German BaFin regulator cracks down on crypto ATMs

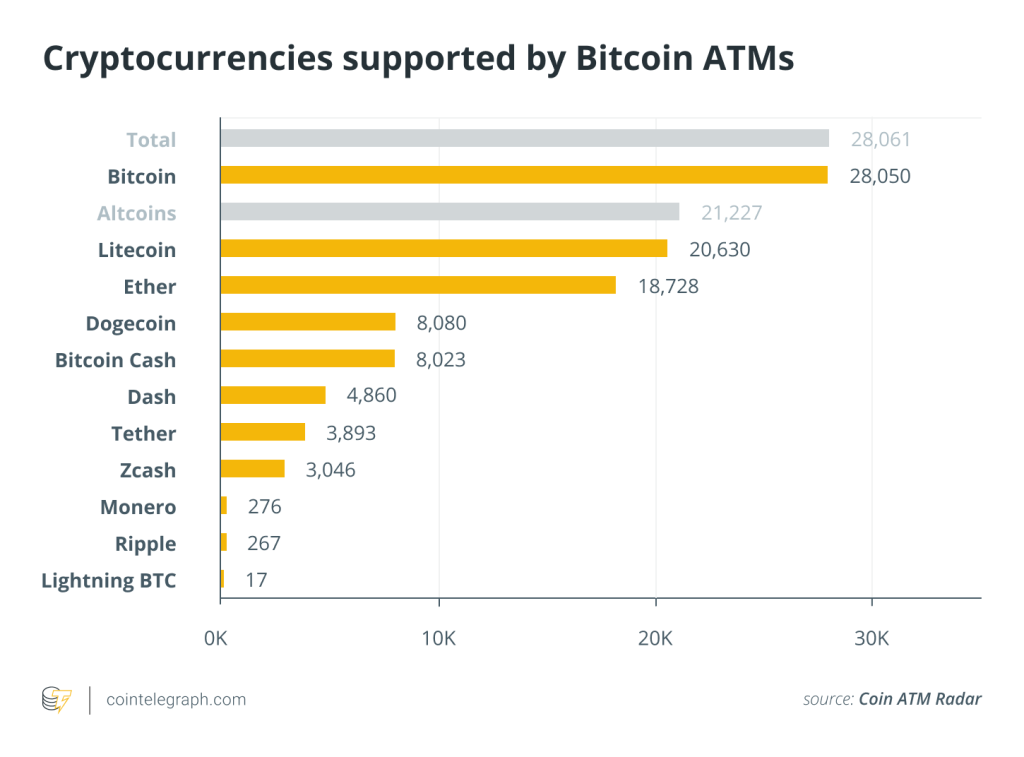

According to Coin ATM Radar, there are currently 38,725 crypto ATMs worldwide, with a vast majority located inside the United States.

Germany’s Federal Financial Supervisory Authority (BaFin) has launched a crackdown on crypto ATMs and seized 13 of these automated cash kiosks from 35 locations, the government regulator announced on Aug. 20.

The German financial regulator conducted the seizures in conjunction with the Federal Criminal Police Office, local law enforcement and Germany’s Bundesbank.

According to the government bureau, the ATM operators “illegally installed” the machines and failed to register them under Section 32 of the Banking Act. BaFin claimed that the exchange of euros to cryptocurrencies or vice versa breached the Banking Act.

Additionally, German officials also claimed that crypto ATMs, in general, could attract a hotbed of criminal activity if the operators fail to properly exercise Know Your Customer controls for transactions above 10,000 euros.

