Hashrate recovery reduces Bitcoin miners’ selling pressure in July

Miner revenues soar 50%, pushing Bitcoin hashrate higher and reducing selling pressure from miners’ reserves.

Bitcoin’s price recovery through July has provided some relief for miners, leading to a surge in mining activity and reduced selling pressure.

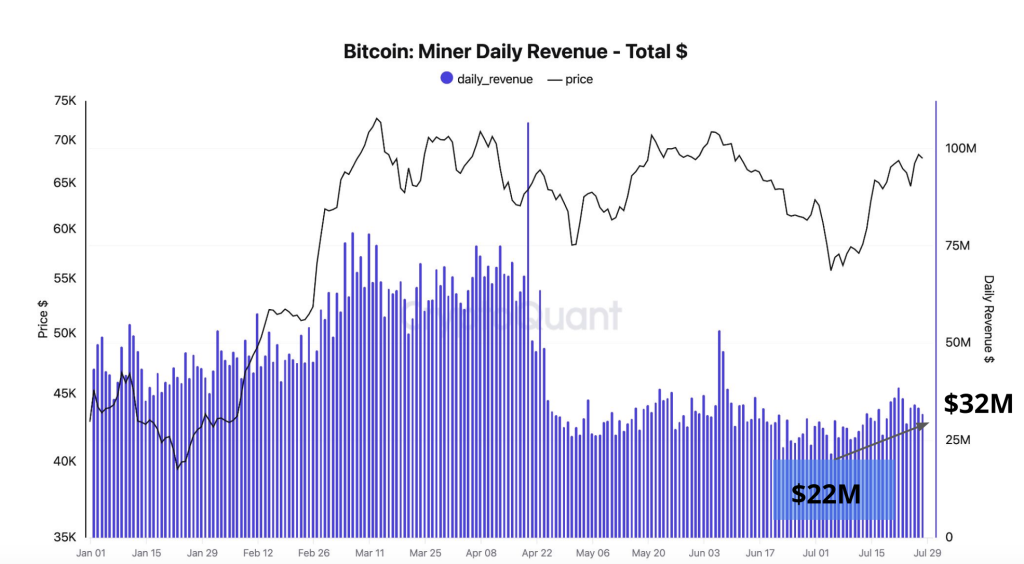

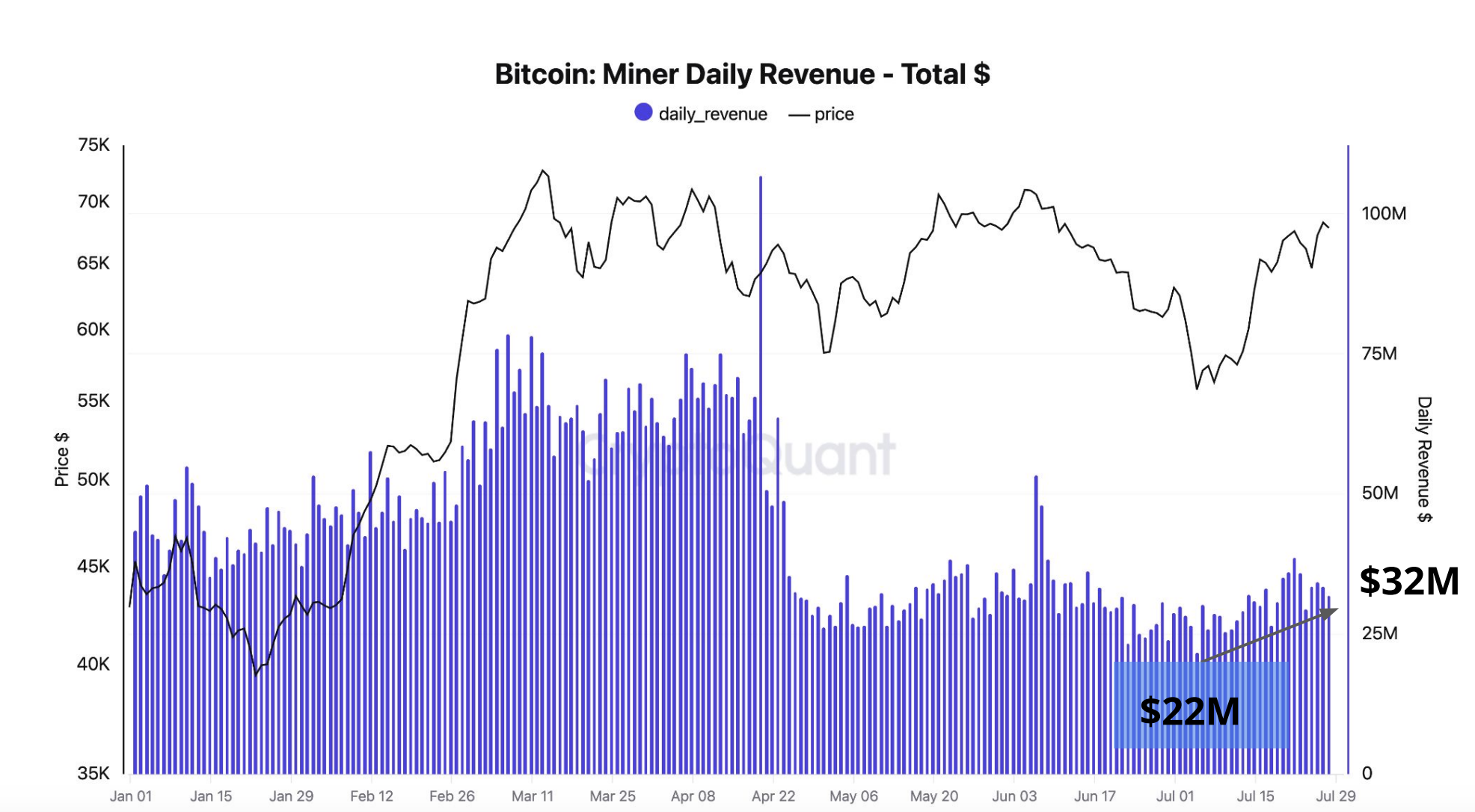

According to a July 31 report from CryptoQuant, miners are currently selling less Bitcoin (BTC) as daily miner revenues have increased by almost 50% since early July. As of July 29, miners’ hashrate was at 604 exahashes per second (EH/s), an increase of 6% since July 9, when it reached its lowest level since Feb. 28. The report notes:

“Daily miner revenues are currently around $32 million, compared to a YTD low of $22 million reached in early July. Higher revenues are supporting the comeback of network hashrate.”

Bitcoin’s price has gained nearly 6% over the past 30 days, trading around $66,500 at the time of writing. The cryptocurrency has climbed over 49% so far this year.

The improved revenue resulted in fewer BTC sales coming from miners’ reserves over the past weeks. According to the report, outflows from miners have remained “generally lower than earlier in the year, signaling less selling pressure from miners as prices recovered.”

