Increasing Ethereum network use strengthens the case for ETH price rally to $3K

Surging Ethereum network activity and growing adoption of layer-2 scaling solutions pave the way for an ETH price rally to $3,000.

Ether (ETH) rallied 16.2% on Aug. 8, but struggled to maintain levels above $2,600 on Aug. 9. Despite encountering stronger-than-expected resistance at $2,700, Ether remains well-positioned to extend its bullish trend, supported by a more favorable macroeconomic backdrop and heightened activity on the Ethereum network and its layer-2 solutions.

Are spot Ether ETF outflows holding back ETH performance?

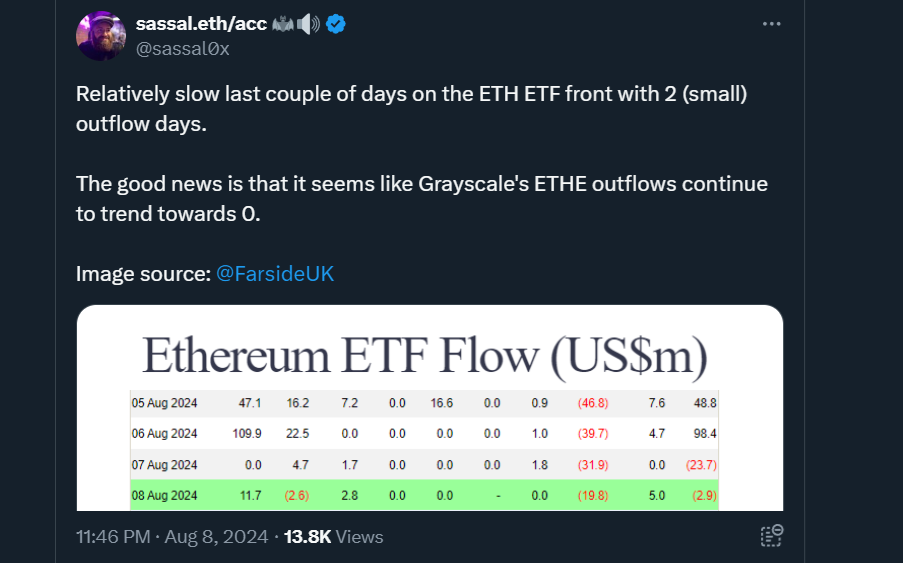

Some investors argue that outflows from the spot EtherETFs have been a drag on its performance. However, this could change as turnover from Grayscale’s ETHE instrument is slowing. The fund has historically charged much higher fees compared to its peers, and most investors were previously locked in as the Trust did not allow redemptions.

Ethereum educator Sassal highlights that, according to Farside Investors data, Grayscale’s ETHE recorded its lowest-ever outflows on Aug. 8 at $20 million, suggesting that the trend may be heading toward zero. Grayscale’s ETHE still holds $5 billion worth of Ether, so even if flows stabilize in the near term, the potential risk remains.

On a positive note, traditional finance investors are increasingly confident that the U.S. Federal Reserve (Fed) is on track to cut interest rates throughout 2024. Lower capital costs benefit-risk markets by stimulating investments, as they reduce the appeal of fixed-income returns.

According to Bloomberg, Boston Fed President Susan Collins stated, “The economy is growing at a pace that I think should preserve that solid labor market.” Collins added that inflation is trending back toward the Fed’s 2% target, so the Fed will soon begin shifting to a less restrictive monetary policy.

Ethereum network data supports bullish price momentum

Regardless of the macroeconomic shifts, the Ethereum network has made significant strides, paving the way for increased demand for Ether and a reduced equivalent inflation rate as more ETH is burned due to growing competition for blockchain space. This bullish momentum is further supported by a 55% increase in decentralized application (DApp) activity on Ethereum over the past seven days.

