3 reasons why Bitcoin traders expect $100K+ BTC price by 2025

If Bitcoin follows its standard post-halving trajectory, its price should be in the six-figure range by 2025.

Bitcoin’s post-halving price action projects a “six-figure value” per BTC as a popular technical indicator presents a bullish pattern for the world’s largest cryptocurrency.

Based on previous price action, Bitcoin’s (BTC) recent drop below $50,000 saw it trade under its “post-halving growth trajectory range,” according to crypto data provider Ecoinometrics.

“If it returns to this range before year-end, we’re looking at a high likelihood of a six-figure value for one BTC,” they declared, setting ambitious targets for Bitcoin price.

“Well, assuming the same growth rate as the past three cycles, we would expect one BTC to be worth between $140,000 and $4,500,000 per coin, starting from $63,000.”

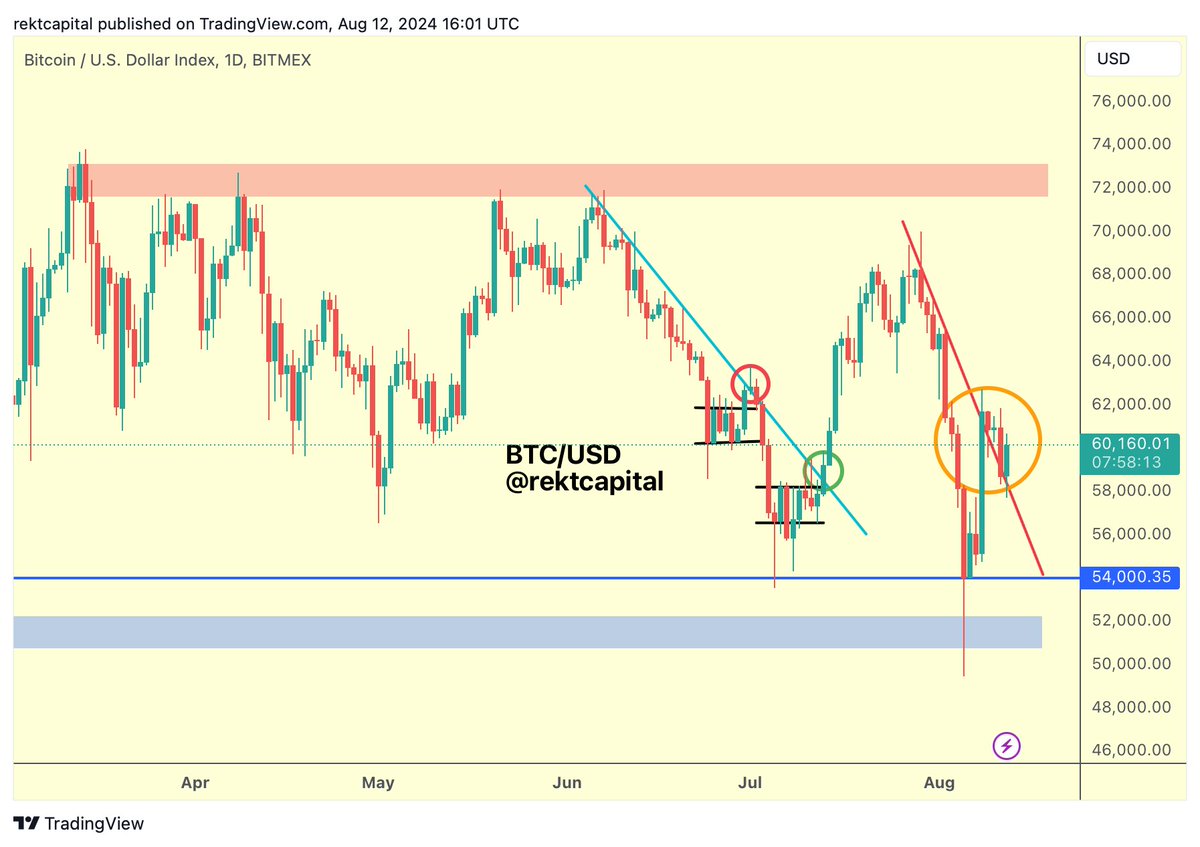

From a technical point of view, anonymous Bitcoin analyst Rekt Capital argued that Bitcoin’s latest recovery above $60,000 had resulted in a significant change in trend.

