar Index (DXY) recently plunged to its lowest level since December 2023, losing strength relative to other major global currencies. Some analysts suggest that DXY holds an inverse correlation with Bitcoin’s price, partly because Bitcoin’s appeal lies in its independent payment processing capabilities and fully transparent economic model.

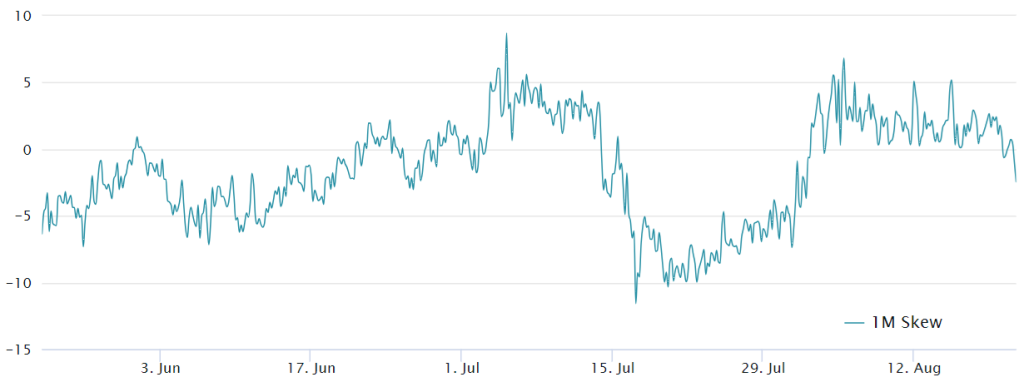

US Dollar Strength Index (DXY) 50-day correlation vs. Bitcoin/USD. Source: TradingView

Historical data shows that the inverse correlation between the DXY index and Bitcoin was evident in the past, but this relationship has weakened in recent months, with the correlation fluctuating between -40% and +40%. This recent variability reduces the statistical strength of the inverse correlation argument. However, the lack of a clear correlation does not entirely dismiss the possibility of Bitcoin price reclaiming the $72,000 level.

Similarly, the recent gains in the S&P 500, which might seem counterintuitive, actually reflect a broader investor distrust in holding cash positions. This sentiment is inherently positive for Bitcoin’s outlook. The largest global companies are highly profitable, offering potential dividends or stock buybacks. These factors position them as effective hedges, particularly when considering the substantial cash reserves held by tech giants.

