Marathon Digital buys $249M Bitcoin, reserves reach 25K BTC

Marathon’s latest 4,144 Bitcoin buy comes as boss Fred Thiel last month said it was adopting a “hodl strategy” for the cryptocurrency.

Bitcoin miner Marathon Digital has purchased another $249 million worth of Bitcoin after raising $300 million from a senior note offering.

On Aug. 14, the miner said it used part of the note sale proceeds to buy around 4,144 Bitcoin (BTC) at an average price of roughly $59,500, which brought its “strategic Bitcoin reserve to over 25,000 BTC,” it added on X.

Marathon saw net proceeds of around $292.5 million for its convertible senior notes due September 2031, which bear a 2.125% annual interest rate and are convertible into cash, Marathon stock, or both.

MARA secures $300M through an oversubscribed offering of convertible senior notes. With proceeds, we purchased 4,144 BTC (valued at approx. $249M), boosting our strategic bitcoin reserve to over 25,000 BTC. Learn more: pic.twitter.com/EKwKW6eSny

— MARA (@MarathonDH) August 14, 2024

Marathon said the remaining cash from the note sales would be used to buy more Bitcoin and for “general corporate purposes,” which possibly includes strategic acquisitions.

A Marathon spokesperson told Cointelegraph it believes Bitcoin “is the premier strategic treasury asset” and is “adopting a multifaceted strategy for acquiring Bitcoin.”

Its latest Bitcoin hoard comes after it purchased 2,282 BTC over July, worth $124 million, which Marathon CEO and chairman Fred Thiel said was part of a “hodl strategy” — a misspelling of “hold” that made its way into the crypto scene’s lexicon.

Marathon (MARA) shares closed 2.26% down on the day to $15.14. Its share price is down nearly 34% year-to-date, according to Google Finance.

Related: Riot Platforms boosts Bitfarms stake with $2.28M share acquisition

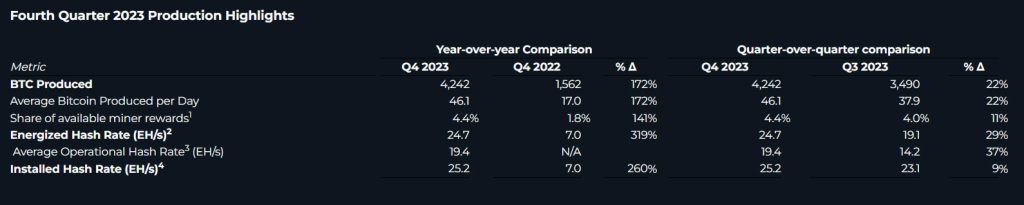

Marathon’s second-quarter earnings earlier this month missed Wall Street estimates, posting 9% lower than estimated revenues of $145.1 million, but still a 78% year-over-year bump from Q2 2023.

It comes as crypto mining profitability has hit a record low after the Bitcoin halving, which cut mining rewards in half.

Miner hashprice, which measures mining profits, fell to a record low earlier this month, with Blockbridge reporting large public miners will struggle to make a profit, especially Marathon, which had the highest all-in mining cost last month.

Magazine — ‘Bitcoin Layer 2s’ aren’t really L2s at all: Here’s why that matters

Responses