During July, daily miner outflows remained between $5,000 and $10,000 compared to $10,000 and $20,000 when BTC first touched the $70,000 mark, which allowed miners to cash out before the Bitcoin halving slashed revenue by 50%.

The halving is Bitcoin’s deflationary mechanism, which reduces the rewards miners receive for adding new blocks every four years by half.

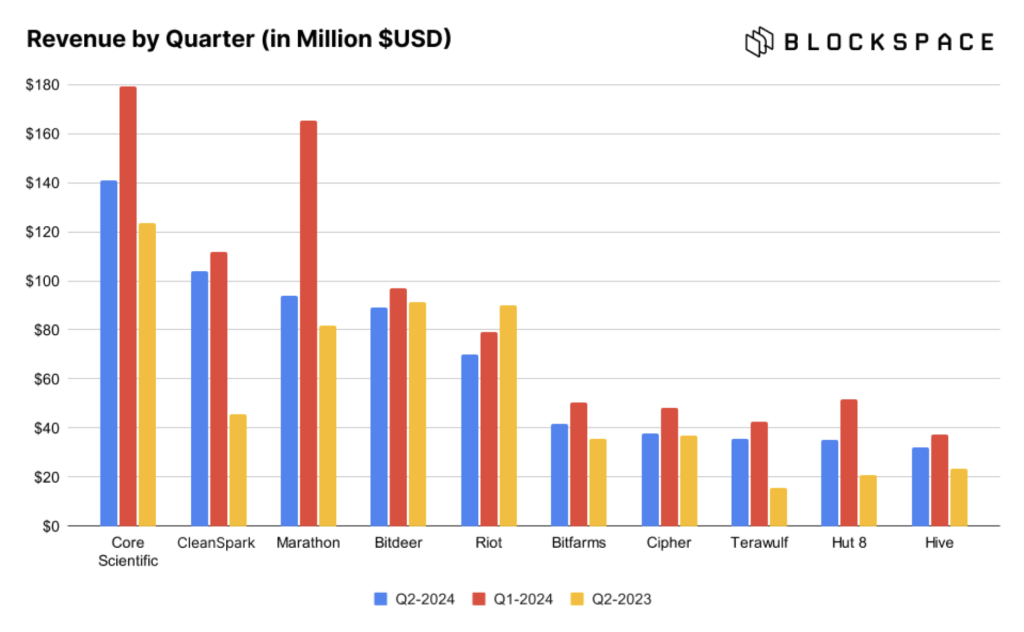

However, sales from miners haven’t been evenly distributed. While larger miners have been increasing BTC holdings in 2024, smaller miners have significantly reduced their BTC ownership.

According to CryptoQuant data, the total Bitcoin balance of large miners as of July 29 stood at 65,000 BTC, up from 61,000 BTC at the beginning of 2024. The total balance of smaller miners, on the other hand, has declined from 59,000 BTC to 51,000 BTC in 2024, with sales accelerating after the halving event.

Transaction fees currently sit at 1.72% of total mining revenues, the lowest level since October 2023. “One risk for miners lies in fees remaining at depressed levels, and mining profitability is currently too dependent on the price of Bitcoin,” the report states.

Magazine: Lazarus Group’s favorite exploit revealed — Crypto hacks analysis

Responses