Bitcoin derivatives metrics display resilience and potential price upside

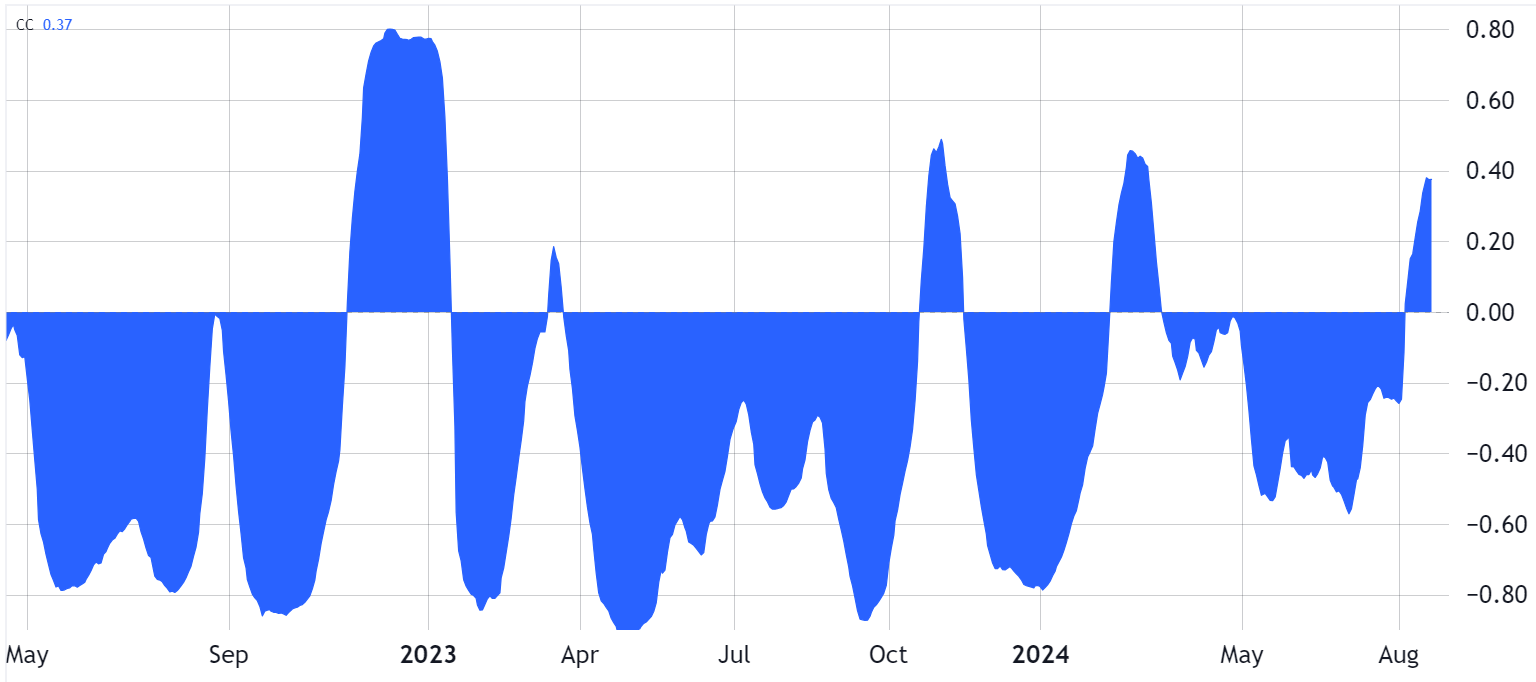

To gauge how professional Bitcoin investors are positioning themselves, it’s essential to analyze BTC futures pricing. Under normal market conditions, monthly contracts should trade at a 5% to 10% annualized premium relative to spot markets, compensating for the longer settlement period associated with futures.

BTC 2-month futures annualized premium (basis rate). Source: Laevitas.ch

The Bitcoin futures premium recently dropped to 6%, its lowest level since October 2023. While this is still within the neutral range, it is bordering on bearish territory. This is a sharp contrast to late July when the premium surpassed 10% as Bitcoin’s price surged above $68,000.

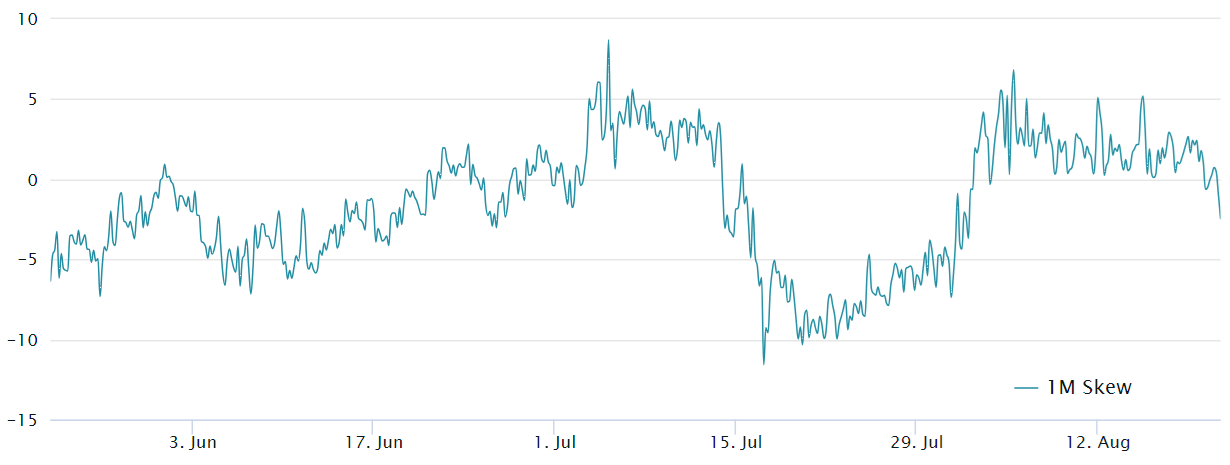

To determine if this movement is isolated to futures markets, one should also examine BTC options data. In a neutral market, the imbalance between call (buy) and put (sell) option pricing should not exceed 7% in either direction. If traders are turning increasingly bearish, the demand for put options would rise, causing the options skew indicator to move above +7%.

Related: 2 key Bitcoin metrics signal steady bull cycle — ‘No bubble’ in sight

Bitcoin 1-month options delta skew at Deribit. Source: Laevitas.ch

In contrast to the futures market, there is currently balanced demand for both call and put options, as indicated by the delta skew. This has been the case for the past few weeks, suggesting that professional traders are not particularly concerned about Bitcoin’s ability to reclaim the $62,000 level. It’s more likely that traders are refraining from increasing their exposure to cryptocurrencies ahead of the Fed’s September decision.

Responses