“Bitcoin is trying to solidify this recently broken downtrending resistance (red) into a new trendline of support,” Rekt Capital said in an Aug. 12 post on X.

The analyst referred to BTC’s sharp recovery a few days after Bitcoin crashed to $49,577 on Aug. 5.

Rekt Capital explained that the price was retesting the support line, confirming “the end of the downtrend to precede trend continuation to the upside.”

“The key thing here is trend continuation.”

The analyst reinforced the need for “strong buy-side volume” once Bitcoin price retests the downtrend line to initiate the uptrend.

The demand side volume may be triggered by the appearance of a bullish signal presented by the moving average convergence divergence indicator (MACD) on the daily chart, as Bitcoin analyst Exel Adler Jr. observed.

The MACD, a trend-following oscillating indicator that shows the relationship between two moving averages of an asset’s price, generates a bullish signal when it moves above its own nine-day EMA.

Adler Jr. shared a chart in an Aug. 13 post on X showing the MACD deep in the negative territory. The same scenario was witnessed on July 8, when the BTC price reached a low of $53,550.

This was followed by a bullish cross from the MACD on July 12, with Bitcoin rising 30% from these lows to retest the $70,000 level on July 29.

There is an impending bullish cross from the MACD on the daily timeframe. If the same scenario plays out, BTC could sustain the ongoing recovery to record higher highs.

Related: Bitcoin buyers wait below $58K as Japan wipes out record stocks crash

Bitcoin investors return to “Hodling”

