Bitcoin ‘Trump pump’ potential matches key technical signal — Can BTC break $71.5K?

The Bitcoin chart flashed a crucial buy signal for investors, but BTC still faces significant resistance at the $68,500 mark.

Bitcoin could be on track for a significant pump based on a key technical indicator used by crypto analysts that flashed ahead of former President Donald Trump’s upcoming speech in Nashville. How high can Bitcoin’s price rise in the near term?

Bitcoin on track to “massive pump” based on hash ribbon

Bitcoin’s (BTC) price could see significant bullish momentum based on hash ribbons, a popular indicator tracking two moving averages of hashrate, the estimated combined processing power miners dedicate to the network.

As Cointelegraph reported, the hash ribbons printed a buy signal on the daily chart for the first time in a year on July 24.

Adding to the bullish momentum, the hash ribbons indicator has now printed another buy signal on the five-day chart, according to popular crypto analyst Titan of Crypto.

The analyst wrote in a July 26 X post:

“After the Hash Ribbons indicator flashed a buy signal on the daily chart, it’s now showing a Buy Signal on the 5-day chart, which is even more significant. Out of 8 past occurrences, this has resulted in a massive pump.”

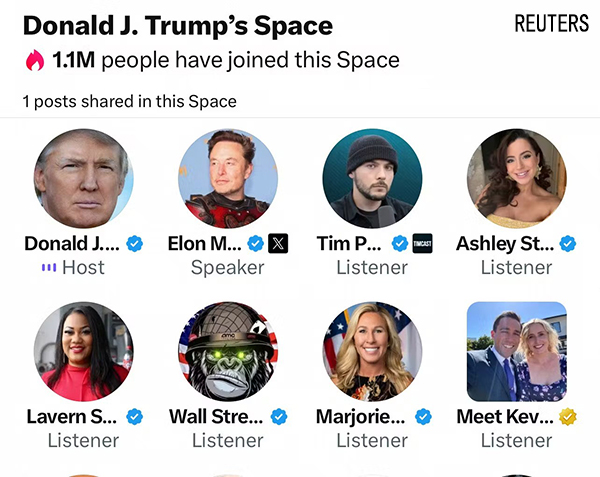

The buy signal flashed ahead of former President Donald Trump’s speech in Nashville, which could be part of Bitcoin’s recovery. Bitcoin’s price rose 4.3% and recovered most of its losses from the week as traders eagerly anticipated Trump’s speech at the Bitcoin 2024 conference.

Moreover, the Bitcoin chart’s moving average convergence/divergence (MACD) has just printed a bullish cross, which suggests more upside momentum, according to pseudonymous trader Mikybull.

The trader wrote in a July 26 X post:

“Bitcoin has finally witnessed a MACD bullish cross on a 3-day chart, further validating this setup. The massive bear squeezes incoming folks!”

New all-time high for BTC’s price if $71,500 breaks

Despite the bullish chart pattern, Bitcoin’s price needs to breach above the key $71,500 mark to have a chance at a new all-time high, wrote popular analyst Rekt Capital in a July 26 X post:

“Bitcoin successfully dipped to $65,000 and rebounded. Now let’s see if Bitcoin now rallies to $71,500. Bitcoin has an entire long weekend to do it.”

But Bitcoin still faces significant resistance at the $68,500 mark first. A move above this level would liquidate over $560 million worth of leveraged short positions, according to CoinGlass data.

Short Bitcoin liquidations would surpass $1 billion at the $70,000 psychological mark.

At the same time, some traders believe that Bitcoin is facing an “impulsive upside” and that it could still risk falling to the $62,000 mark, warned popular trader Crypto Ed in a July 26 X post:

“I expected a corrective bounce, followed by another leg lower towards 62k and maybe even lower.”

Related: World’s largest BTC miner Marathon buys $100M BTC to go ‘full HODL’

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Responses