Bitcoin ‘ghost month’ started with a 20% BTC price flash crash — What’s next?

Bitcoin prices have seen flash crashes during each ghost month since 2017, and 2024 appears to be no different.

The Bitcoin price has recovered 13% since dropping to $49,050, but the commencement of 2024’s so-called “ghost month” is expected to keep investors cautious, especially in the Asian market.

What is a ghost month?

This year, the ghost month is from Aug. 4 to Sept. 2. According to the Chinese lunar calendar, a ghost month is technically the seventh month of the year, or around August and into early September. This period is associated with bad luck in Asian culture, and historically, Bitcoin (BTC) has demonstrated negative returns during this particular time.

Related: How low can the Bitcoin price go?

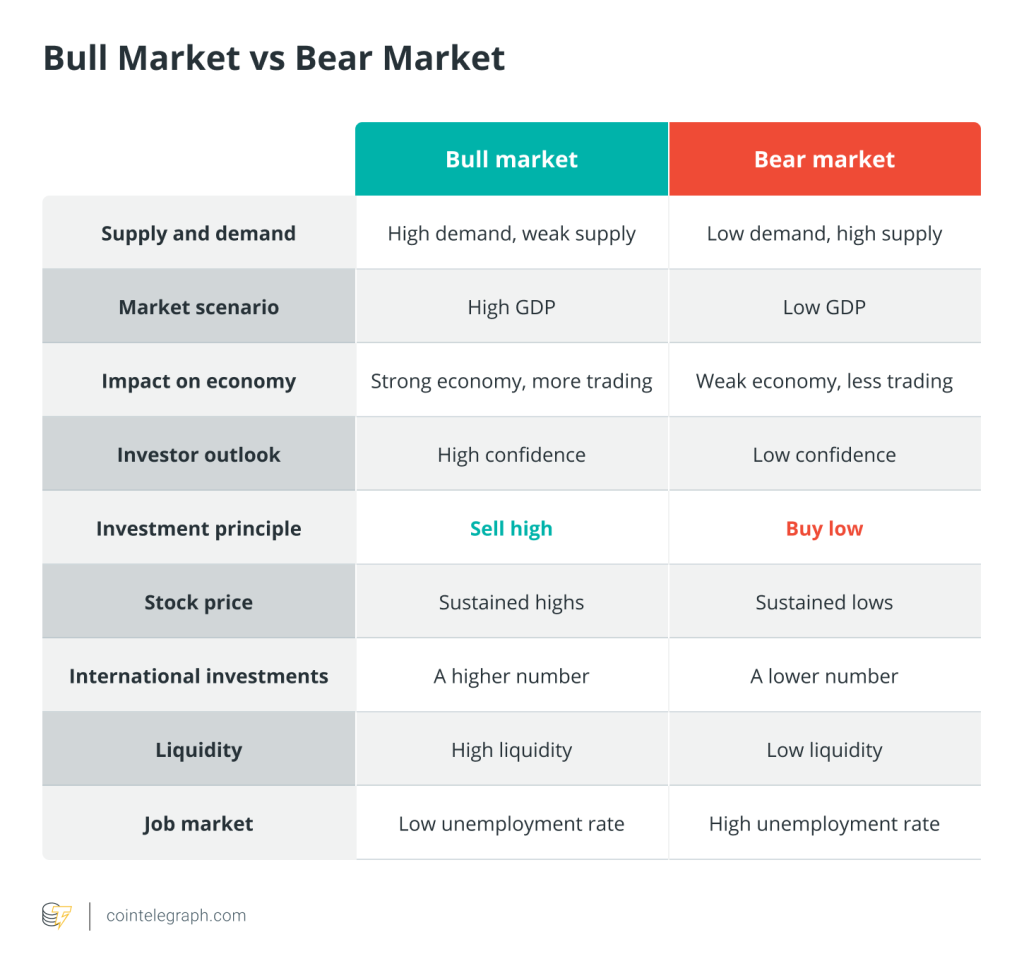

It is important to note that this cultural phenomenon does not objectively affect stock or crypto markets. Yet, the beginning of a ghost month usually plays a role in market psychology and investors’ profit expectations.

