Bitcoin stagnates as bearish headwinds continue to blow

Bitcoin price falls as demand for leveraged long BTC futures and stablecoins drops.

Bitcoin (BTC) has been stuck in a narrow range since Aug. 8, and unable to surpass $62,000 while reinforcing support at $58,000. This consolidation reflects growing uncertainty among traders, especially as the BTC futures funding rate remains negative, indicating low demand leverage from buyers.

The question arises as to whether this indicator alone can dictate the cryptocurrency market’s trajectory or if historical patterns suggest an impending rally.

S&P 500 and gold near all-time highs while Bitcoin fails to sustain momentum

A key concern for Bitcoin investors is the positive performance of the S&P 500 index, which is currently just 2.5% below its all-time high, and gold, which is trading a mere 1% below its record level. In this context, it’s challenging to rationalize Bitcoin being 19.5% below its March 14 peak of $73,757, regardless of whether the cryptocurrency is viewed as a risk-on asset or a hedge against potential disruptions in the US debt situation.

Investor sentiment toward Bitcoin has also been dampened by the fact that Democratic presidential nominee Kamala Harris has not provided a clear stance on the crypto industry, beyond vague campaign statements. In contrast, Republican nominee Donald Trump has announced plans to remove Gary Gensler from his position as Chair of the US Securities and Exchange Commission (SEC). Industry leaders have been vocal in their criticism of Gensler’s lack of a clear regulatory framework for crypto companies in the US.

Recent economic data supporting the US Federal Reserve’s (Fed) successful efforts to curb inflation without triggering a recession may have also contributed to the decreased interest in Bitcoin. US retail sales increased by 1% in July, surpassing economists’ expectations of a 0.4% rise. Meanwhile, the Department of Labor reported 7,000 fewer initial jobless claims than the previous week.

Yung-Yu Ma, chief investment officer at BMO Wealth Management US, told Yahoo Finance that a “soft landing is firmly in place.” Essentially, a stronger macroeconomic environment boosts the stock market, diminishing Bitcoin’s appeal as an independent store of value.

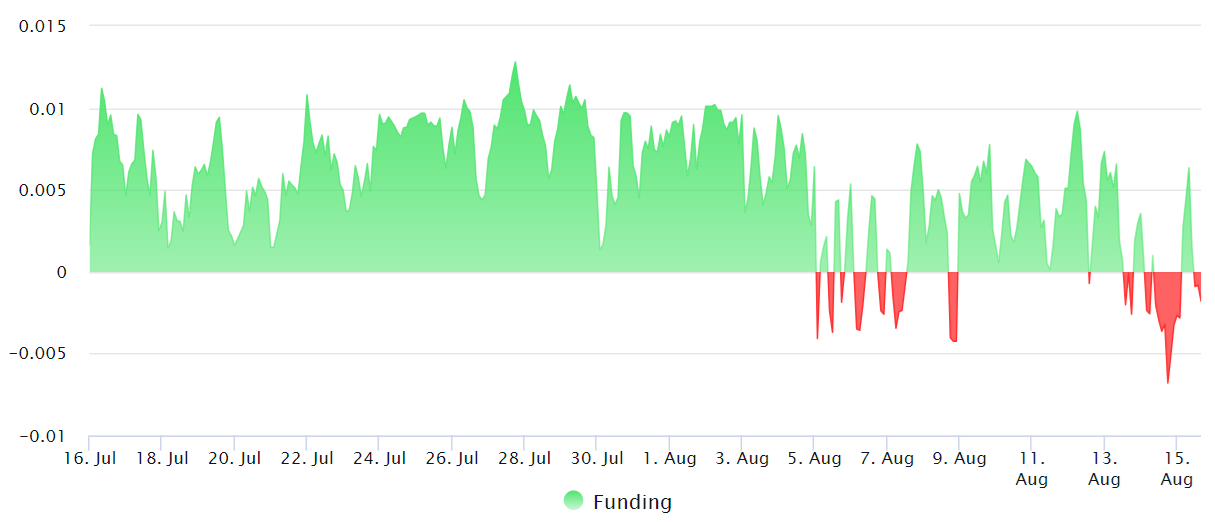

From a trading perspective, the demand for leverage through BTC futures contracts serves as a key indicator of investor confidence. When the market is optimistic, bullish investors typically enter leveraged positions, pushing the funding rate on perpetual contracts into positive territory. Rates between 0.2% and 1.2% per month generally suggest neutral market conditions, while rates below this range are considered bearish.

Data shows that the Bitcoin perpetual futures funding rate was predominantly negative on Aug. 14 and 15. In fact, the last time this indicator approached bullish levels was on June 8, when Bitcoin’s price tested the $72,000 resistance. This is logical, as perpetual futures are the preferred leverage instrument for retail traders, while monthly contracts, which require rollovers, often trade at a premium or discount relative to spot markets.