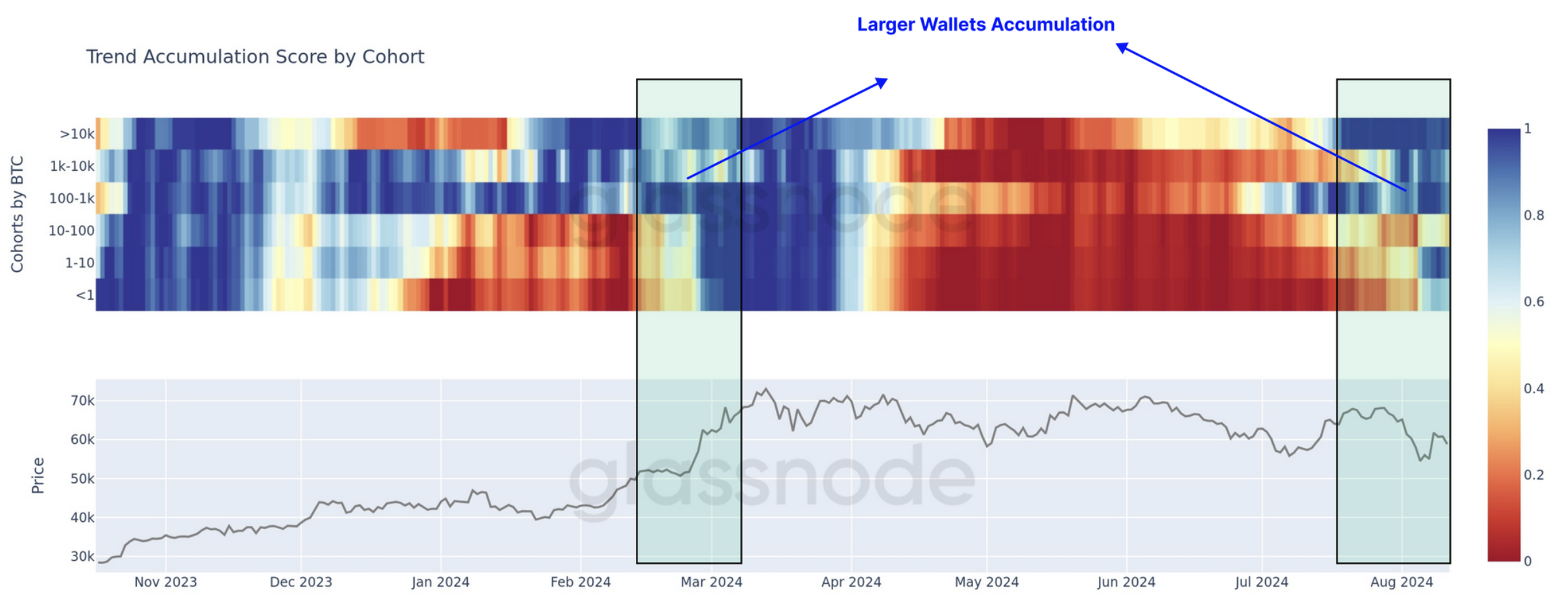

Reinforcing the long-term bullish outlook for Bitcoin, analysts at market intelligence firm Glassnode found a “hodling preference is beginning to emerge” among long-term investors as the market slowly recovers from last week’s sell-off.

Glassnode analysts said,

“After several months of relatively heavy distribution pressures, the behavior of Bitcoin holders appears to be rotating back towards HODLing and accumulation.”

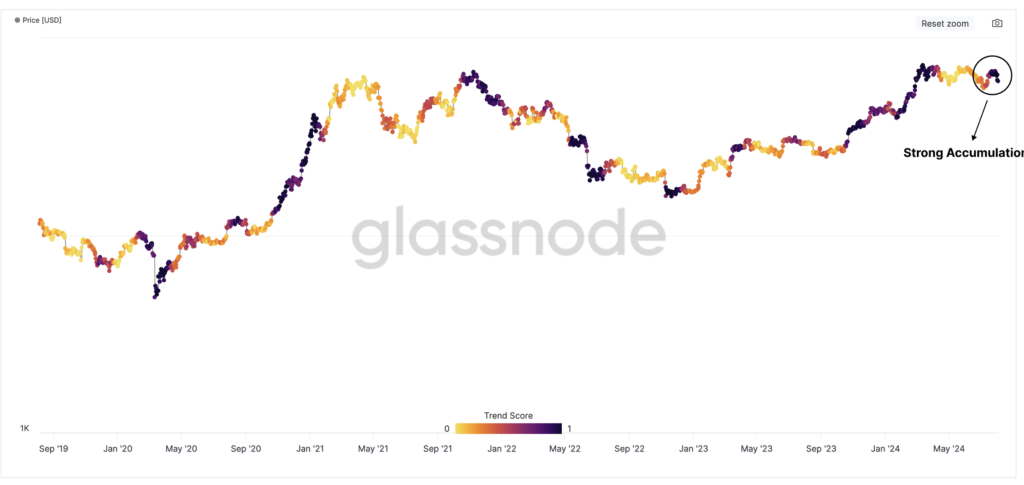

The chart below shows that following an extensive period of supply distribution, Bitcoin whales are “returning to a regime of accumulation.”

Using the Accumulation Trend Score (ATS), a metric that assesses a weighted balance change across the market, Glassnode found that the indicator recorded its highest possible value of 1.0. This suggests there has been significant accumulation throughout the last four weeks.

“This metric also suggests there is a shift back toward accumulation dominant behavior.”

This trend was more pronounced among Long-term Holders (LTHs), who, according to Glassnode, have returned to a preference for HODLing. Over the last 90 days, more than 374,000 BTC migrating into LTH status.

“Overall, onchain conditions speak to an undertone of high conviction amongst the Bitcoin holder-base.

Responses