Bitcoin long liquidations hit $300M as BTC price falls to $62K

A flash crash in Bitcoin price on shorter timeframes induces panic among leveraged long traders, but analysts believe it’s a short-term pullback.

Bitcoin (BTC) fell over $1,600 in 60 minutes on Aug. 1 as a wave of volatility disrupted the market.

Data from Cointelegraph Markets Pro and TradingView showed a nightmare for long traders unfolding on Aug. 1, as BTC suddenly dropped from $64,000 to $62,800.

At the time of publication, the losses were still mounting after the BTC/USD pair hit lows of $62,212 at Coinbase, levels last seen two weeks ago.

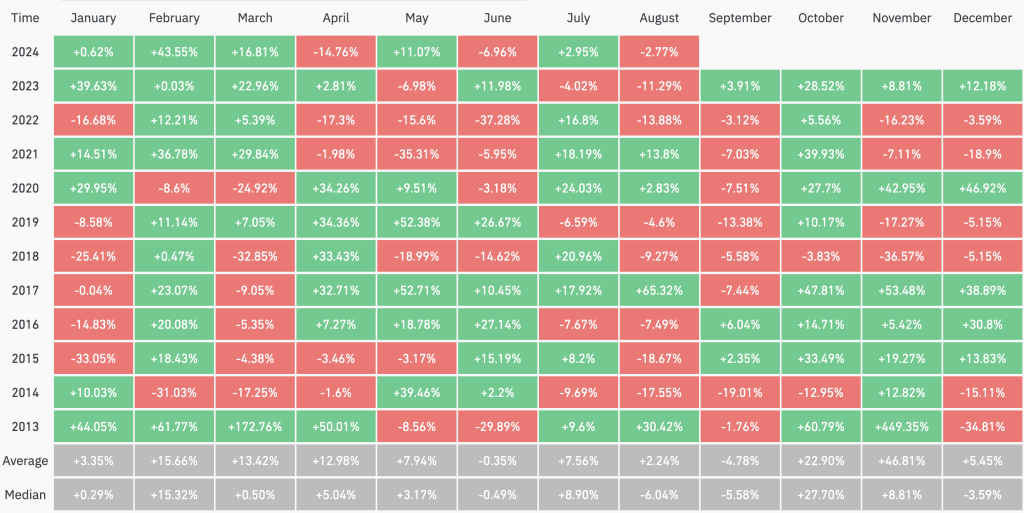

Those betting on Bitcoin’s recovery lost big on Aug. 1, however, as the downturn liquidated long positions worth $310.27 million amid a 24-hour total wipeout of $337 million, according to data from Coinglass.

More than $77.07 million worth of long Bitcoin positions have been liquidated over the last 24 hours, with $26.6 million being wiped out in the last four hours alone.

The largest single liquidation occurred on the OKX crypto exchange involved an ETH-USDT swap worth $4 million.

For market analyst DW, the demise of the positions was not “extreme” despite the significant downward move. DW said that the market is back to experiencing low liquidity, cautioning high selling moving forward.

“Mt. Gox is not behind us. It is the summer, and post BTC 2024, it is back to low liquidity, so whatever selling is happening will be magnified.”

Meanwhile, independent analyst Mags had a more positive outlook for Bitcoin, saying that the price was holding above a crucial moving average support as it traded close to the upper boundary of a descending broadening wedge.

“The hash ribbons have also printed a buy signal,” the declared Mags in an X post on Aug. 1.

According to the analyst, the current BTC price action is a short-term pullback that resembles the previous instances when the ribbons turned green, followed by significant upward moves.

“The price dipped immediately after, followed by some consolidation and a nice V-shaped recovery. As long as the price is holding above $60,000, dips are for buying.”