Demand for crypto in China has plummeted according to stablecoin data

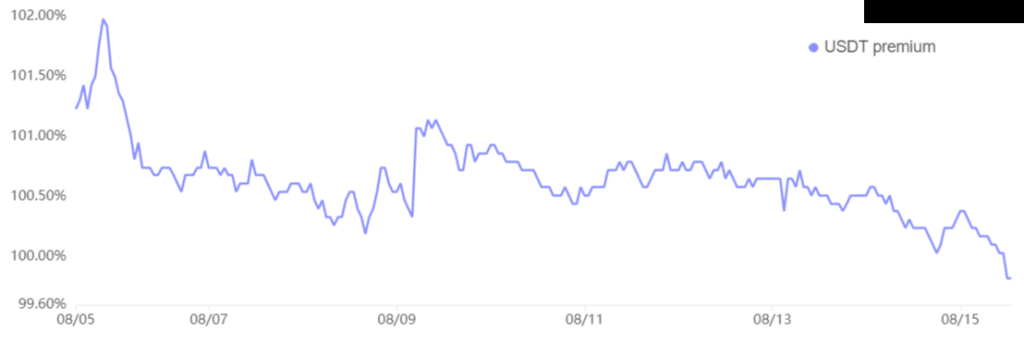

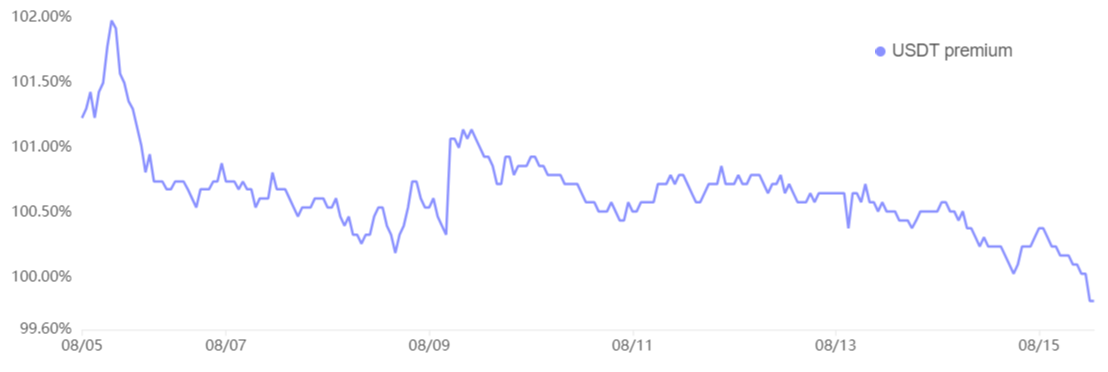

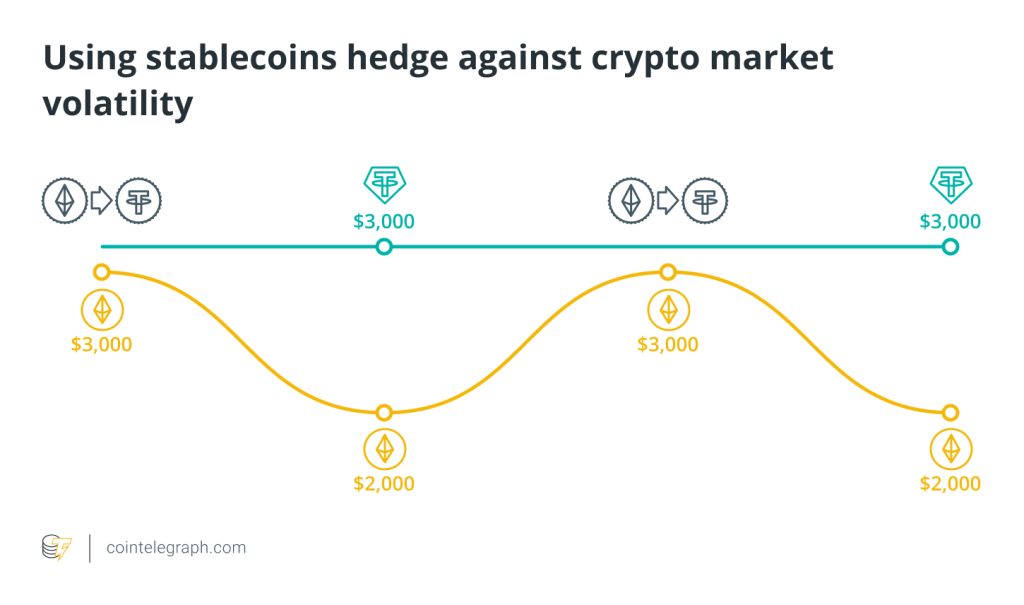

To determine if the lack of buyer confidence is limited to perpetual futures, one should also examine stablecoin demand in Chinese markets. Typically, strong retail demand for cryptocurrencies drives stablecoins to trade at a premium of 2% or more above the official US dollar rate. Conversely, a discount usually signals fear, with traders eager to exit the crypto markets.

Related: Bitcoin sell pressure may break $56K support as options expiry looms

On Aug. 15, USD Tether (USDT) was trading at a 0.2% discount in China, indicating reduced demand for cryptocurrencies. This is a notable shift from Aug. 6, when traders were paying a 2% premium for USDT, marking the lowest level for this indicator in three months.

Based on BTC derivatives metrics and stablecoin demand in China, Bitcoin faces a challenging path to reclaim the $62,000 support. However, historical data suggests that retail traders often react to market movements rather than anticipating them, so a breakout cannot be entirely ruled out.

Responses