Marathon Digital shares plunge 8% after Q2 revenue miss estimates

Marathon Digital has missed consensus estimates for the second quarter in a row, though its year-on-year performance has risen by 78%.

United States-listed Bitcoin miner Marathon Digital shares fell 8% after filing its second quarter earnings, which fell short of Wall Street expectations.

Marathon reported revenue of $145.1 million in the second quarter, roughly 9% lower than the $157.9 million that analysts had anticipated, according to Yahoo Finance data.

The shortfall occurred despite a year-on-year revenue increase of 78% from $81.7 million in Q2 2023, according to its earnings report published on August 1.

Following the report’s release, MARA’s stock price fell 7.78%, ending the trading day at $18.14, according to Google Finance data.

As Bitcoin miners struggled throughout the quarter due to rising operational costs after the Bitcoin halving in April, Marathon Digital revealed it sold 51% of its Bitcoin (BTC) to cover operating expenses.

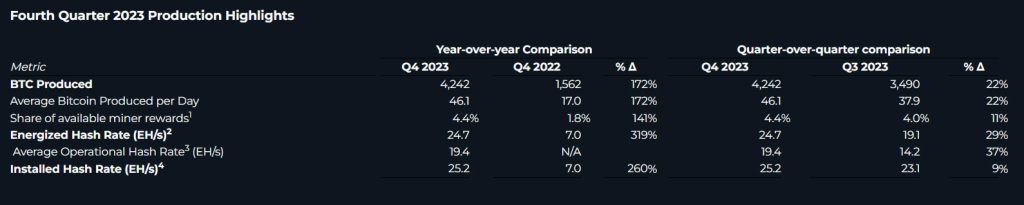

The report highlighted that Marathon’s average price of BTC mined in the second quarter of 2024 was 136% higher than in the prior year period.

On average, Marathon mined 22.9 Bitcoin per day, which is 9.3 less Bitcoin daily compared to the previous period.

Related: World’s largest BTC miner Marathon buys $100M BTC to go ‘full HODL’

It is the second quarter in a row that Marathon has missed consensus estimates, having also missed Q1 estimates.

At the time, Marathon’s Q1 revenues increased 223% year-on-year to $165.2 million in results shared on May 9 — but it still missed the $193.9 million estimate from investment analyst firm Zacks by 14.80%.

Riot Platforms Q2 closer to estimates

It follows the news on July 23 that Marathon has been fined $138 million after being found guilty of breaching a non-disclosure or non-circumvention agreement.

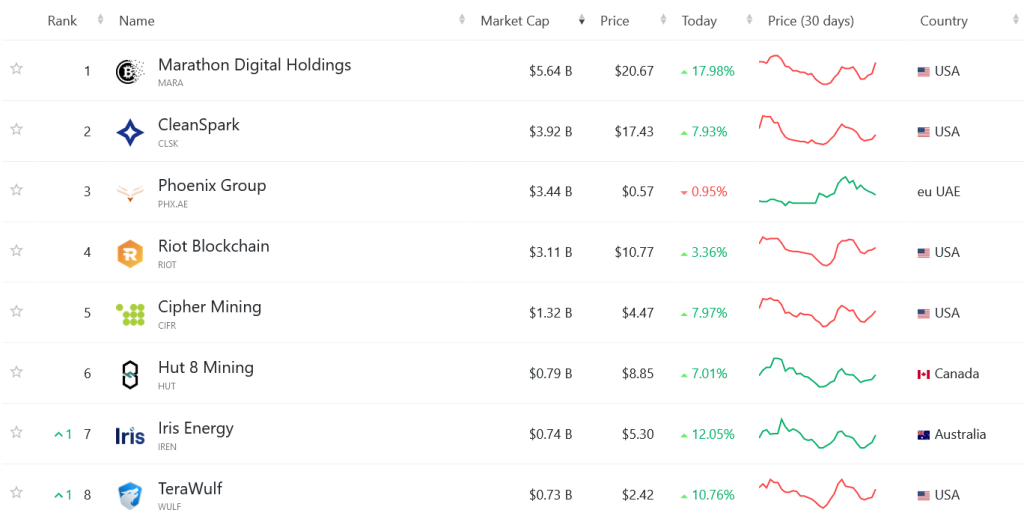

Meanwhile, rival crypto miner Riot Platforms posted $70 million in revenue for Q2 2024, a year-on-year decline of 8.8%, as per its earnings report published on July 31.

Riot’s reported revenues were a lot closer to consensus estimates, which was only 0.63% lower than Zacks’ prediction.

Riot’s stock (RIOT) ended the trading day down 8.54%, closing at $9.32.

Responses