Exclusive: Fireblocks granted New York charter for crypto custody

The charter allows Fireblocks to offer cold-storage custody to US clients.

Web3 infrastructure provider Fireblocks has been granted a New York state charter to custody cryptocurrency for clients in the United States, Fireblocks told Cointelegraph on Aug. 14.

“As of this month, Fireblocks Trust Company, LLC has received its limited purpose trust company charter to engage in virtual currency business and will soon begin offering cold storage custody solutions powered by Fireblocks’ technology to US customers,” Fireblocks told Cointelegraph in a statement.

In May, Fireblocks said it intended to “launch a limited-purpose trust company that is under the regulation of the New York Department of Financial Services (NYDFS)” called Fireblocks Trust Company that “will offer cold storage custody solutions to US clients.”

Related: Fireblocks launches Web3 startup toolkit amid a surge in new ventures

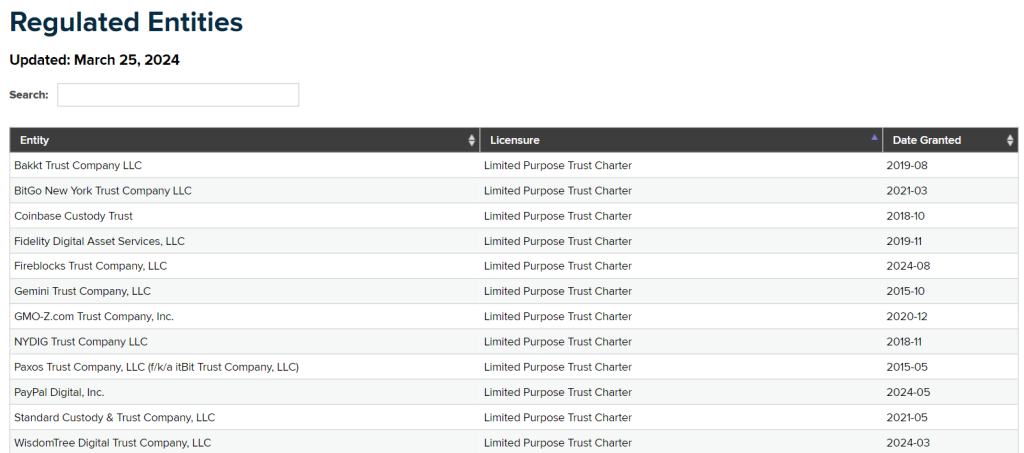

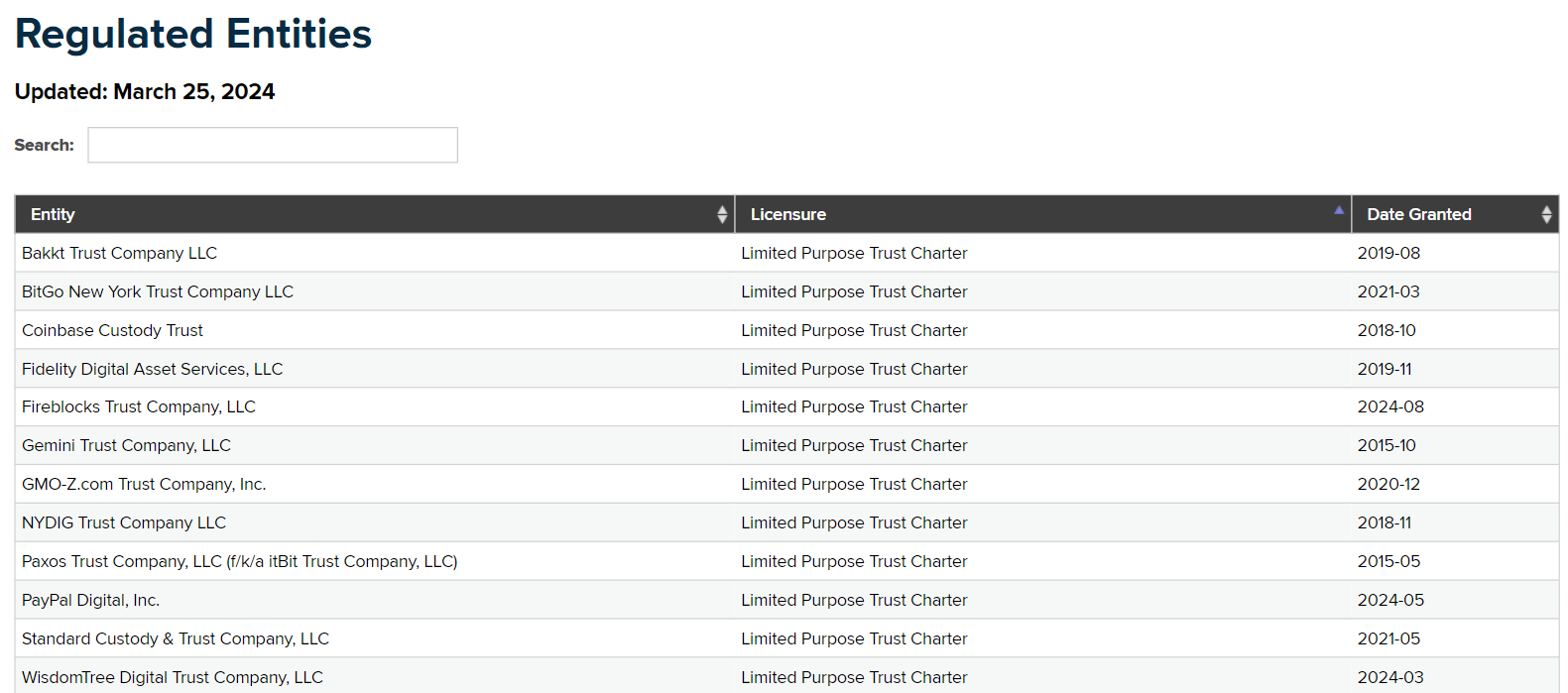

Fireblocks joins a growing list of institutional crypto companies — including Coinbase Custody Trust, Fidelity Digital Asset Services and PayPal Digital — authorized to custody assets by NYDFS, according to NYDFS.

The Trust is part of Fireblocks’ broader plan to create a global network of regulated cryptocurrency custodians.

In June, Fireblocks launched a global network of licensed digital asset custodians powered by Fireblocks’ technology and connected to customers through the Fireblocks platform,” Fireblocks said.

Fireblocks historically focused on user-managed wallets but has expanded its focus to include regulated custody solutions.

The New York-regulated Trust is “designed to meet the growing institutional demand for digital-asset-focused Qualified Custody that can support the needs of registered investment advisors, asset managers and [exchange-traded fund] issuers, among other institutional market participants,” Fireblocks said.

Obtaining a limited purpose trust charter is an alternative to New York’s demanding BitLicense regime for crypto companies seeking to do business in the state. It also may provide additional benefits.

“[A] limited purpose trust company can exercise fiduciary powers” — including custodial services — and “can engage in money transmission in New York without obtaining a separate New York money transmitter license,” according to NYDFS.

Magazine: When Musk Empire listing? Find love in The Sandbox and more: Web3 Gamer

Responses