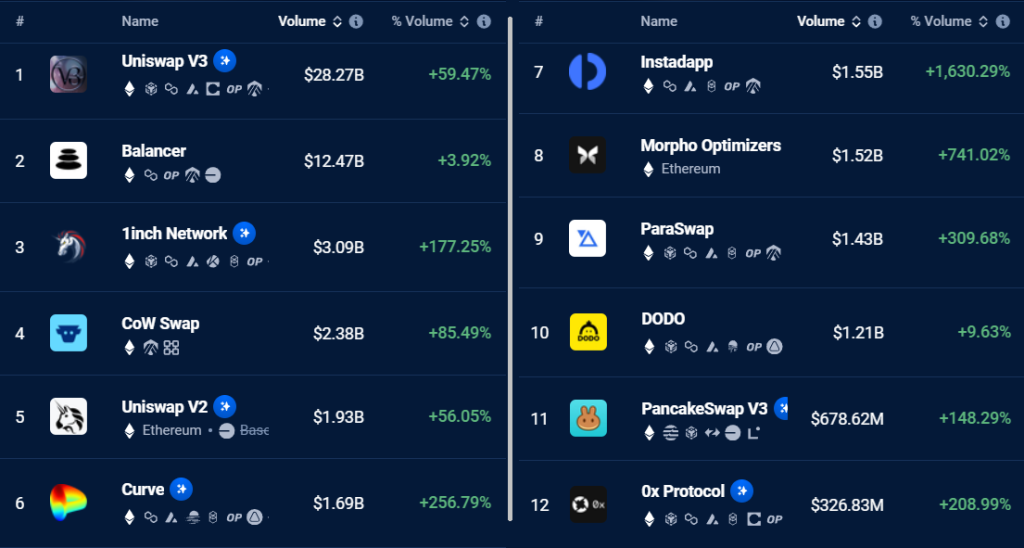

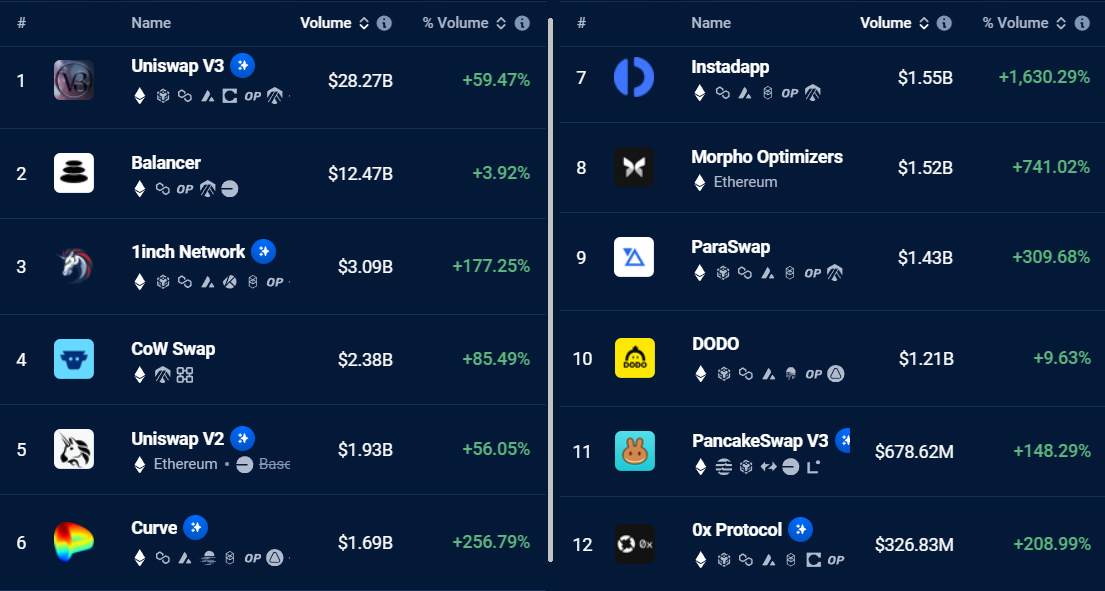

Ethereum’s activity surge was driven by Uniswap, its leading decentralized exchange (DEX), followed by 1inch Network and CoW Swap. Other notable contributors include Curve, Instadapp, and Morpho Optimizers. Crucially, Ethereum’s dominance in the DEX industry remains unmatched, with $21 billion in volume over the past 7 days, far ahead of competitor Solana’s $14.4 billion, according to DefiLlama data.

Ethereum’s success is further underscored by its total value locked (TVL) reaching its highest level since Nov. 2022 at 19.7 million ETH, a 9.4% increase from the previous month. This growth has been driven by platforms like Aave, Zircuit Staking, Curve Finance, Magpie Ecosystem, and Mellow Protocol, as reported by DefiLlama. In comparison, BNB Chain’s TVL has remained stagnant around 8.7 million BNB (BNB) over the past month.

