Private transactions now dominate Ethereum order flow — report

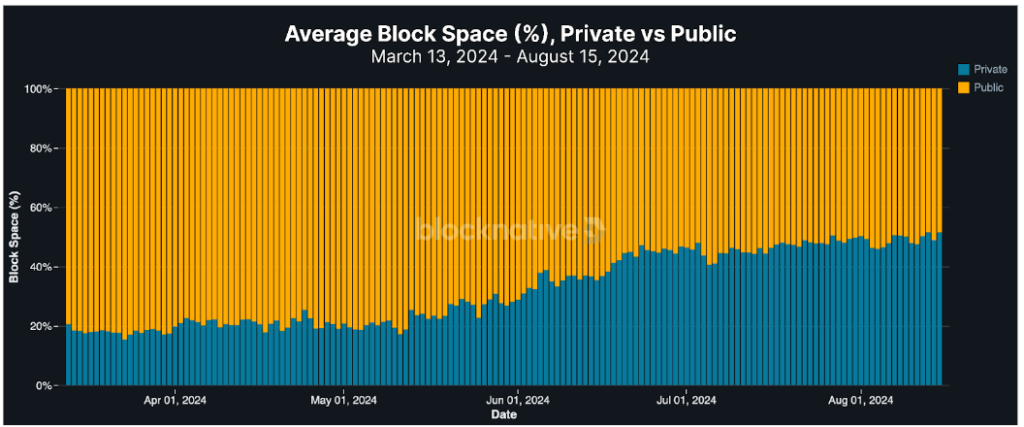

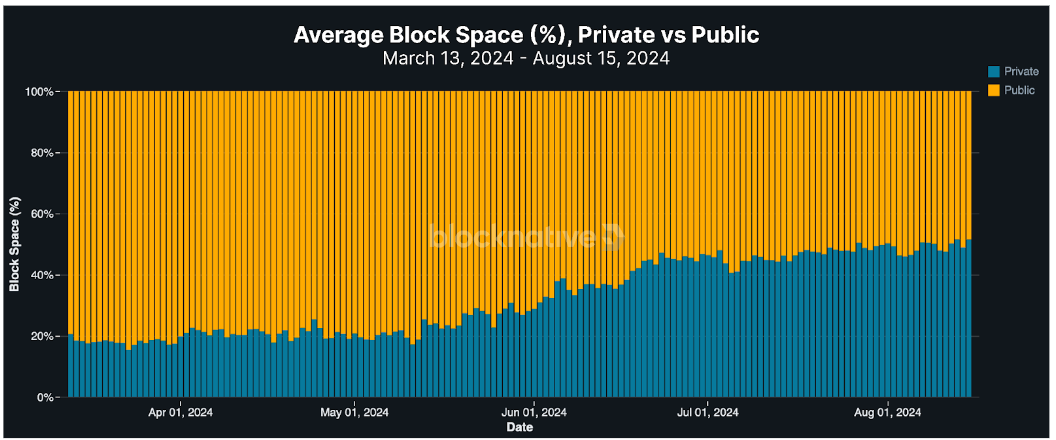

Private orders consume more than 50% of gas used on Ethereum, according to Blocknative.

Private transactions now dominate Ethereum’s order flow as users seek to protect trades from frontrunners, according to an Aug. 20 report from Blocknative.

While private order flow still only comprises approximately 30% of Ether (ETH) transactions, they consume more than half of all gas used on the network, Blocknative said. This shift creates “[n]ew centralization vectors as private transaction order flow is accessible only to permissioned network participants,” according to the report.

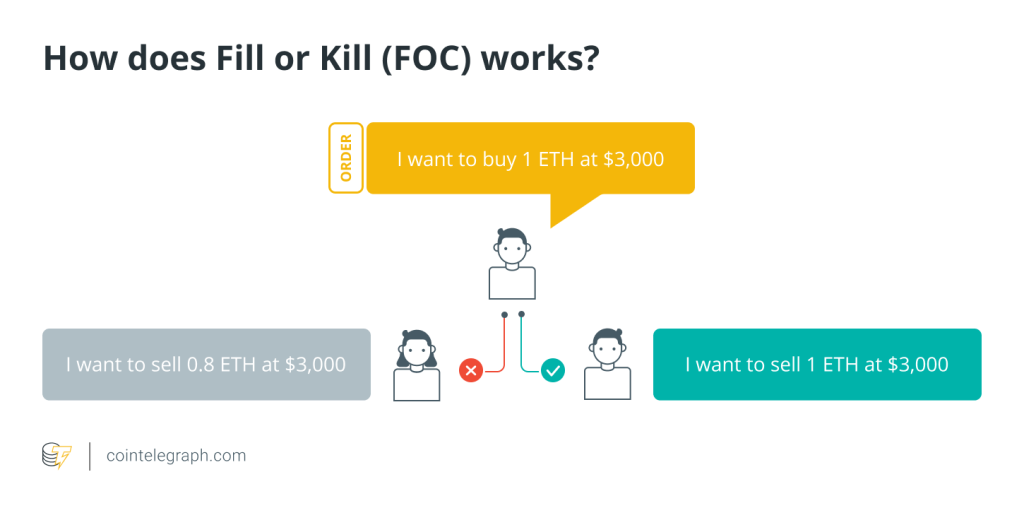

Private orders involve sending transactions directly to a validator, in an arrangement known as a “dark pool,” instead of into the public queue. Public transactions risk being frontrun by automated trading “bots” that profit at users’ expense — a practice known as maximum extractable value (MEV).

Related: What is MEV: A beginner’s guide to Ethereum’s invisible tax

“Because users typically choose to transmit transactions privately for MEV protection, particularly when conducting more complex—and hence gas-intensive—onchain actions such as swaps,” according to Blocknative. “These, in turn, consume more gas per transaction than non-MEV transactions.”

Private order flow is dominated by a handful of blockbuilders, namely Beaver, Titan, Rsync and Flashbots, all of which “have shown dramatic increases in private order flow since March,” according to Blocknative. Gas consumption for each of these blockbuilders has grown by 130% to 150% during this timeframe, the report said.

The growth of dark pools has negative effects on users participating in the public transaction queue, including more volatile and unpredictable gas prices, according to Blocknative.

“There is reduced observability in the gas fees to get onchain when the majority of block space is consumed by transactions that are sent privately,” the report says.

“This means an increase in the likelihood that you will either price your transaction too low and end up with a stuck transaction or price your transaction too high to ensure your transaction lands onchain,” the report added.

Responses