Bitcoin correlates with ghost months, as BTC prices have witnessed massive drawdowns in each phase since 2017.

As tabulated in the chart below, Bitcoin has witnessed varying levels of correction in each ghost month.

While the overall return on investment (ROI) over each ghost month hasn’t been extremely bearish, each period witnessed a flash crash.

Only 2021 was a true exception in recent years, as the market rallied. However, BTC lost 23% thereafter and entered a multimonth bear market.

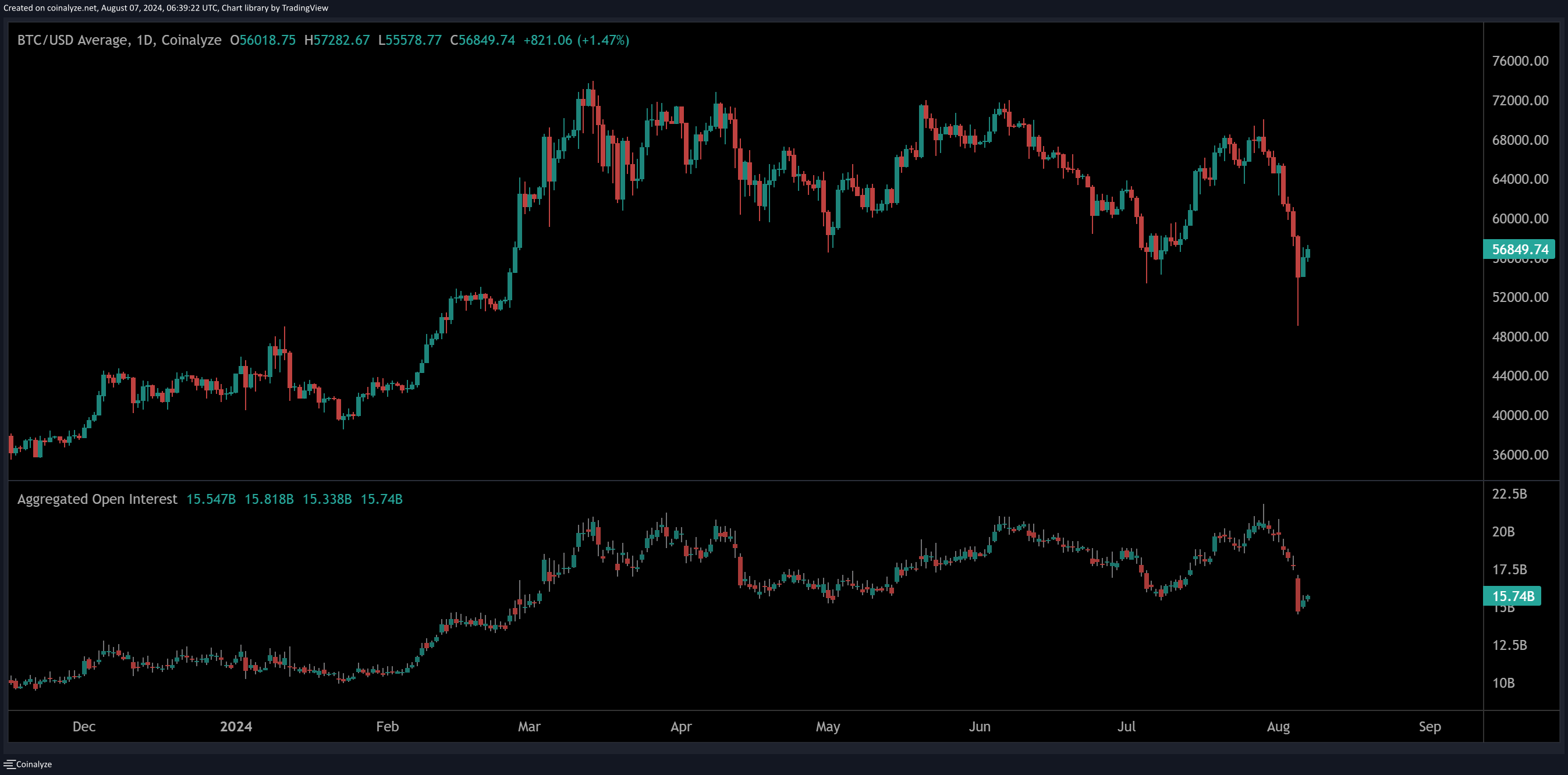

Previously, BTC open interest (OI) dropped from a high of $21 billion on July 29 to under $15 billion on Aug. 6. This was a sign of caution exhibited by traders potentially trying to avoid liquidation.

Then as the ghost month kicked off, Aug. 5 witnessed a record number of coins being sold at a loss.

Specifically, for BTC with age ranges up to one day and one day to one week alone, more than $5.2 billion in BTC was moved in a single hour.

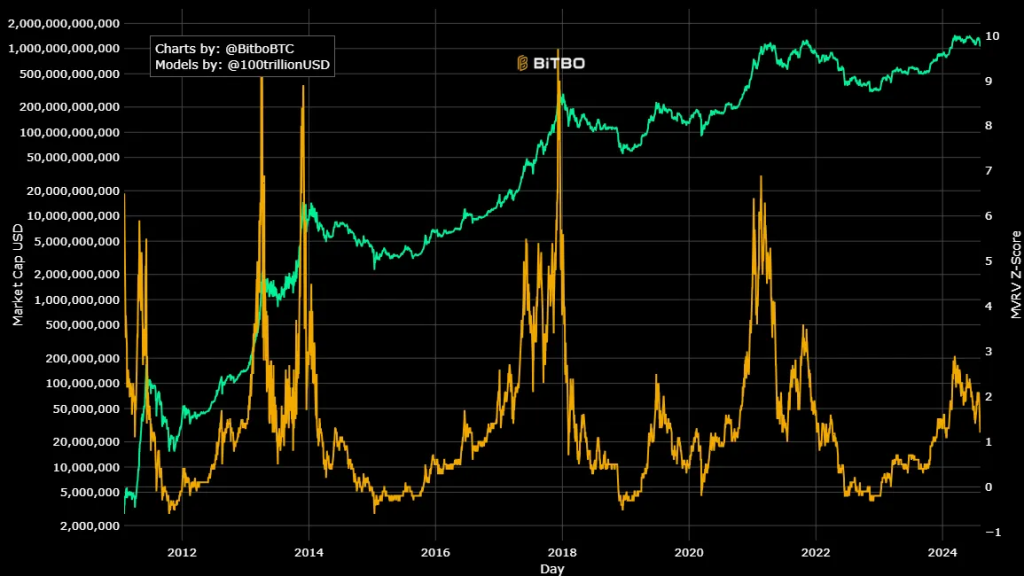

Bitcoin MVRV-Z score highlights key pattern

Bitcoin’s latest drop below $50,000 was caused by multiple headwinds, such as fears of recession and a potential pivot by the United States Federal Reserve. However, BTC’s market value to realized value (MVRV-Z) score indicates that the euphoric stage of this particular bull market is yet to happen.

MVRV-Z is calculated by dividing the market value by its realized value. It essentially gives another perspective on BTC demand and supply dynamics. When the ratio is above 3.7, it marks an overvaluation of the asset, while an index below 1 indicates undervaluation.

In the past, Bitcoin has crossed the 3.7 mark by a huge margin during each bull market phase. This was evident in 2013, 2017 and 2021, but it hasn’t done that yet in 2024. Presently, the ratio is at 1.40, which means it is still undervalued at its current price point.

The price has rebounded above $57,000 at the time of publication, with BTC up 4% over the past 24 hours. The relative strength index is also in the oversold region on the daily chart, suggesting that the bulls have the advantage in the near term.

However, BTC price action has a habit of volatility during its ghost month in particular. Thus, Bitcoin could “fill” and remaining gaps or downside wicks over the next days or weeks.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses