Why is ETH demand lacking post-Ethereum ETF?

ETH price failed to crack the $3,400 resistance level, as spot Ethereum ETFs are seeing more outflows largely due to Grayscale.

Ethereum (ETH) is about to close the month of July in the red, down roughly 1%, despite the launch of spot Ethereum ETFs in the United States.

US spot Ethereum ETFs went live on July 23, and the market’s immediate reaction was a 9% drawdown. At present, the ETH price is down 4.05% since launch. However, other reasons may have hindered price performance.

ETHE seeing faster outflows than GBTC

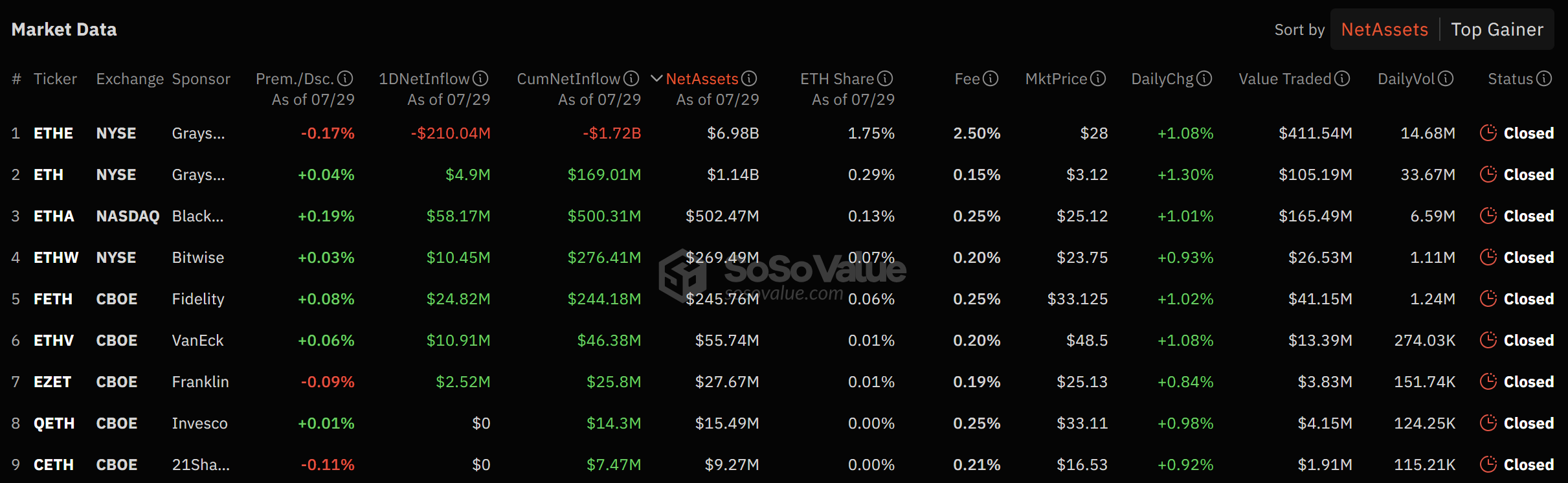

The overall ETF numbers have been underwhelming, with the cumulative total net inflow currently at negative $439.64 million, according to Sosovalue.

The chart below highlights that most selling pressure has prevailed at Grayscale’s expense. Every other major spot ETH ETF, including BlackRock, Bitwise, and Fidelity, recorded positive daily inflows as of July 29.