History suggests Bitcoin is poised for a red August

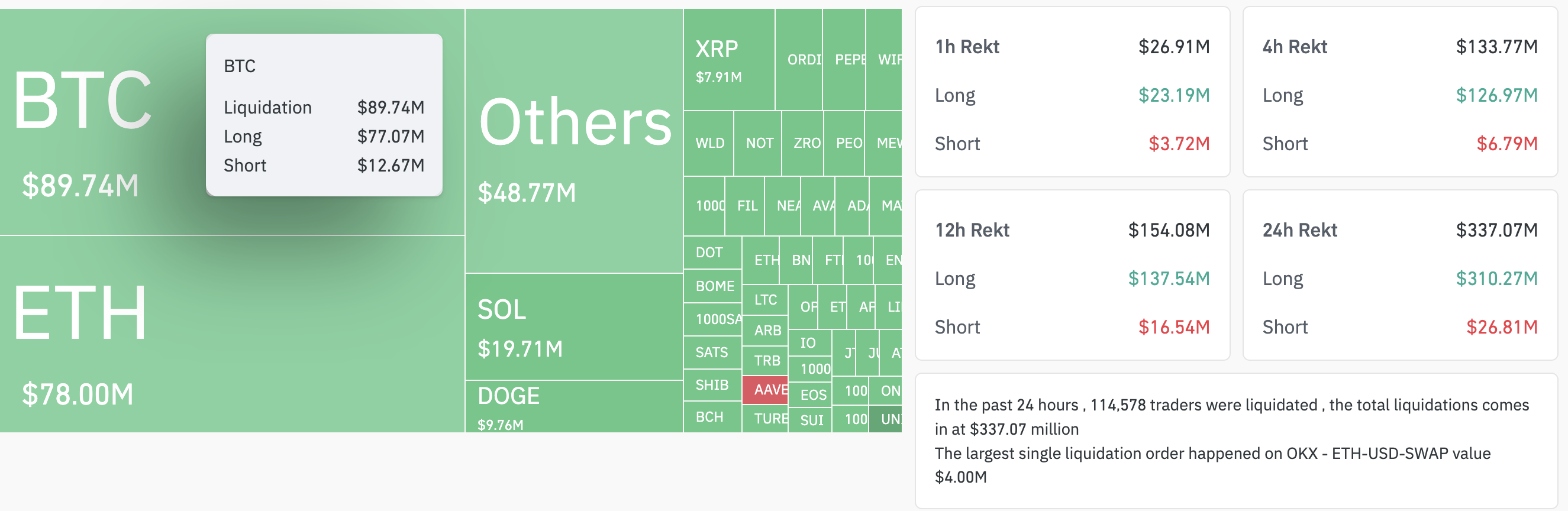

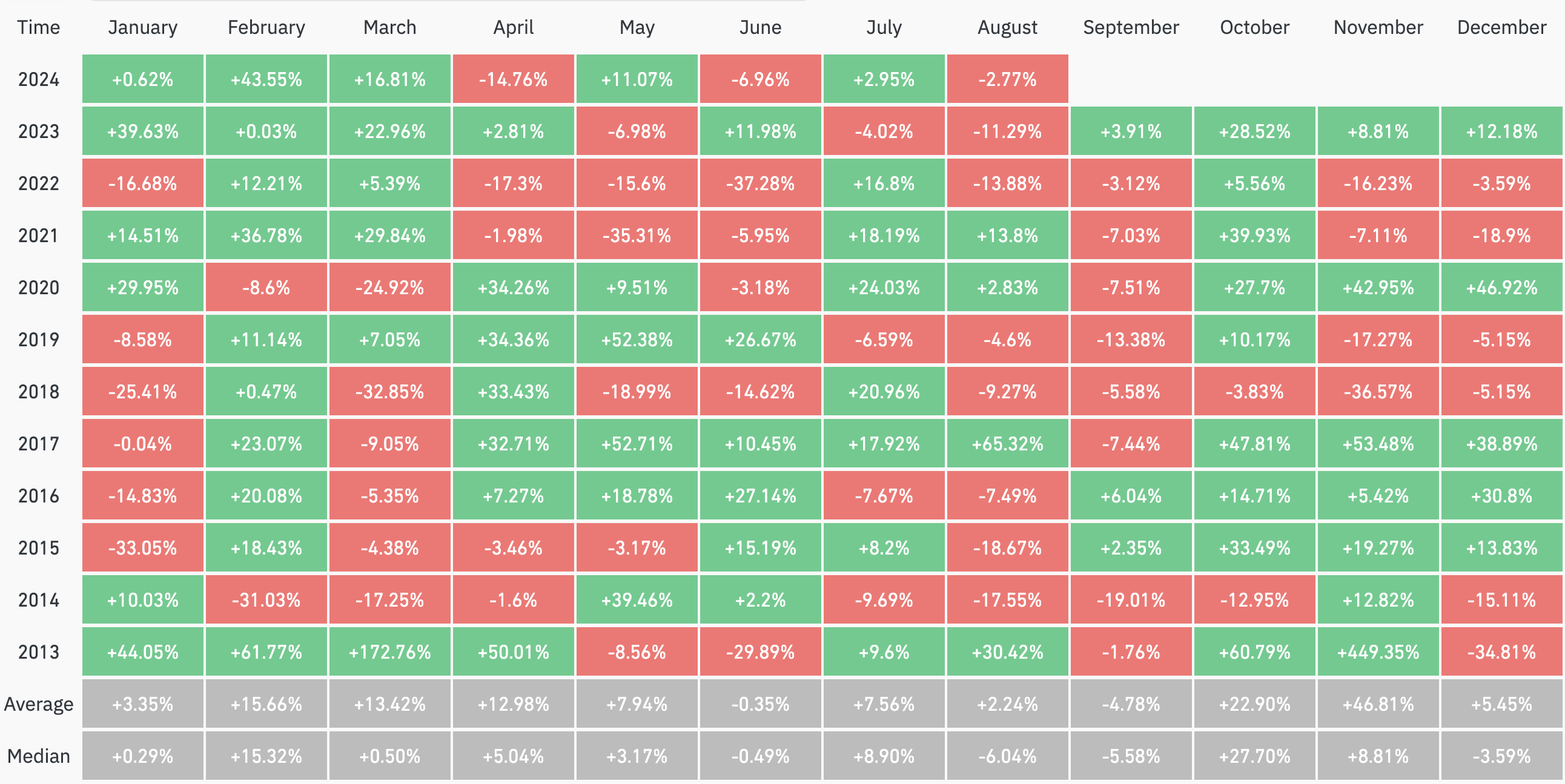

Bitcoin’s correction on the first day of August is no surprise as historical data reveals that BTC price tends toward weak performance in August, after a volatile July.

Bitcoin returns in August have historically averaged 2.24%, according to data from Coinglass, which has tracked BTC’s monthly returns since 2013.

In eight out of the last 11 years, Bitcoin’s price closed in August in the negative, with a medium return of -6% historically.

Independent analyst Karen also highlighted this in an X post on Aug. 1, pointing to the sharp correction in the price of Bitcoin.

“On the first day of August, while gold and oil prices are rising, Bitcoin isn’t.”

Karen also noted that Bitcoin had ignored 100% Fed rate cut odds, which are apparently “not enough to push the BTC price higher.”

Responses