Ethereum’s firm $2,860 support signals path to $4,500 — Deribit

A Deribit report underscores Ethereum’s resilience at $2,860, pointing toward potential highs driven by recent ETF approvals.

All eyes are on Ethereum as it continues to hold firm to its $2,860 support level, a price point tested multiple times since July 5.

According to a Deribit Insights report, Ether (ETH) is poised for a significant upside after the recent approval of United States ETH exchange-traded funds (ETFs).

The insights suggest that the strong support witnessed through July indicates high buyer demand, potentially setting the path for highs of $4,500.

Related: Ethereum ETFs could reach $10B AUM in first year: Sygnum Bank

ETF approval boosts institutional interest

After the Ethereum ETF launch, Deribit highlights that the regulatory green light is expected to drive increased institutional attention and investment.

The introduction of Ether ETFs made the underlying crypto asset more accessible and regulated, generating positive market sentiment as analysts predict further substantial inflows.

An example of this interest increase can be seen in the significant inflow of funds on July 30, as $33.6 million in net inflows entered all nine spot Ether ETFs.

Related: What needs to happen for Ethereum (ETH) price to reach $4K?

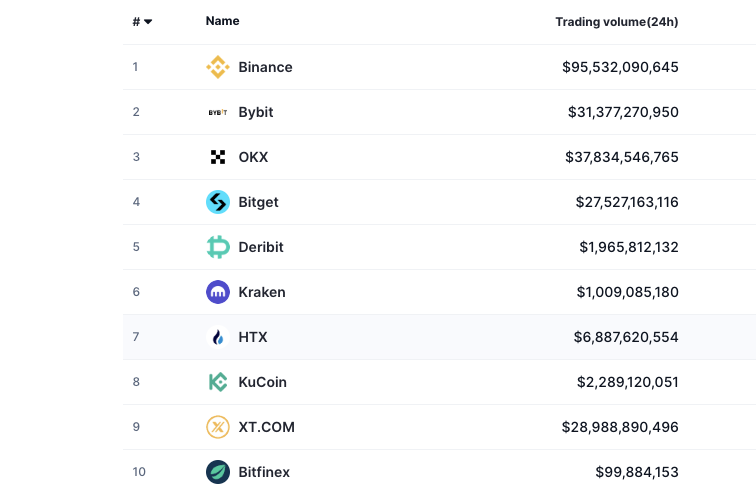

Ether ETF issuers battle it out

According to Nansen data on July 31, a different trend was revealed, highlighting almost $750 million in outflows from the Ether ETFs in four of five recorded trading days.

The shifts saw Bitwise temporarily surpass BlackRock in the total trading volume of the Ether ETFs on July 30, but this was reversed by July 31.

According to Nansen data, at the time of publication on Aug. 1, BlackRock’s holdings now account for 6.9% of assets under management (AUM), up from 5.59%.

Related: BlackRock battles Bitwise as new Ethereum ETFs struggle to gain traction

Can ETH break $4,000 again?

ETH last broke above the $4,000 mark on March 14, currently around $3,200 as market sentiment shifts among ongoing geopolitical events.

Unlike the launch of Bitcoin (BTC) ETFs, the price of ETH did not receive equivalent inflows, which is suspected to be the result of the US Securities and Exchange Commission (SEC) not approving staking.

According to L2Beat, the Ethereum network total value locked (TVL) of 17.8 million remains unchanged, suggesting a lack of continued ecosystem growth.

Responses