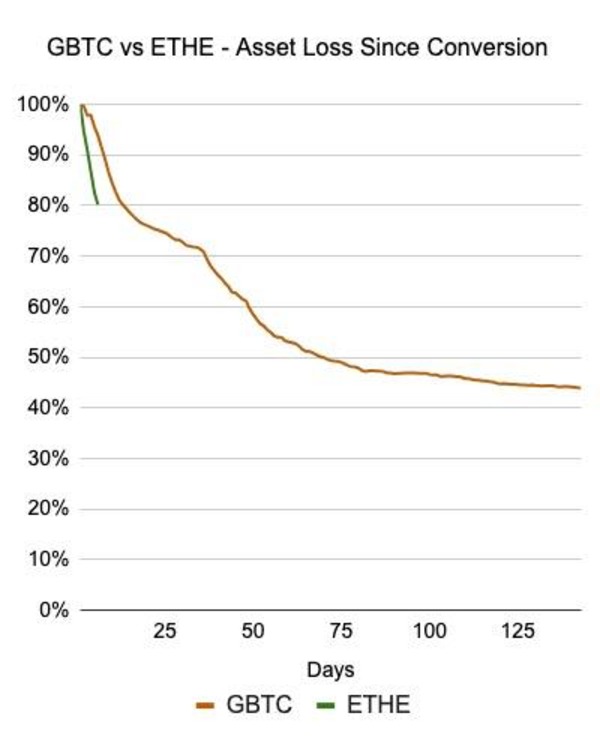

It was also observed that Grayscale has carried out ETHE outflows faster than GBTC did after spot Bitcoin (BTC) ETFs launched in January. The chart below highlights the asset loss for both investment vehicles since their conversion.

As Cointelegraph reported, it’s “likely” the massive outflows from Grayscale’s ETHE will subside this week, according to some analysts.

“Simply no demand” for ETH on exchanges

Additionally, exchange withdrawal transactions for Ethereum have significantly declined since March. This metric is highly correlated with price, suggesting that “there is simply no demand,” according to Crypto Lion, an independent analyst.

The estimated leverage ratio, or ELR, drove ETH price action during this volatile period, argues Crypto Lion. This metric signifies the open interest ratio in futures contracts with the balance of corresponding exchanges. A high ELR indicates the futures/perps are leading the price action, which is usually short-lived or choppy. He noted,

ETH price moves like a range after ETH ETF approval. However, in the absence of Withdraw and while the ELR has not yet been resolved, it is advisable to refrain from buying.

