Bitcoin whale transactions hit highest level in 4 months amid crypto dip

Santiment found that wallets holding between 10 and 1,000 BTC “rapidly accumulated” as Bitcoin fell under $50,000 during “Crypto Black Monday.”

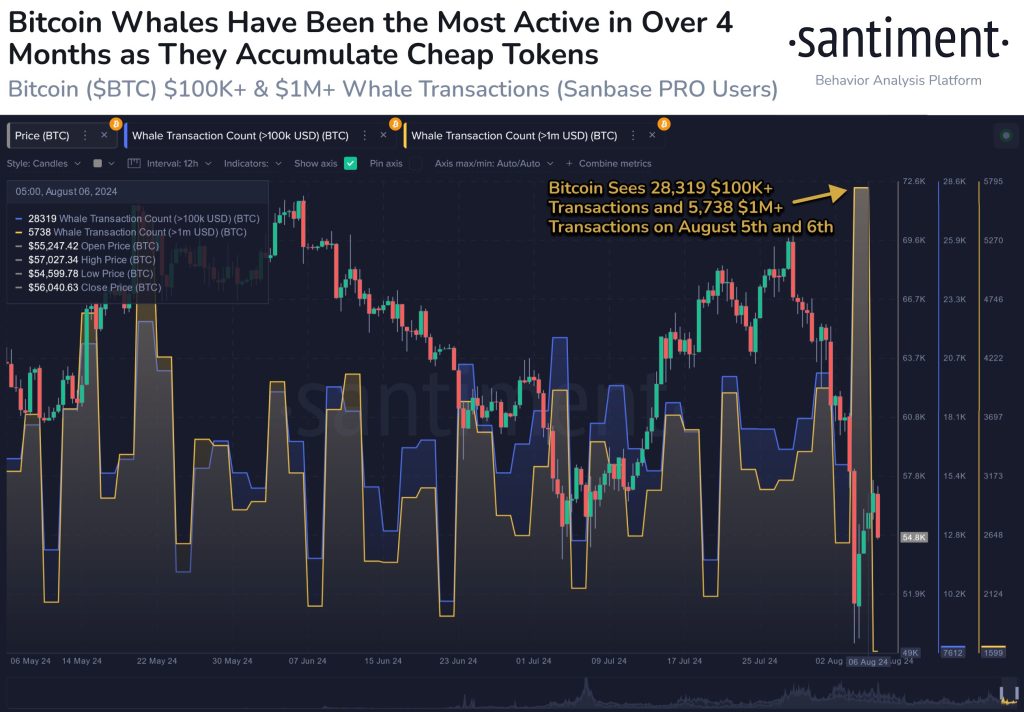

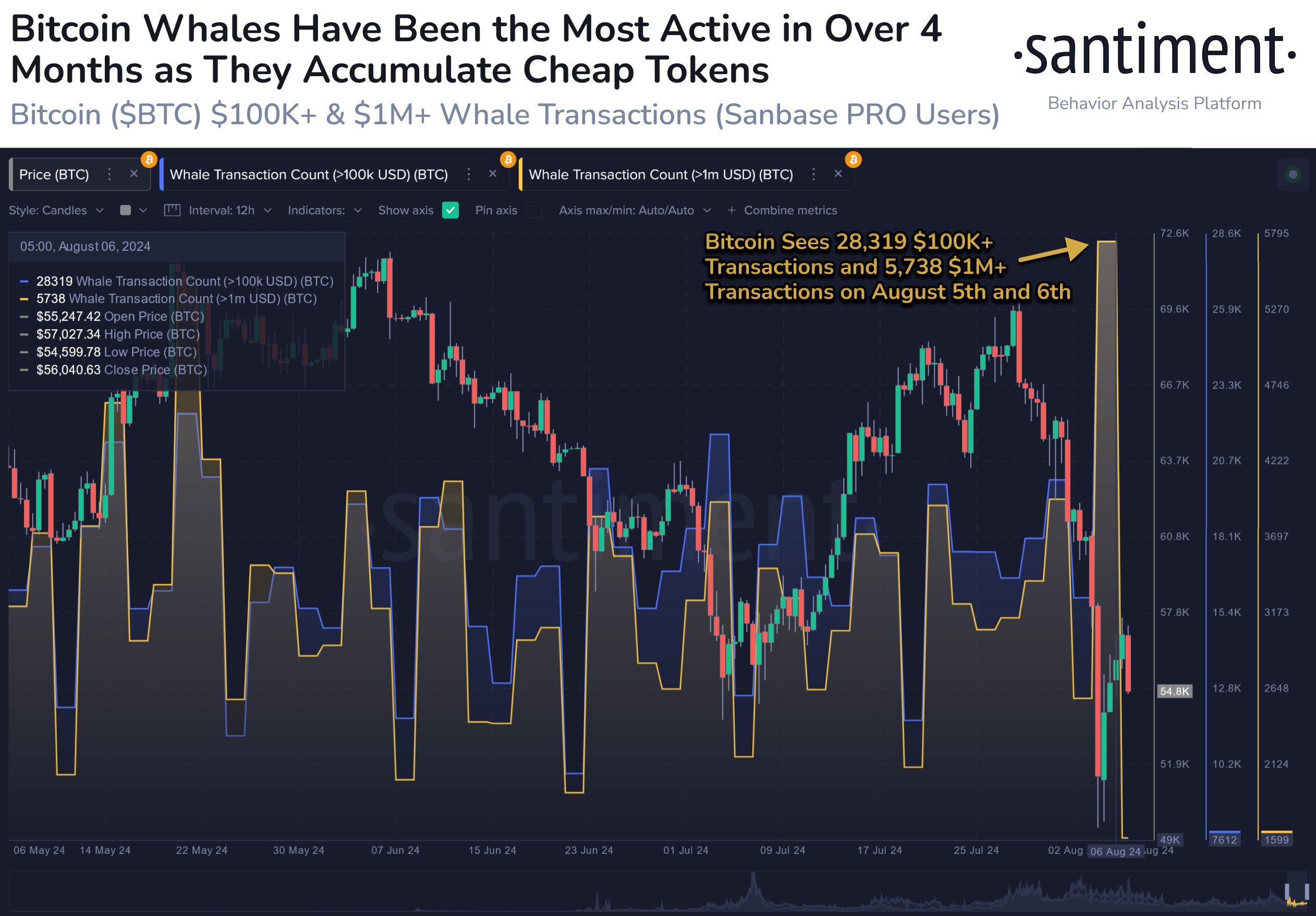

Bitcoin whale transactions hit their highest levels since April during an outsized crypto market rout on Aug. 5 and 6, according to onchain data.

In an X post on Aug. 8, onchain analytics platform Santiment revealed wallets with total holdings between 10 and 1,000 Bitcoin (BTC) “rapidly accumulated on the price dip that saw crypto’s top asset fall below $50,000.”

According to Santiment, on the two dates, there were 28,319 BTC transactions worth more than $100,000 and 5,738 transactions worth more than $1 million as crypto prices tanked.

Bitcoin shed around 18% on Aug. 5, plunging from just over $60,000 to below $50,000 in less than a day. However, it has since recovered slightly to reclaim the $57,000 level following the bout of dip buying.

On Aug. 7, Cointelegraph reported that Bitcoin whales had scooped up almost $23 billion worth of the asset over the last 30 days, with activity peaking during the market crash.

“It’s clearly accumulation,” said CryptoQuant founder and CEO Ki Young Ju, who reported that more than 400,000 BTC had moved to permanent holder addresses since early July.

He also said that whales holding BTC for more than three years sold their holdings to new whales between March and June but added, “There is no significant selling pressure from old whales at this time.”

On Aug. 3, days before the big slump, Cointelegraph reported that whales were already moving Bitcoin off exchanges at the highest rate in nine years. Bitcoin whales with at least a thousand coins have moved the most BTC out of exchanges since 2015, according to the report.

Related: ‘Something is happening’ — Bitcoin hodlers scooped $23B in the past 30 days

However, the same cannot be said for investors in United States-based spot Bitcoin exchange-traded funds, which saw aggregate outflows of $554 million between Aug. 2 and 6, according to Farside Investors.

“The absence of [ETF] buyers during this dip is alarming and raises concerns about the market’s direction,” noted market research firm 10x Research on Aug. 8.

Responses