Activity on Ethereum layer-2 solutions reach an all-time high

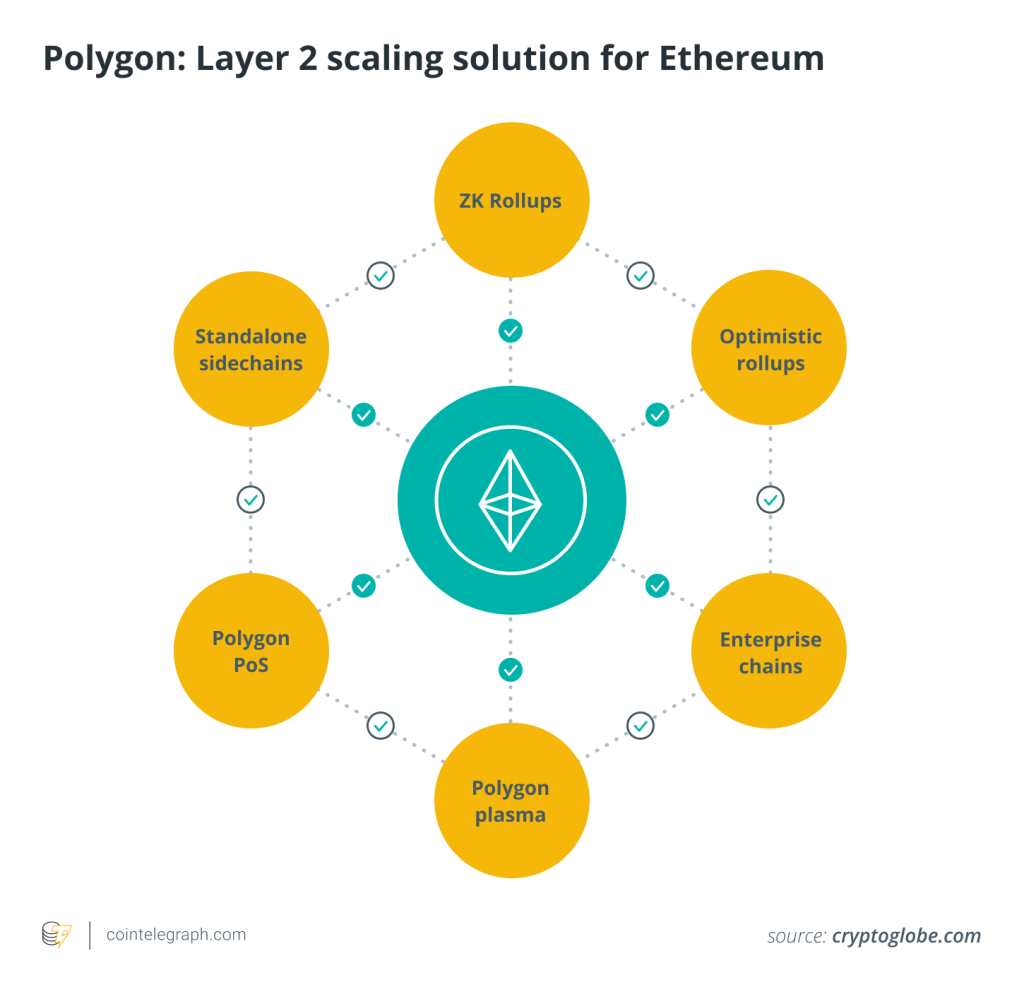

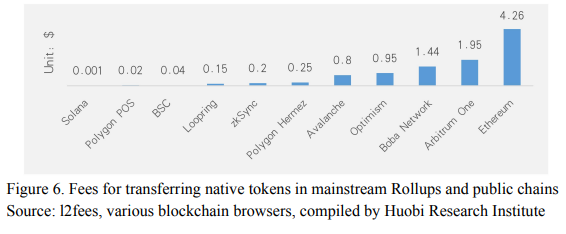

Critics argue that Ethereum’s average transaction fees of $3.85 limit its adoption. However, this view overlooks the significant impact of its second-layer scaling solutions, including Base, Arbitrum, Blast, Optimism, and Mantle, which collectively account for $11.7 billion in native TVL, or $36.7 billion when including bridge deposits, according to L2Beat data.

Related: Vitalik Buterin moves $8M Ether to new wallet — Possible donation ahead?

In fact, Ethereum layer-2 activity approached an all-time high on Aug. 7, averaging 318 transactions per second, driven by the growth of networks like Xai, Base, and Proof of Play, according to L2Beat. In summary, Ethereum’s scaling solutions are now processing 24 times more transactions than the base chain, highlighting the success of recent upgrades aimed at reducing the operational costs of rollups.

Given the strengthening of the Ethereum network in terms of activity and deposits, Ether is well-positioned to reclaim the $3,000 level in the near term, barring any significant external shocks to investor risk sentiment.

Responses