The current state of crypto ATMs globally

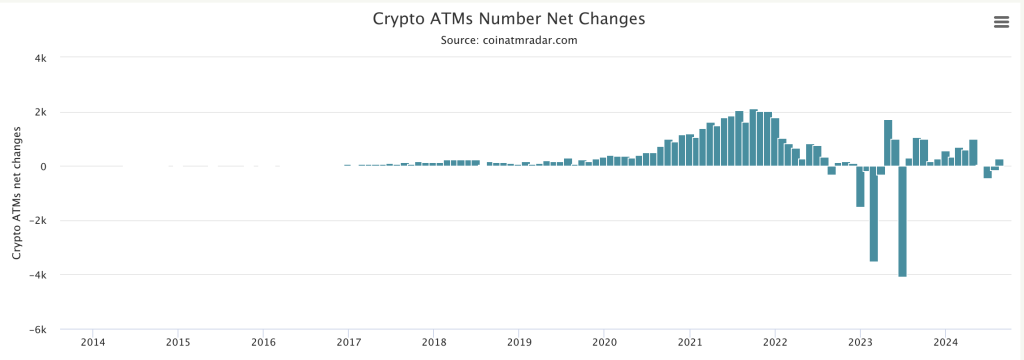

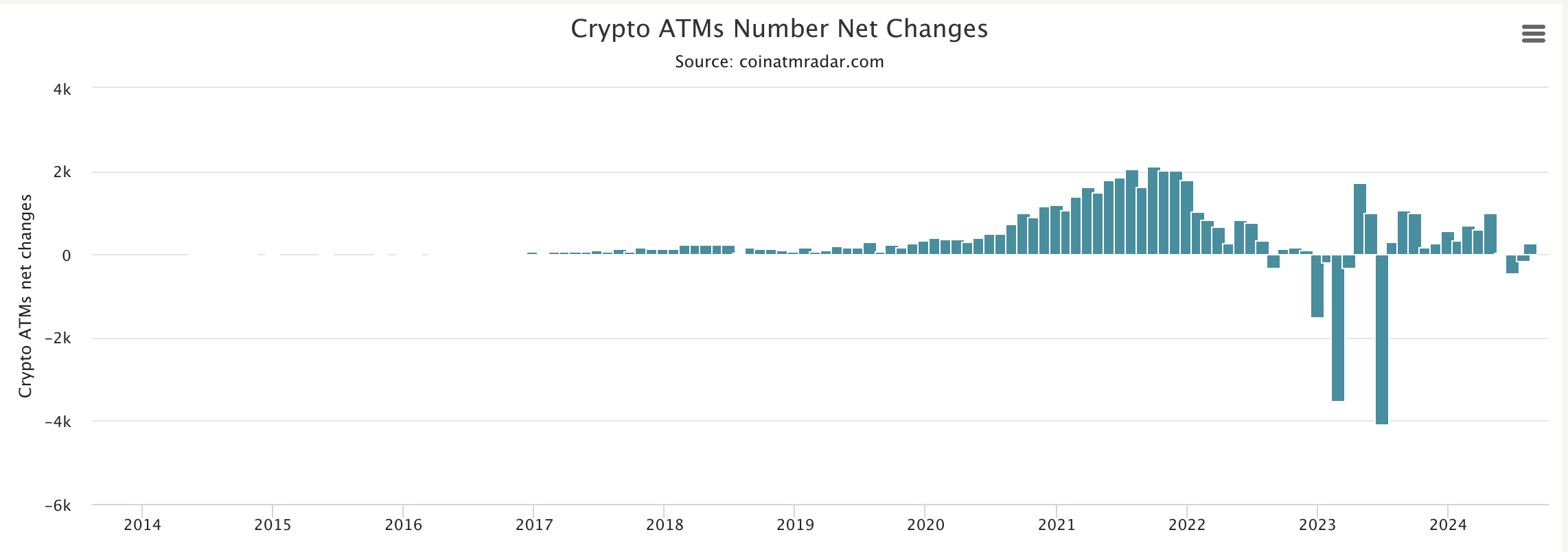

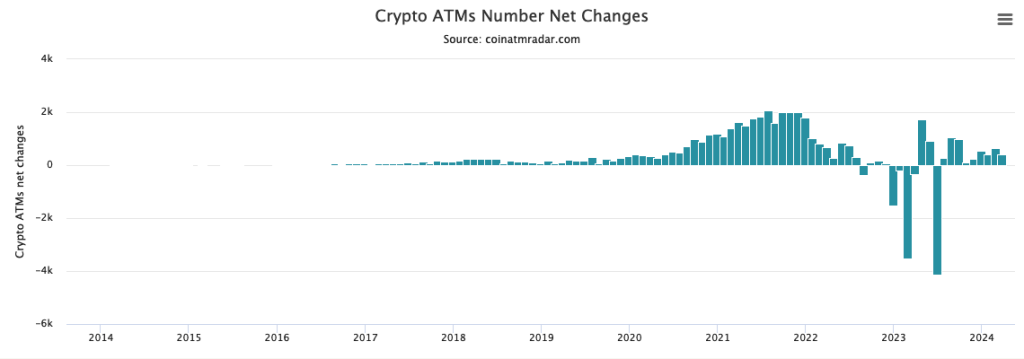

Although the number of Bitcoin ATMs installed worldwide in 2024 had been nearing all-time highs, the uptrend in machine installation was disrupted in July by a decrease of 440 crypto ATMs. There was an additional reduction of 173 ATMs by Aug. 1.

Source: Bitcoin ATM Radar

According to the latest data from Coin ATM Radar, the number of crypto ATMs installed has recovered, and an additional 266 ATMs have been installed since the beginning of August.

Related: California county to regulate Bitcoin ATMs backed by state laws

The global reduction of Bitcoin ATMs in July and early August was partially fueled by shutdowns in the United States. Though the exact reasons behind the shutdowns have varied, US law enforcement officials have conducted several enforcement actions against Bitcoin ATM operators, including Bitcoin of America.

In 2023, Bitcoin of America agreed to shut down operations in Connecticut after the state’s Department of Banking charged the company with operating money transmitter services without a license.

The state regulator took action against Bitcoin of America after several customers complained that they were collectively scammed out of tens of thousands of dollars.

As part of the consent order, the Bitcoin ATM operator also agreed to pay $86,000 as compensation to the injured parties.

Magazine: Weird ‘null address’ iVest hack, millions of PCs still vulnerable to ‘Sinkclose’ malware: Crypto-Sec

Responses