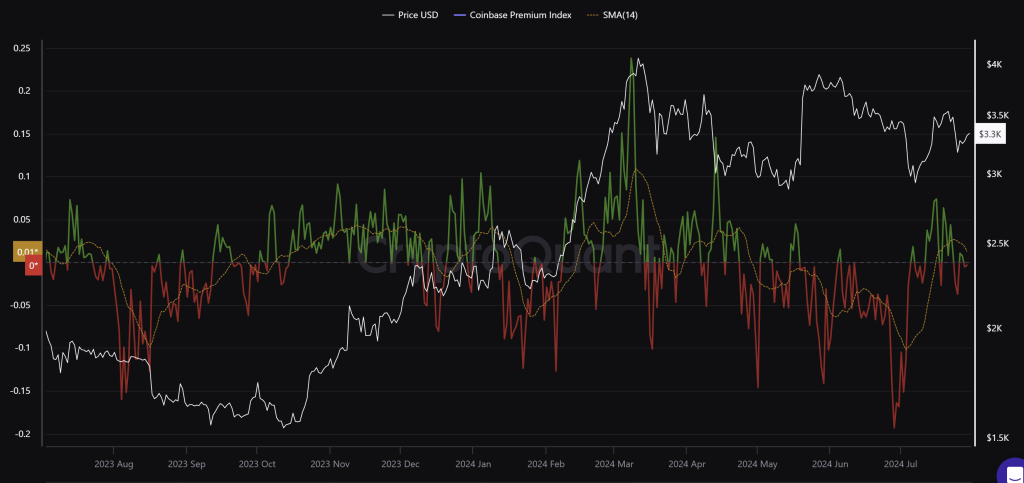

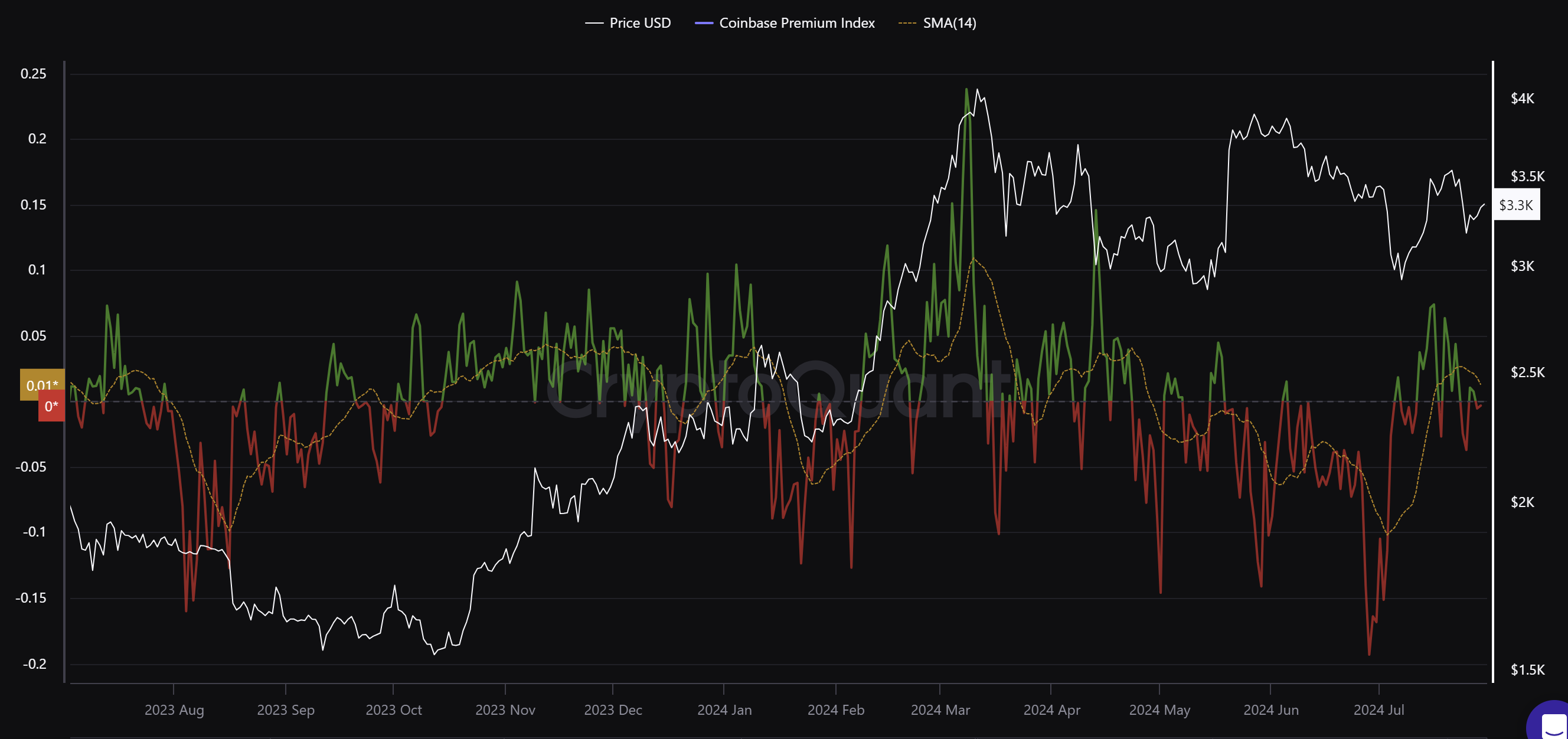

Coinbase premium index flips negative

Coinbase data hints at a similar lack of demand. The Coinbase premium index for ETH has been strictly declining in Q2 2024. It peaked in March simultaneously with ETH’s year high but is currently at a negative value. A negative premium value indicates US investors lack buying pressure, drying out spot demand.

In May 2024, the potential approval of an Ethereum ETF increased spot buying on Coinbase, which had a bullish effect on its price. The Coinbase Premium Index also spiked above 0.15, indicating demand from ETH spot buyers. As mentioned above, the same indicator is declining now, which has the opposite impact on ETH price.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses