US regulator fines crypto fund $150K for illicit Bitcoin loan

It’s part of the fallout from the industry-wide liquidity crunch triggered by FTX in 2022.

Cryptocurrency fund lkigai Strategic Partners agreed to pay the National Futures Association (NFA) in the United States a $150,000 fine for an allegedly illicit Bitcoin (BTC) loan, according to an Aug. 20 decision by an NFA hearing panel.

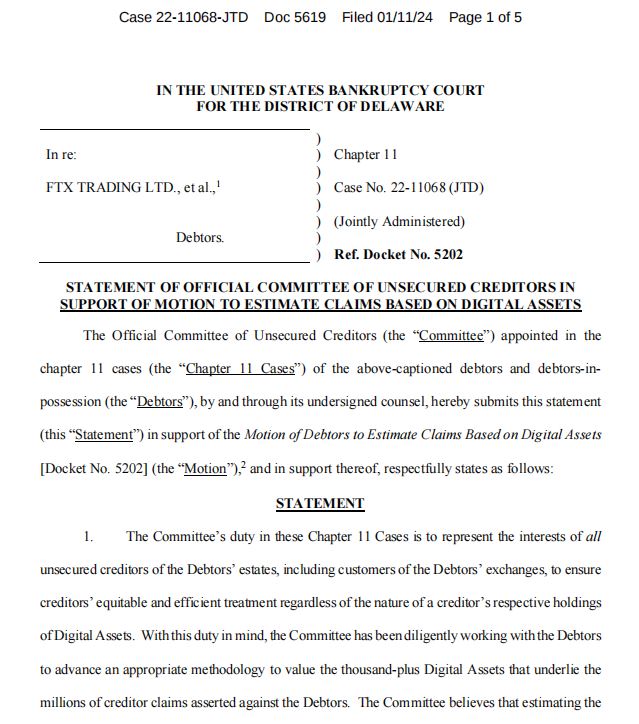

The action is part of the ongoing fallout from the industry-wide liquidity crisis following crypto exchange FTX’s collapse in 2022. It is also the latest instance of NFA — which helps regulate the United States derivatives market — policing activities in the spot cryptocurrency markets.

Related: National Futures Association adds rules for members handling digital assets

“Ikigai Strategic permitted one of the pools the firm operates to make a prohibited advance of pool assets to an affiliate that [fund principal Anthony Robert] Emtman and another Ikigai Strategic principal own,” NFA alleged in an Aug. 20 statement.

Bitcoin declined sharply in 2022 amid the FTX crisis. Source: CoinMarketCap

In 2022, lkigai allegedly loaned approximately $2.5 million worth of BTC to a crypto exchange to benefit another fund owned and operated by the same people who ran lkigai ,according to the April 29 complaint. The fund held around $65 million — or 80% of its assets — on the exchange, the complaint said. It did not name the exchange.

As a result of the loan, which NFA says went against lkigai’s regulatory obligations, lkigai was unable to meet redemption demands from its investors, the complaint said.

“Ikigai Strategic used the Master Fund’s Bitcoin as collateral for a $1.3 million [US Dollar Coin] USDC existing line of credit” extended to affiliated fund Ikigai Capital Partners GP LLC, the complaint said.

According to the decision, Kigali and its principal operator agreed to pay a $150,000 fine without admitting or denying the allegations.

On May 31, NFA issued rules governing the conduct of member firms operating in the spot cryptocurrency markets, including extensively regulating fraudulent and misleading claims.

Before the May rule issuance, the self-regulatory organization had “well over 100” members engaging in activities with digital asset commodities, but no way to address fraud or misconduct committed by those members, NFA said in a Feb. 28 letter.

Magazine: Asia Express: WazirX hackers prepped 8 days before attack, swindlers fake fiat for USDT

Responses