JPMorgan Chase launches AI tool for research analyst tasks

JPMorgan Chase has introduced LLM Suite, an AI-driven tool similar to ChatGPT, to boost productivity in its asset and wealth management division.

Investment banking giant JPMorgan Chase is reportedly rolling out an in-house version of a ChatGPT-like generative artificial intelligence product capable of doing the work of a research analyst.

JPMorgan’s asset and wealth management division employees were provided access to the newly launched generative AI tool — LLM Suite — which was primarily built to help them with writing, idea generation and summarizing documents.

The tool was introduced through an internal memo co-signed by Mary Erdoes, the CEO of JPMorgan Chase’s asset and wealth management line of business; Teresa Heitsenrether, the company’s chief data and analytics officer; and Mike Urciuoli, the managing director.

Can generative AI replace JPMorgan research analysts?

The memo was viewed by the Financial Times, which explained to the employees:

“Think of LLM Suite as a research analyst that can offer information, solutions and advice on a topic.”

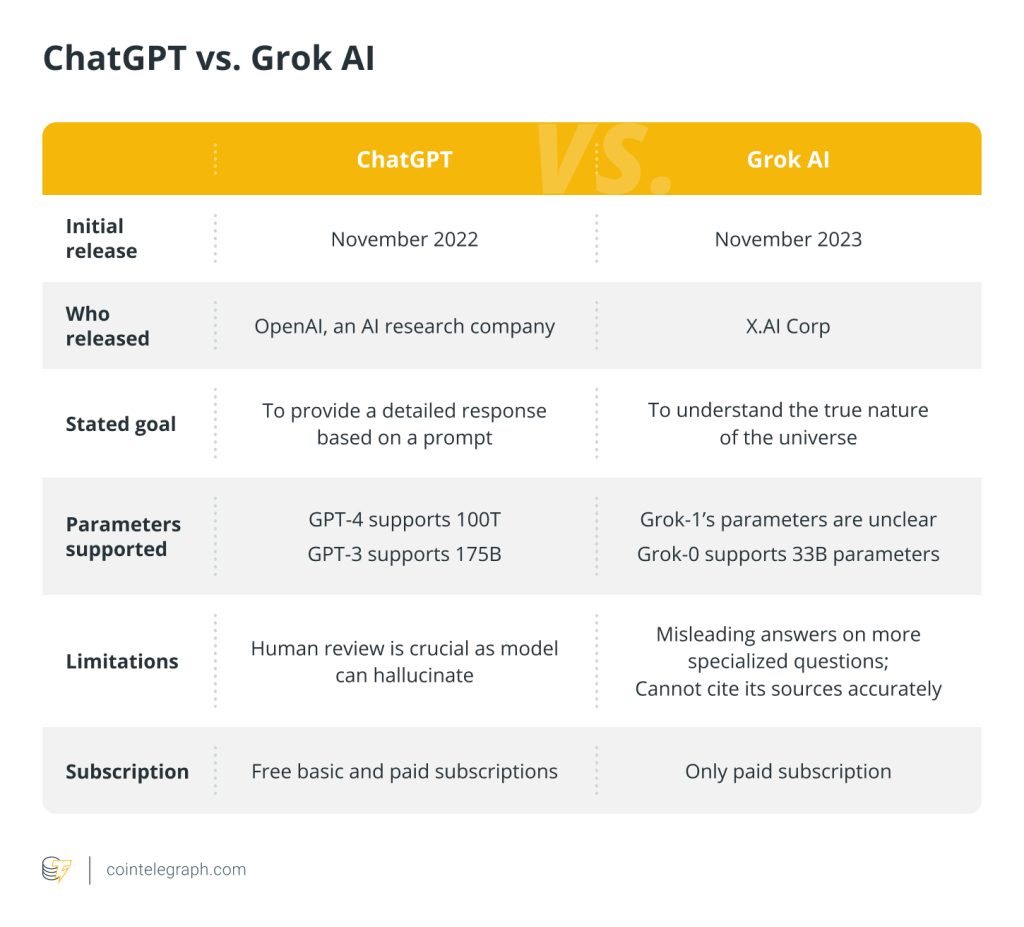

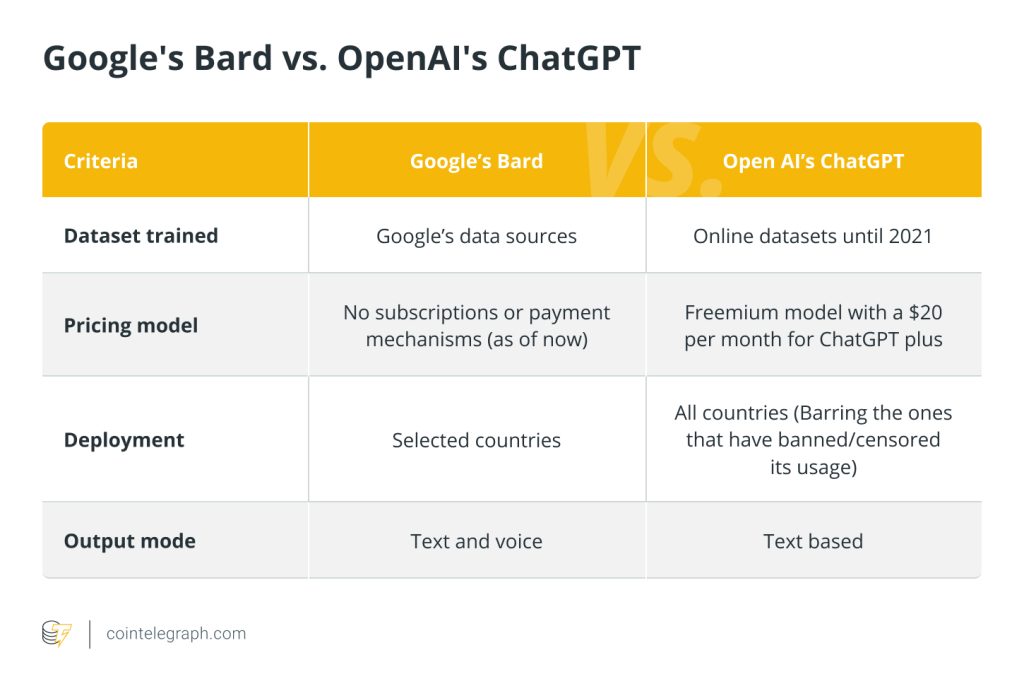

JP Morgan explained that LLM Suite is a “ChatGPT-like product” that can work with other internal systems that handle sensitive financial information to increase “general purpose productivity.”

