Ethereum ETF launch drives $2.2B inflows —CoinShares

CoinShares reports that spot-based Ether ETFs debut with a significant $2.2 billion of inflows, offset by Grayscale’s $285 million in net outflows.

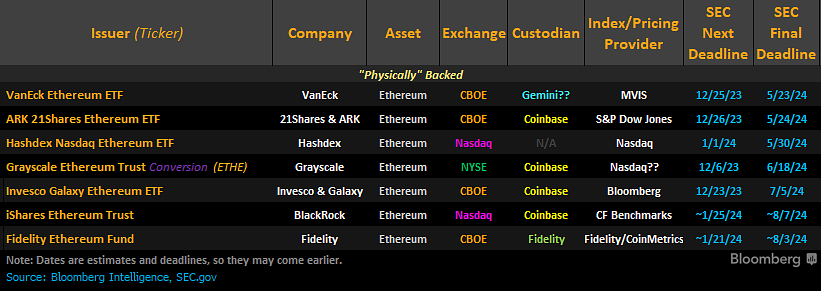

The launch of spot Ether exchange-traded funds (ETFs) in the United States has marked one of the largest inflows to the asset since December 2022.

According to the latest CoinShares report, newly issued spot Ether (ETH) ETFs racked up a significant $2.2 billion in inflows alongside a 542% hike in ETH exchange-traded products (ETPs).

The new inflows milestone was tempered by $285 million in overall net outflows from Grayscale’s $1.5 billion Ethereum trust.

Related: BlackRock imposters target crypto ETF investors

Bitcoin inflows persevering

Alongside ETH developments, Bitcoin (BTC) has attracted $3.6 billion in inflows over the past month, contributing to a year-to-date (YTD) total of $19 billion — a historic high.

According to CoinShares analysts, the firm believes the surge is driven by speculation surrounding the upcoming US elections and the potential for BTC to become a strategic reserve asset.

The analysts also attribute this to renewing investor confidence in BTC, given the expectations of a Federal Reserve rate cut in September.

Related: Grayscale Ethereum Trust ETF net outflows hit $1.5B

Market trends and statistics

The report reveals that the digital asset market continues to grow, with total assets under management reaching $99.1 billion.

Total inflows for 2024 have reached a record-breaking $20.5 billion YTD as trading volumes across all digital assets rose to an all-time high in May in anticipation of Ether ETFs.

The report highlights that this record was broken on the week of July 22, totaling $14.8 billion, largely fueled by the launch of the Ether ETFs, despite digital asset investment products seeing only $245 million in inflows.

Related: bitFlyer acquires FTX Japan, plans to launch crypto ETFs

Grayscale outflows hit $1.5 billion

On July 26, theGrayscale Ethereum Trust ETF outflows reached over $1.5 billion, with net outflows topping $356 million in a single day.

The newly converted Ethereum Trust ETF witnessed investors withdraw over $1.5 billion since the spot Ether ETFs launched in the US on July 23.

Contrastingly, Grayscale’s Ethereum Mini Trust ETH (ETH) performed well, recording a net inflow of $44.9 million on July 26.

Responses