Grayscale ETHE outflows continue as Ethereum ETF shows mixed trends

Factors such as market performance, management strategies, and broader economic conditions could influence the significant outflows from Grayscale’s ETHE.

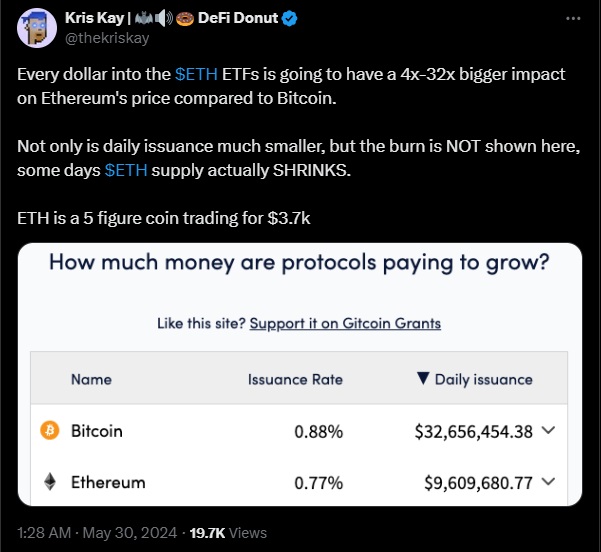

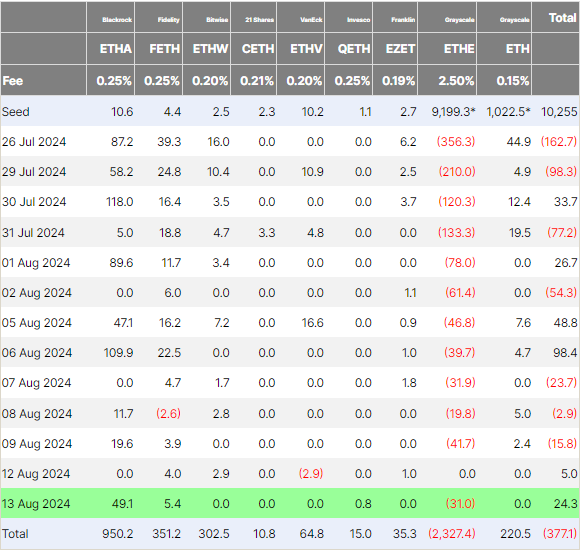

The cryptocurrency investment landscape witnessed notable movements on Aug. 2, particularly within the Ethereum exchange-traded funds (ETFs) sector. This substantial movement contributed to the current historical net outflow of ETHE, which stands at a staggering $2.117 billion.

According to data from SoSoValue, the total net outflow of Ethereum spot ETFs reached $54.2704 million on Aug. 2, 2024. A significant portion of this outflow was attributed to Grayscale’s Ethereum Trust ETF (ETHE), which saw a single-day net outflow of $61.4314 million.

Grayscale’s Ethereum Trust ETF faces more outflows

Grayscale’s Ethereum Trust ETF ETHE has been a prominent player in the market, offering investors exposure to Ethereum without the need to directly purchase and store the cryptocurrency. However, the recent trend of outflows suggests shifting investor sentiment.

While Grayscale’s ETHE experienced substantial outflows, other Ethereum ETFs showed different trends. The Grayscale Ethereum Mini Trust ETF ETH reported no outflows, maintaining its current net inflow of $201 million. This stability contrasts with the volatility observed in ETHE.

In contrast to the outflows seen in ETHE, Fidelity’s Ethereum spot ETF (FETH) recorded the most significant net inflow yesterday, with $6.0176 million added. This influx of capital brings the total net inflow for FETH to $297 million.

Related: Why is ETH demand lacking post-Ethereum ETF?

Similarly, the Franklin Templeton ETF (EZET) also saw positive inflows, with a single-day net inflow of $1.1433 million. The cumulative net inflow for EZET now stands at $30.6733 million.

Overall dynamics

As of publication, the total net asset value of Ethereum spot ETFs is $8.332 billion. The ETF net asset ratio, which compares the market value of Ethereum held in ETFs to the total market value of ETH, is currently at 2.29%.

The historical cumulative net outflow for Ethereum spot ETFs has reached $511 million, indicating a net withdrawal of funds from these investment vehicles overall.

Meanwhile, on Aug. 1, the daily net inflows into the United States spot Ether exchange-traded funds (ETFs) were positive. The Ether (ETH) ETFs posted a net inflow of $26.7 million, led by a $89.6 million inflow into BlackRock’s iShares Ethereum Trust (ETHA).

ETH is changing hands for $2,987 at the time of publication. Thus, Ethereum has fallen approximately 5.71% since the launch of the ETFs.

Responses