The FT stated that the bank released the LLM Suite in early 2024 and provided access to 15% (50,000 employees) of its workforce. However, JP Morgan has not officially acknowledged the launch of its newly appointed AI research analyst, LLM Suite.

Related: JP Morgan-backed blockchain firm ‘Partior’ closes $60M Series B funding

In 2023, JPMorgan created an AI tool to analyze United States Federal Reserve statements and speeches to detect potential trading signals, according to a Bloomberg report.

The AI tool gave analysts a way to detect policy shifts and trigger a heads-up on trading signals. “Preliminary applications are encouraging,” JPMorgan economist Joseph Lupton reportedly said.

Growing support for AI from institutional traders

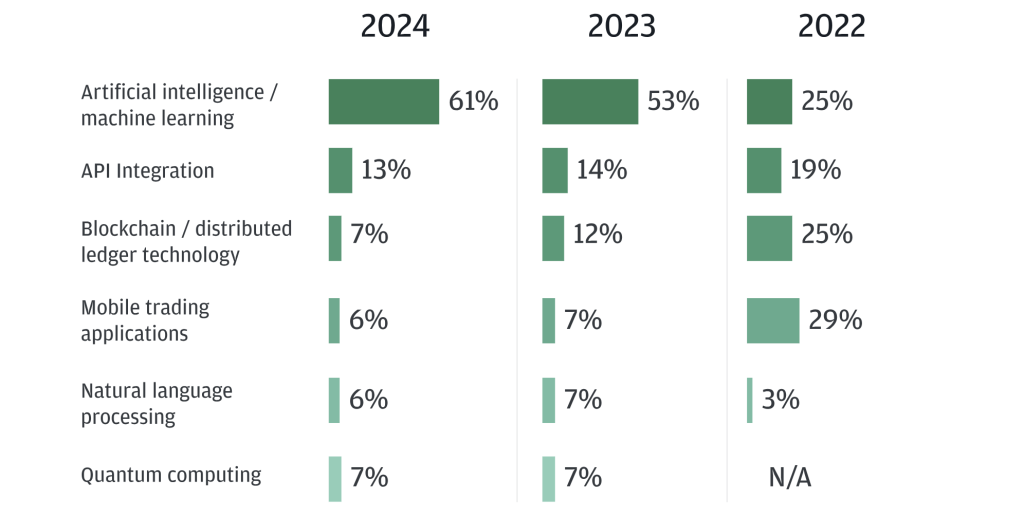

JPMorgan recently surveyed 4,010 institutional traders and found that 61% of the respondents regard AI as the most impactful technology shaping the future of trading.

Most participants across 65 countries anticipate AI and machine learning will emerge as the most impactful trading technologies within the next three years.

While 13% bet on a larger impact from application programming interface integration, blockchain or distributed ledger technology and quantum computing each received 7% of the votes.

Responses